Publications

Australian Government Department of Foreign Affairs and Trade, 2010

Download

Trade at a Glance 2010 [PDF 2.97 MB]

Minister for Trade's Foreword

Welcome to Trade at a Glance 2010, a concise summary of Australia's trade performance.

Australia is a trading nation – and our trading relationships have been a major contributor to the prosperity Australians enjoy.

Exports generate more than 20 per cent of the nation's income and trade is directly responsible for more than two million – or one in five – Australian jobs.

Without trade and Australia's ongoing commitment to trade liberalisation, the living standards of Australians would be substantially lower.

Exports of goods and services add to the wealth of our nation. Every day, Australian-made products are shipped to more than 200 countries around the world. They include our minerals, fuels and farm products, manufactured goods like cars and medicines, and our expanding array of services and knowledge-based industries.

Imports, too, are vital to a healthy and open economy. They give consumers the choice of a wide range of affordable, quality products. They also give Australian companies a wider choice of inputs into their products, making them more efficient and productive. And, like exports, they help create jobs.

I hope you find Trade at a Glance 2010 a valuable resource.

The Hon Dr Craig Emerson MP

Minister for Trade

Trade Performance at a Glance

Profile of Australian Trade

Resource commodities including coal and iron ore, made up around 40 per cent of Australia's exports in 2009. Other key exports included services such as education and tourism, manufactured goods, and agricultural produce. Australia's two-way trade totalled $506.8 billion, down 10 per cent from the record $563.2 billion in 2008.

China, Japan, United States and the Republic of Korea were the nation's top four trading partners in 2009. About 70 per cent of Australia's trade was with the member economies of the Asia-Pacific Economic Cooperation (APEC) forum.

More than 2 million Australian jobs are generated by trade.

Exports of goods and services, 2009(a),

Share of exports by sector

- (a) Balance of payments basis.

- (b) Minerals and fuels.

Source: ABS catalogue 5368.0.

| $ billions | |

|---|---|

| Coal | 39.4 |

| Iron ore & concentrates | 30.0 |

| Education-related travel services | 18.0 |

| Gold (b) | 15.6 |

| Personal travel (excl education) services | 12.1 |

| Natural gas | 7.6 |

| Crude petroleum | 7.2 |

| Aluminium ores & conc (incl alumina) | 4.8 |

| Wheat | 4.7 |

| Beef | 4.3 |

| Aluminium | 4.1 |

| Copper ores & concentrates | 3.7 |

| Medicaments (incl veterinary) | 3.7 |

| Professional services | 3.3 |

| Technical & other business services | 3.2 |

| Passenger transport services (c) | 2.9 |

| Business travel services | 2.7 |

| Copper | 2.5 |

| Alcoholic beverages | 2.4 |

| Refined petroleum | 2.4 |

| Total exports (d) | 249.9 |

- (a) Goods trade is on a recorded trade basis. Services trade is on a balance of payments basis.

- (b) Balance of payments basis.

- (c) Includes related agency fees and commissions.

- (d) Total exports on a BOP basis.

Sources: ABS trade data on DFAT STARS database and ABS catalogue 5368.0.

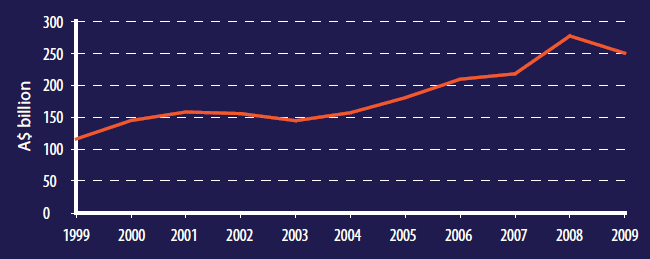

Australia's 2009 Trade Performance

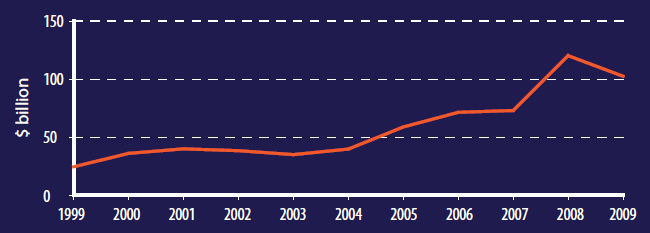

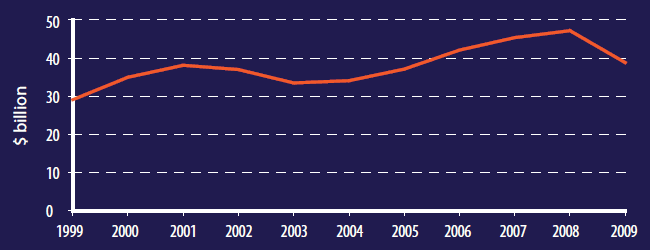

The worst global recession in the past 75 years saw global trade flows (in volume terms) fall by 12 per cent in 2009. Australia's two-way trade in goods and services fell 10.0 per cent to $506.8 billion (with volumes falling 3.9 per cent).

