Vietnam’s resources and energy demand has grown quickly over the past decade and electricity demand in Vietnam is forecast to increase at an average rate of 9% from 2021 onwards 27.

Vietnam aims to become a fully industrialised and modernised country by 203028 and needs a secure supply of energy resources to meet these goals. At the same time, Australia is well positioned to support Vietnam’s energy needs.

Trade

The Australian resources sector is one of the most technologically advanced in the world, with strong long-term growth potential. In spite of global challenges related to the pandemic, which have disrupted operations across the globe, Australia’s resources and energy export values are expected to rise to a record all-time high of A$310 billion for the 2020-2021 period29. This increase is due to growing trade volumes and strengthening prices.

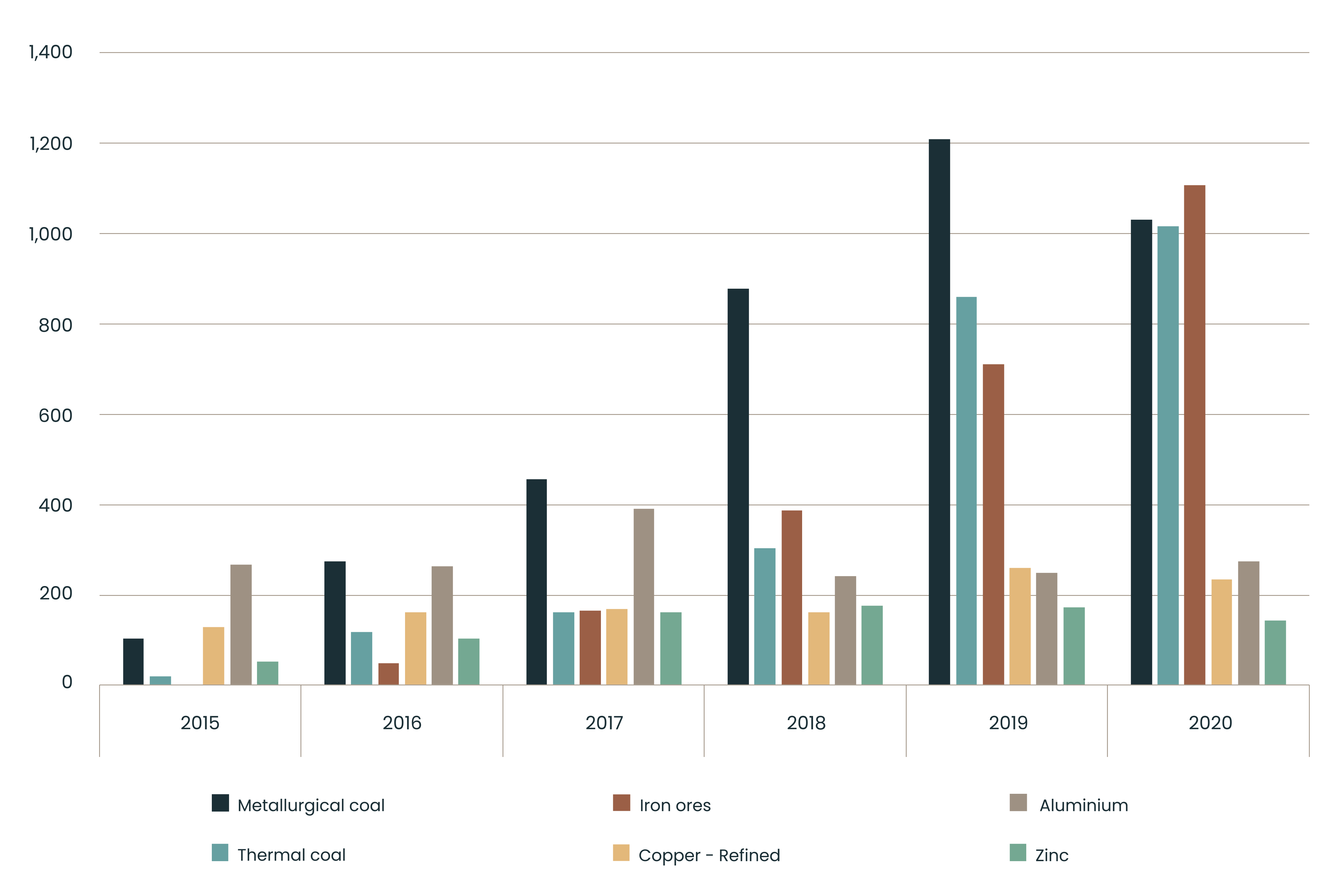

Australia remains a reliable supplier of Vietnam’s energy needs. As an indicator, Australian coal exports have tripled in value since 2017, to A$2.05 billion in 2020. Energy and resources exports now account for just over half of all Australia’s merchandise exports to Vietnam30.