The value of Australia's export fell by 9.8 per cent in 2009 to $249.9 billion, with falls across the board. However, export volumes rose 0.6 per cent in 2009, making Australia one of only three OECD economies to record export volume growth in 2009 (the others being Iceland and New Zealand).

Australia's import values in 2009 fell 10.2 per cent to $257.0 billion (with volumes falling 7.8 per cent). The fall in imports during the year reflected a slower Australian economy (with reduced domestic consumption and investment). As a result of imports falling faster than exports, the trade deficit improved $2.3 billion to $7.1 billion.

Exports of goods and services (a)

(a) Balance of payments basis.

Source: ABS catalogue 5368.0.

The Australian Economy

The Australian economy has been resilient throughout the Global Financial Crisis. Australia was one of just three OECD economies to avoid recession in 2009, with economic growth of 1.4 per cent. Australia's average unemployment rate during the crisis was one of the lowest in the OECD at 5.6 per cent in 2009.

The strong performance of the Australian economy was the result of a number of factors, including:

- The strength of the Australian financial sector. No Australian banks collapsed or needed government bail-outs during the crisis. Of the 10 largest banks in the world with a credit rating of AA or better, four are Australian.

- Economic measures which added 2.1 percentage points to GDP growth in 2009 – supporting around 200,000 jobs.

- Australia's close trade and economic links with the emerging economies of Asia also helped support growth and employment. Although world trade values fell 23 per cent in 2009, Australia's exports to China increased by 29 per cent and India by 10 per cent.

- Australia was one of only three advanced economies to record an increase in export volumes in 2009.

- Australia's budget position is among the strongest in the developed world.

| Goods(a) | $ millions | % share |

|---|---|---|

| Coal | 39,397 | 20.0 |

| Iron ore & concentrates | 29,960 | 15.2 |

| Gold (b) | 15,603 | 7.9 |

| Natural gas | 7,640 | 3.9 |

| Crude petroleum | 7,180 | 3.6 |

| Aluminium ores & conc (incl alumina) | 4,798 | 2.4 |

| Wheat | 4,747 | 2.4 |

| Beef | 4,307 | 2.2 |

| Aluminium | 4,068 | 2.1 |

| Copper ores & concentrates | 3,722 | 1.9 |

| Medicaments (incl veterinary) | 3,661 | 1.9 |

| Copper | 2,494 | 1.3 |

| Alcoholic beverages (mainly wine) | 2,418 | 1.2 |

| Refined petroleum | 2,400 | 1.2 |

| Meat (excl beef ) | 2,240 | 1.1 |

| Wool & other animal hair (incl tops) | 1,840 | 0.9 |

| Passenger motor vehicles | 1,583 | 0.8 |

| Animal feed | 1,216 | 0.6 |

| Milk & cream | 1,208 | 0.6 |

| Live animals (excl seafood) | 1,144 | 0.6 |

| Total goods exports (c) | 196,890 | 100.0 |

- (a) Recorded trade basis.

- (b) Balance of payments basis.

- (c) Total goods exports on a BOP basis.

Sources: ABS trade data on DFAT STARS database and ABS catalogue 5368.0.

| $ millions | % share | |

|---|---|---|

| Manufactured services on physical inputs owned by others | 329 | 0.6 |

| Maintenance & repair | 69 | 0.1 |

| Transport | ||

| Passenger (b) | 2,911 | 5.5 |

| Freight | 625 | 1.2 |

| Other (b) | 2,073 | 3.9 |

| Postal & courier services | 946 | 1.8 |

| Total Transport | 6,555 | 12.4 |

| Travel | ||

| Business | 2,708 | 5.1 |

| Personal | 30,108 | 56.8 |

| - Education-related | 17,986 | 33.9 |

| - Other personal (c) | 12,122 | 22.9 |

| Total Travel | 32,816 | 61.9 |

| Other | ||

| Construction | 107 | 0.2 |

| Insurance & pension | 287 | 0.5 |

| Financial | 1,271 | 2.4 |

| Intellectual property charges | 938 | 1.8 |

| Telecommunications, computer & information | 1,911 | 3.6 |

| Other business services | 7,086 | 13.4 |

| Personal, cultural and recreational | 776 | 1.5 |

| Government services | 853 | 1.6 |

| Total other services | 13,229 | 25.0 |

| Total services exports | 53,202 | 100.0 |

- (a) Balance of payments basis.

- (b) Passenger services include air transport-related agency fees and commissions.

- (c) Inbound tourism for mainly recreational purposes.

Based on ABS catalogue 5368.0.

| Goods(a) | $ millions | % share |

|---|---|---|

| Crude petroleum | 12,281 | 6.0 |

| Passenger motor vehicles | 11,678 | 5.7 |

| Refined petroleum | 10,281 | 5.1 |

| Gold (b) | 8,994 | 4.4 |

| Medicaments (incl veterinary) | 7,648 | 3.8 |

| Telecom equipment & parts | 7,239 | 3.6 |

| Computers | 5,589 | 2.8 |

| Goods vehicles | 4,367 | 2,1 |

| Pumps (excl liquid pumps) & parts | 3,651 | 1.8 |

| Monitors, projectors & TVs | 3,251 | 1.6 |

| Prams, toys, games & sporting goods | 2,823 | 1.4 |

| Measuring & analysing instruments | 2,649 | 1.3 |

| Furniture, mattresses & cushions | 2,632 | 1.3 |

| Civil engineering equipment & parts | 2,572 | 1.3 |

| Electrical machinery & parts | 2,274 | 1.1 |

| Vehicle parts and accessories | 2,205 | 1.1 |

| Heating & cooling equipment & parts | 2,152 | 1.1 |

| Household-type equipment | 2,079 | 1.0 |

| Manufactures of base metal | 1,996 | 1.0 |

| Plastic articles | 1,930 | 0.9 |

| Total goods imports (c) | 203,172 | 100.0 |

- (a) Recorded trade basis.

- (b) Balance of payments basis.

- (c) Total goods imports on a BOP basis.

Sources: ABS trade data on DFAT STARS database and ABS catalogue 5368.0.

| $ millions | % share | |

|---|---|---|

| Manufactured services on physical inputs owned by others | 4 | 0.0 |

| Maintenance & repair | 228 | 0.4 |

| Transport | ||

| Passenger (b) | 5,112 | 9.5 |

| Freight | 7,829 | 14.6 |

| Other (b) | 377 | 0.7 |

| Postal & courier services | 176 | 0.3 |

| Total Transport | 13,494 | 25.1 |

| Travel | ||

| Business | 3,005 | 5.6 |

| Personal | 19,858 | 36.9 |

| - Education-related | 823 | 1.5 |

| - Other personal (c) | 19,035 | 35.4 |

| Total Travel | 22,863 | 42.5 |

| Other | ||

| Construction | 0 | 0.0 |

| Insurance & pension | 539 | 1.0 |

| Financial | 690 | 1.3 |

| Intellectual property charges | 3,611 | 6.7 |

| Telecommunications, computer & information | 2,165 | 4.0 |

| Other business services | 7,949 | 14.8 |

| Personal, cultural and recreational | 1,347 | 2.5 |

| Government services | 887 | 1.6 |

| Total other services | 17,188 | 32.0 |

| Total services exports | 53,777 | 100.0 |

- (a) Balance of payments basis.

- (b) Passenger services include air transport-related agency fees and commissions.

- (c) Outbound tourism for mainly recreational purposes.

Based on ABS catalogue 5368.0.

| Goods(a) | Services(b) | Total(c) | % share | ||

|---|---|---|---|---|---|

| 1 | China | 78.2 | 6.9 | 85.1 | 16.8 |

| 2 | Japan | 54.9 | 4.3 | 59.2 | 11.7 |

| 3 | United States (d) | 31.9 | 15.7 | 47.6 | 9.4 |

| 4 | Republic of Korea | 22.3 | 2.1 | 24.4 | 4.8 |

| 5 | United Kingdom | 15.2 | 9.1 | 24.3 | 4.8 |

| 6 | Singapore | 16.5 | 6.4 | 23.0 | 4.5 |

| 7 | India | 16.5 | 4.4 | 20.9 | 4.1 |

| 8 | New Zealand | 14.5 | 6.1 | 20.6 | 4.1 |

| 9 | Thailand | 15.9 | 3.4 | 19.2 | 3.8 |

| 10 | Germany | 12.2 | 2.1 | 14.4 | 2.8 |

| Total two-way trade (b) | 400.1 | 106.8 | 506.8 | 100.0 | |

| of which: | APEC | 287.0 | 60.9 | 347.5 | 68.6 |

| ASEAN | 58.8 | 17.7 | 76.6 | 15.1 | |

| EU27(d) | 56.9 | 20.3 | 77.2 | 15.2 | |

| OECD | 189.7 | 52.8 | 242.6 | 47.9 | |

- (a) Recorded trade basis.

- (b) Balance of payments basis.

- (c) Total may not sum due to rounding.