In the resources sector, Australian iron ore exports to Vietnam for steelmaking grew from no trade in 2015 to over A$1.1 billion in 2020. Australia is a significant exporter of aluminum (A$273 million), copper (A$232 million), zinc (A$143 million) and lead (A$100 million). These are essential inputs for Vietnam’s thriving manufacturing sector31.

Vietnam has traditionally been a significant exporter of crude petroleum to Australia.

Investment

Australia is a desirable, stable investment destination and partner. Australia consistently rates highly as an investment destination. The Fraser Institute, and its 2019 Annual Survey of Mining Companies showed Western Australia as the most attractive jurisdiction in the world for mining investment, with other Australian mining states also performing well.

Vietnamese investment in Australia’s resources sector increased in May 2021 with the approval of Vietnamese company Hoa Phat’s investment application to aquire an iron ore mining operation in the Northern Territory. The investment will create jobs and add as much as A$185 million to Australia’s annual export revenue.

Australia and Vietnam have agreed to enhance the current bilateral relationship at ministerial and senior officials’ levels to support cooperation, trade and investment in this important sector. A variety of mechanisms will be used to enhance government-to-government and business-to-business linkages, with the aim of establishing lasting government and commercial relationships to build energy and resources security for both Vietnam and Australia.

Further opportunities

Australia welcomes further investment from Vietnam in the resources and energy sector. Vast deposits of minerals and primary energy resources exist in proven, underexplored or unexplored sites. Australia’s stable market, its proximity to Vietnam and strong economic complementarities make Australia attractive to investors in Vietnam seeking sustainable, long-term returns.

Vietnamese industry demand for Australia’s resources exports will grow further. In 2018, Vietnam imported around US$3.2 billion in value of mining products, of which 17% came from Australia32. Australia has vast supplies of bulk commodities, precious metals, energy resources and critical minerals of a high quality, and there are many opportunities for increased bilateral trade and cooperation.

Australia also has rich stocks of a large number of known mineral resources, including critical minerals, essential to the production of low emissions energy technologies such as electric vehicles, wind turbines, and batteries. Australia also holds significant endowments of other mineral resources that are used in conjunction with critical minerals in these emerging technologies, such as nickel, copper and bauxite for aluminum production.

Opportunities also exist in Vietnam for Australia’s technologically advanced and world-leading mining equipment, technology and services (METS) sector. This can assist with exploration in Vietnam’s resources sector, introduce new innovations and support Vietnam’s energy security needs.

There is also great potential for Australian liquefied natural gas (LNG) exports to Vietnam. The Government of Vietnam recently revised its generation mix, converting some planned coal-fired power plants to use LNG as a replacement. Australian LNG producers’ proximity to Vietnam makes them cost-competitive with other sources of LNG.

Vietnam has excellent potential for developing renewable energy. Vietnam is endowed with a coastline of over 3,000 kilometres and favourable conditions for wind energy development. The entire country is located in the tropical belt between the equator and the Tropic of Cancer and Vietnam has high potential for solar energy. There are significant opportunities for Australian companies to invest in Vietnam’s renewable energy sector.

Australia's Exports of Selected Resources & Energy Commodities to Vietnam

(AUD million)

Resources and energy

Vietnam and Australia will collaborate to enhance government-to-government and business-to-business linkages, with the aim of increasing trade and investment in energy and resources, diversifying markets, commodities and technologies, and ensuring energy and resources security for both Vietnam and Australia.

Footnotes

- [27]Ngoc Mai 2020, “Electricity demand in Vietnam forecast to grow by 9% from 2021 onwards: Fitch”, Hanoi Times, 16 September, viewed 1 October 2021, http://hanoitimes.vn/electricity-demand-in-vietnam-forecast-to-grow-by-9-from-2021-onwards-fitch-314219.html

- [28]Resolution No.23-NQ/TW of the Communist Party of Vietnam.

- [29]Department of Industry, Science, Energy and Resources 2021, Resources and Energy Quarterly, June 2021

- [30]Based on ABS trade data on DFAT STARS database, ABS catalogue 5368.0

- [31]Based on ABS trade data on DFAT STARS database, ABS catalogue 5368.0

- [32]Based on UN Comtrade data on the DFAT STARS database.