- (d) Excludes imports of aircraft from regional import totals from Sep-08 onwards

Based on ABS trade data on DFAT STARS database and ABS catalogues 5368.0. and 5368.0.05.44.

| Rank | Country | Goods(a) | Services(b) | Total exports | % share |

|---|---|---|---|---|---|

| 1 | United States | 1,057 | 470 | 1,527 | 9.7 |

| 2 | Germany | 1,121 | 215 | 1,336 | 8.5 |

| 3 | China | 1,202 | 129 | 1,330 | 8.4 |

| 4 | Japan | 581 | 124 | 705 | 4.5 |

| 5 | France | 475 | 140 | 615 | 3.9 |

| 6 | Netherlands | 499 | 92 | 590 | 3.7 |

| 7 | United Kingdom | 351 | 240 | 590 | 3.7 |

| 8 | Italy | 405 | 101 | 506 | 3.2 |

| 9 | Belgium | 370 | 75 | 444 | 2.8 |

| 10 | Republic of Korea | 364 | 56 | 419 | 2.7 |

| 11 | Hong Kong (c) | 330 | 86 | 416 | 2.6 |

| 12 | Canada | 316 | 57 | 373 | 2.4 |

| 13 | Russian Federation | 304 | 42 | 346 | 2.2 |

| 14 | Singapore | 270 | 74 | 343 | 2.2 |

| 15 | Spain | 218 | 122 | 340 | 2.2 |

| 16 | Mexico | 230 | 15 | 245 | 1.6 |

| 17 | India | 155 | 86 | 242 | 1.5 |

| 18 | Switzerland | 173 | 68 | 241 | 1.5 |

| 19 | Taiwan | 204 | 31 | 235 | 1.5 |

| 20 | Ireland | 115 | 95 | 209 | 1.3 |

| 21 | Saudi Arabia | 189 | 10 | 198 | 1.3 |

| 22 | Australia | 154 | 41 | 195 | 1.2 |

| 23 | Sweden | 131 | 60 | 191 | 1.2 |

| 24 | Austria | 137 | 53 | 190 | 1.2 |

| 25 | Malaysia | 157 | 28 | 185 | 1.2 |

| 26 | United Arab Emirates | 175 | 8 | 183 | 1.2 |

| 27 | Thailand | 152 | 30 | 183 | 1.2 |

| 28 | Brazil | 153 | 26 | 179 | 1.1 |

| 29 | Poland | 134 | 29 | 163 | 1.0 |

| 30 | Norway | 121 | 38 | 158 | 1.0 |

| Total exports | 12,461 | 3,312 | 15,773 | ||

- (a) Goods on recorded trade basis.

- (b) Commercial services on balance of payments basis.

- (c) Special Administrative Region of China.

Sources: WTO online database and EIU Viewswire.

| Goods(a) | Services(b) | Total(c) | % share | ||

|---|---|---|---|---|---|

| 1 | China | 42.4 | 5.5 | 47.9 | 19.2 |

| 2 | Japan | 38.3 | 2.1 | 40.4 | 16.2 |

| 3 | India | 14.5 | 3.7 | 18.2 | 7.3 |

| 4 | Republic of Korea | 15.6 | 1.8 | 17.5 | 7.0 |

| 5 | United States | 9.6 | 5.6 | 15.2 | 6.1 |

| 6 | United Kingdom | 9.0 | 4.2 | 13.3 | 5.3 |

| 7 | New Zealand | 7.9 | 3.2 | 11.1 | 4.5 |

| 8 | Singapore | 5.4 | 2.9 | 8.3 | 3.3 |

| 9 | Taiwan | 6.5 | 0.6 | 7.1 | 2.8 |

| 10 | Indonesia | 4.1 | 1.2 | 5.3 | 2.1 |

| Total exports (b) | 196.9 | 53.0 | 249.9 | 100.0 | |

| of which: | APEC | 147.7 | 30.6 | 178.3 | 71.3 |

| ASEAN | 19.6 | 8.3 | 27.9 | 11.1 | |

| EU27 | 17.4 | 8.6 | 26.0 | 10.4 | |

| OECD | 91.9 | 23.2 | 115.1 | 46.1 | |

- (a) Recorded trade basis.

- (b) Balance of payments basis.

- (c) Total may not sum due to rounding.

Based on ABS trade data on DFAT STARS database and ABS catalogues 5368.0. and 5368.0.55.004.

| Rank | Country | Goods(a) | Services(b) | Total | % share |

|---|---|---|---|---|---|

| 1 | United States | 1,604 | 331 | 1,935 | 12.3 |

| 2 | Germany | 931 | 255 | 1,187 | 7.5 |

| 3 | China | 1,006 | 157 | 1,163 | 7.4 |

| 4 | Japan | 551 | 146 | 696 | 4.4 |

| 5 | France | 551 | 124 | 675 | 4.3 |

| 6 | United Kingdom | 480 | 160 | 640 | 4.1 |

| 7 | Netherlands | 446 | 87 | 533 | 3.4 |

| 8 | Italy | 410 | 114 | 524 | 3.3 |

| 9 | Belgium | 351 | 72 | 423 | 2.7 |

| 10 | Canada | 330 | 77 | 407 | 2.6 |

| 11 | Republic of Korea | 323 | 74 | 397 | 2.5 |

| 12 | Hong Kong (c) | 353 | 44 | 397 | 2.5 |

| 13 | Spain | 290 | 87 | 377 | 2.4 |

| 14 | Singapore | 246 | 74 | 320 | 2.0 |

| 15 | India | 244 | 74 | 318 | 2.0 |

| 16 | Mexico | 242 | 22 | 264 | 1.7 |

| 17 | Russian Federation | 192 | 60 | 252 | 1.6 |

| 18 | Australia | 165 | 41 | 207 | 1.3 |

| 19 | Taiwan | 175 | 29 | 204 | 1.3 |

| 20 | Switzerland | 156 | 34 | 190 | 1.2 |

| 21 | Austria | 144 | 38 | 181 | 1.2 |

| 22 | Brazil | 134 | 44 | 178 | 1.1 |

| 23 | United Arab Emirates | 140 | 35 | 175 | 1.1 |

| 24 | Thailand | 134 | 38 | 172 | 1.1 |

| 25 | Poland | 147 | 24 | 170 | 1.1 |

| 26 | Sweden | 119 | 47 | 165 | 1.0 |

| 27 | Ireland | 62 | 104 | 165 | 1.0 |

| 28 | Saudi Arabia | 92 | 72 | 164 | 1.0 |

| 29 | Turkey | 141 | 15 | 156 | 1.0 |

| 30 | Malaysia | 124 | 26 | 150 | 1.0 |

| Total imports | 12,647 | 3,115 | 15,762 | ||

- (a) Goods on recorded trade basis.

- (b) Commercial services on balance of payments basis.

- (c) Special Administrative Region of China.

Sources: WTO online database and EIU Viewswire.

| Goods(a) | Services(b) | Total(c) | % share | ||

|---|---|---|---|---|---|

| 1 | China | 35.8 | 1.5 | 37.3 | 14.5 |

| 2 | United States | 24.8 | 10.1 | 34.9 | 13.6 |

| 3 | Japan | 16.7 | 2.1 | 18.8 | 7.3 |

| 4 | Singapore | 11.2 | 3.5 | 14.7 | 5.7 |

| 5 | Thailand | 11.6 | 2.3 | 13.9 | 5.4 |

| 6 | Germany | 10.6 | 1.1 | 11.7 | 4.6 |

| 7 | United Kingdom | 6.2 | 4.9 | 11.1 | 4.3 |

| 8 | New Zealand | 6.6 | 2.9 | 9.5 | 3.7 |

| 9 | Malaysia | 7.6 | 1.0 | 8.5 | 3.3 |

| 10 | Republic of Korea | 6.6 | 0.3 | 6.9 | 2.7 |

| Total imports(b) | 203.2 | 53.8 | 256.9 | 100.0 | |

| of which: | APEC | 141.8 | 30.0 | 171.8 | 66.9 |

| ASEAN | 39.3 | 9.4 | 48.7 | 19.0 | |

| EU27 | 39.5 | 11.7 | 51.2 | 19.9 | |

| OECD | 101.1 | 29.6 | 130.7 | 50.9 | |

- (a) Recorded trade basis.

- (b) Balance of payments basis.

- (c) Total may not sum due to rounding.

- (d) Excludes imports of aircraft from regional import totals from Sep-09 onwards.

Based on ABS trade data on DFAT STARS database and ABS catalogues 5368.0. and 5368.0.55.004.

| Country | Level of direct investment in Australia | Level of total investment in Australia | |

|---|---|---|---|

| United States | 99,161 | 514,305 | |

| United Kingdom | 63,177 | 498,559 | |

| Japan | 44,963 | 102,024 | |

| Netherlands | 33,640 | 43,362 | |

| Hong Kong (SAR of China) | 5,464 | 43,187 | |

| Singapore | 15,826 | 40,224 | |

| Germany | 16,389 | 38,106 | |

| Switzerland | 17,543 | 32,133 | |

| New Zealand | 6,063 | 31,231 | |

| France | 12,608 | 22,976 | |

| Total all countries | 436,059 | 1,897,67 | |

| of which: | APEC | 198,567 | 791,145 |

| ASEAN | 21,132 | 51,718 | |

| EU27 | 146,597 | 658,689 | |

| OECD | 327,844 | 1,361,523 | |

(a) Foreign investment in Australia: level of investment (stocks) as at 31 December 2009, by selected country and country group.

Source: ABS catalogue 5352.0.

| Country | Level of direct investment abroad | Total Australian investment abroad | |

|---|---|---|---|

| United States | 99,621 | 403,673 | |

| United Kingdom | 64,447 | 178,746 | |

| New Zealand | 41,885 | 79,759 | |

| Germany | 9,711 | 37,653 | |

| Canada | np | 36,760 | |

| Japan | 682 | 31,607 | |

| France | 310 | 27,829 | |

| Hong Kong (SAR of China) | 11,496 | 27,713 | |

| Netherlands | 4,181 | 26,361 | |

| Singapore | 9,213 | 21,658 | |

| Total all countries | 344,572 | 1,130,363 | |

| of which: | APEC | 201,872 | 641,417 |

| ASEAN | 15,548 | 35,643 | |

| EU27 | 93,856 | 346,657 | |

| OECD | 266,644 | 897,697 | |

(a) Australian investment abroad: level of investment (stocks) as at 31 December 2009, by selected country and country group.

Source: ABS catalogue 5352.0.

| Gross value added(a) | Employed persons(b) | |||

|---|---|---|---|---|

| ($m) | %share(c) | ('000) | % share | |

| Agriculture, forestry and fishing | 31,708 | 2.9 | 358.6 | 3.3 |

| Mining | 81,397 | 7.3 | 161.0 | 1.5 |

| Manufacturing | 100,902 | 9.1 | 1,002.1 | 9.3 |

| Services | ||||

| Electricity, gas and water | 29,310 | 2.6 | 133.3 | 1.2 |

| Construction | 83,139 | 7.5 | 980.7 | 9.1 |

| Wholesale trade | 54,686 | 4.9 | 407.0 | 3.8 |

| Retail trade | 55,110 | 5.0 | 1,193.0 | 11.0 |

| Accommodation & food services | 26,560 | 2.4 | 726.0 | 6.7 |

| Transport postal and warehousing | 59,492 | 5.4 | 583.9 | 5.4 |

| Information, media & telecommunications | 34,003 | 3.1 | 217.4 | 2.0 |

| Finance and insurance | 118,640 | 10.7 | 393.6 | 3.6 |

| Rental, hiring & real estate | 36,533 | 3.3 | 182.6 | 1.7 |

| Professional, scientific & technical | 71,597 | 6.4 | 784.0 | 7.3 |

| Administrative & support | 28,297 | 2.5 | 354.1 | 3.3 |

| Public administration & safety | 61,414 | 5.5 | 667.4 | 6.2 |

| Education & training | 49,223 | 4.4 | 807.0 | 7.5 |

| Health care & social assistance | 69,997 | 6.3 | 1,185.4 | 11.0 |

| Arts & recreation | 10,305 | 0.9 | 200.8 | 1.9 |

| Other services | 21,911 | 2.0 | 439.2 | 4.1 |

| Total services | 810,217 | 72.9 | 9,255.3 | 85.6 |

| Ownership of dwellings | 86,567 | 7.8 | ||

| Gross value added at basic prices (d) | 1,110,792 | 100.0 | ||

| Taxes less subsidies on products | 88,330 | |||

| Statistical discrepancy (e) | 8,450 | |||

| Total (d) | 1,207,570 | 10,808 | 100.0 | |

- (a) The term is used to describe gross product by industry and by sector (Chain Volume Measures reference year 2007-08). Industry breakdown based on ANZSIC 2006.

- (b) Derived from seasonally adjusted data on an annual average.

- (c) As a share of GDP at basic prices.

- (d) Basic prices are amounts received by producers, including the value of any subsidies on products, but before any taxes on products. GDP at purchasers' (market) prices is derived by adding Taxes less subisidies on products to gross value added at basic prices.

- (e) Production approach.

Based on ABS catalogues 5206.0, 6202.0 and 6203.0.

| 1999 | 2007 | 2008 | 2009 | ||

|---|---|---|---|---|---|

| Demand and production – chain volume measures, reference year 2007-08 | |||||

| Gross domestic product (a) | % change | 4.3 | 5.0 | 2.1 | 1.3 |

| Exports of goods & services (a) | % change | 4.7 | 3.3 | 3.0 | 1.5 |

| Imports of goods & services (a) | % change | 8.4 | 12.2 | 11.1 | -7.9 |

| Labour force | |||||

| Population (b) | '000 | 19,038 | 21,263 | 21,723 | 22,066(e) |

| Labour force (c) | '000 | 9,507 | 11,144 | 11,319 | 11,550 |

| Employed persons (c) | '000 | 8,870 | 10,665 | 10,801 | 10,915 |

| - Annual growth | % | 2.1 | 2.5 | 1.3 | 1.1 |

| Unemployment rate (c) | % | 6.7 | 4.3 | 4.6 | 5.5 |

| Prices and interest rates | |||||

| Consumer prices | % change | 1.8 | 3.0 | 3.7 | 2.1 |

| Interest rates - 90 day bills (d) | % pa | 5.0 | 6.7 | 7.0 | 3.4 |

- (a) Derived from annual movements in original data.

- (b) At end of period.

- (c) Derived from seasonally adjusted data.

- (d) Annual average.

- (e) September 2009 data.

Sources: Australian Bureau of Statistics and Reserve Bank, various catalogues.

Australia's Trade and Economic Statistics

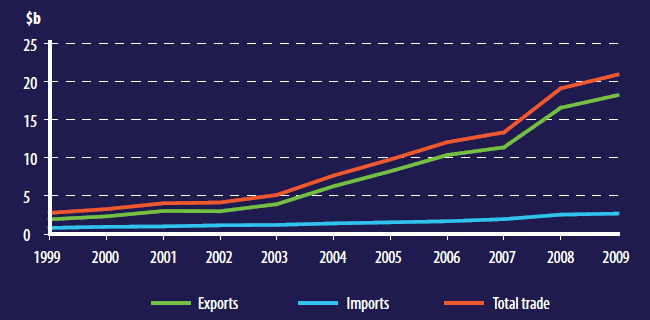

India's Rise Fuels Trade Growth

India is one of Australia's fastest growing major trading partners.

In 2009 the Prime Ministers of Australia and India agreed to a Strategic Partnership, reflecting shared interests and values.

India's economy is expanding thanks to economic reforms. The International Monetary Fund (IMF) estimates it will grow by 9.5 per cent in 2010.

This strong growth rate is reflected in Australia's trade with India.

Two-way trade has grown in value from $3.3 billion in 2000 to $20.9 billion in 2009 – an average rise of 24.6 per cent per annum. Australian exports of goods have grown from A$1.8 billion in 2000 to A$14.5 billion in 2009.

Australia and India are working closely together to stimulate trade and investment growth.

| 2009 Major Exports to India | $billion | 2009 Major Imports from India | $billion |

|---|---|---|---|

| Gold | 6.7 | Travel services | 0.4 |

| Coal | 5.0 | Electric plant and parts | 0.3 |

| Education services | 3.2 | ICT services | 0.1 |

| Copper | 0.8 | Pearls and gems | 0.1 |

| Travel service | 0.2 | Medicaments | 0.1 |

Australia's Goods and Services Trade with India

Based on ABS trade data on DFAT STARS database & ABS catalogue 5368.0.55.004.

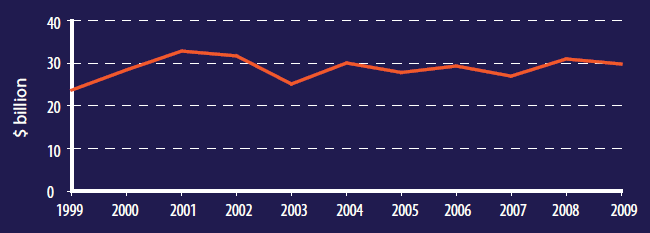

Agriculture

- Wheat overtook beef as Australia's largest agricultural export in 2009.

- Agricultural products accounted for around 11 per cent of Australia's exports in 2009.

- Australia exports around two-thirds of its total farm production.

Agricultural Exports

Based on ABS trade data on DFAT STARS database.

| Rank | Commodity | $ million | % share |

|---|---|---|---|

| 1 | Wheat | 4,747 | 15.9 |

| 2 | Beef | 4,307 | 14.4 |

| 3 | Wine | 2,298 | 7.7 |

| 4 | Meat (excl beef ) | 2,240 | 7.5 |

| 5 | Wool & other animal hair (incl tops) | 1,840 | 6.2 |

| 6 | Animal feed | 1,216 | 4.1 |

| 7 | Milk & cream | 1,208 | 4.1 |

| 8 | Live animals (excl seafood) | 1,144 | 3.8 |

| 9 | Wood in chips or particles | 857 | 2.9 |

| 10 | Cereal preparations | 778 | 2.6 |

| 11 | Barley | 766 | 2.6 |

| 12 | Fruit & nuts | 758 | 2.5 |

| 13 | Oil-seeds & oleaginous fruits, soft | 749 | 2.5 |

| 14 | Vegetables | 710 | 2.4 |

| 15 | Cheese & curd | 701 | 2.3 |

| 16 | Crustaceans | 673 | 2.3 |

| 17 | Edible products & preparations | 565 | 1.9 |

| 18 | Cotton | 538 | 1.8 |

| 19 | Hides & skins, raw (excl furskins) | 522 | 1.8 |

| 20 | Fish | 273 | 0.9 |

| Total agricultural(a) exports(b) | 29,831 | 100.0 | |

- (a) Based on the WTO definition of agriculture, which includes alcoholic beverages. Also excludes confidential raw sugar in bulk. Data for confidential raw sugar in bulk are released with a six-month lag. In 2008-09, raw sugar in bulk exports totalled $1.2 billion.

- (b) Recorded trade basis.

Based on ABS trade data on DFAT STARS database.

Minerals and fuels

- Australia's largest export sector in 2009.

- Coal and iron ore were Australia's largest minerals exports, while natural gas was the biggest fuels export.

- China and Japan were Australia's two largest markets for minerals and fuels.

Mineral and Fuels Exports

Based on ABS trade data on DFAT STARS database.

| Rank | Commodity(a) | $ million | % share |

|---|---|---|---|

| 1 | Coal | 39,397 | 38.4 |

| 2 | Iron ore | 29,960 | 29.2 |

| 3 | Natural gas | 7,640 | 7.4 |

| 4 | Crude petroleum | 7,180 | 7.0 |

| 5 | Aluminium ores (incl alumina) | 4,798 | 4.7 |

| 6 | Copper ores | 3,722 | 3.6 |

| 7 | Other ores | 2,942 | 2.9 |

| 8 | Refined petroleum | 2,400 | 2.3 |

| 9 | Confidential mineral ores | 1,187 | 1.2 |

| 10 | Liquefied propane & butane | 1,006 | 1.0 |

| 11 | Nickel ores | 804 | 0.8 |

| 12 | Ferrous waste & scrap | 689 | 0.7 |

| 13 | Uranium or thorium ores | 679 | 0.7 |

| 14 | Non-ferrous waste & scrap | 622 | 0.6 |

| 15 | Precious metal ores (excl gold) | 193 | 0.2 |

| 16 | Coke & semi-coke | 161 | 0.2 |

| 17 | Crude minerals | 155 | 0.2 |

| 18 | Stone, sand & gravel | 89 | 0.1 |

| 19 | Natural abrasives | 42 | 0.0 |

| 20 | Residual petroleum products | 14 | 0.0 |

| Total minerals and fuels exports(b) | 102,556 | 100.0 | |

- (a) Recorded trade basis.

- (b) Total minerals and fuels exports on a BOP basis.

Based on ABS trade data on DFAT STARS database and ABS catalogue 5368.0.

Manufacturing

- Aluminium medicines and copper were Australia's largest exports of manufactured goods.

- Foreign sales of passenger motor vehicles slumped worldwide as a result of the Global Financial Crisis, resulting in lower exports from Australian car manufacturers.

- The manufacturing sector accounted for approximately 16 per cent of Australian exports in 2009.

Manufacturing Exports

Based on ABS trade data on DFAT STARS database.

| Rank | Commodity(a) | $ million | % share |

|---|---|---|---|

| 1 | Aluminium | 4,068 | 10.5 |

| 2 | Medicaments (incl veterinary) | 3,661 | 9.4 |

| 3 | Copper | 2,494 | 6.4 |

| 4 | Passenger motor vehicles | 1,583 | 4.1 |

| 5 | Medical instruments (incl veterinary) | 1,133 | 2.9 |

| 6 | Measuring & analysing instruments | 911 | 2.3 |

| 7 | Telecom equipment & parts | 891 | 2.3 |

| 8 | Zinc | 890 | 2.3 |

| 9 | Aircraft, spacecraft & parts | 863 | 2.2 |

| 10 | Lead | 848 | 2.2 |

| 11 | Civil engineering equipment & parts | 807 | 2.1 |

| 12 | Specialised machinery & parts | 751 | 1.9 |

| 13 | Pigments, paints & varnishes | 649 | 1.7 |

| 14 | Nickel | 640 | 1.6 |

| 15 | Pearls & gems | 540 | 1.4 |

| 16 | Vehicle parts & accessories | 535 | 1.4 |

| 17 | Starches, inulin & wheat gluten | 530 | 1.4 |

| 18 | Paper & paperboard | 503 | 1.3 |

| 19 | Electrical circuits equipment | 500 | 1.3 |

| 20 | Computer parts & accessories | 499 | 1.3 |

| Total manufactures exports(b) | 38,815 | 100.0 | |

- (a) Recorded trade basis.

- (b) Total manufactures exports on a BOP basis.

Source: ABS trade data on DFAT STARS database and ABS catalogue 5368.0.

Trade Policy at a Glance

Australia's Trade Policy

A Strong, Prosperous and Outward Looking Nation

Trade is vital to Australia's economy and the prosperity of its people.

Australia s trade policy aims to open new markets, reduce barriers to trade and improve market access for Australian goods and services. The Government is also working to improve competition, innovation and productivity in Australia. Australia is committed to full participation in the global economy and supports an open, transparent and rules based global trading system.

The Government is pursuing improved market access for Australian exporters in global markets through multilateral trade negotiations in the World Trade Organization (WTO).

At a regional level, the Government actively engages with the Asia-Pacific Economic Cooperation (APEC) forum and the Association of South East Asian Nations (ASEAN).

The Australian Government also undertakes bilateral negotiations with key trading partners through comprehensive Free Trade Agreements.

The international trading regime of the WTO is open, equitable and enforceable. the WTO's dispute settlement system is central to that regime. It gives member countries and exporters confidence that the commitments and obligations contained in the WTO agreements will be respected. Regional fora (APEC and ASEAN) and comprehensive bilateral agreements provide exporters with further rules-based systems and a more open, fair and predictable trading environment in which to operate.

For more information on Australia's trade policy visit: www.dfat.gov.au/trade

For more information on Australia and WTO dispute settlement visit: /trade/negotiations/wto_disputes.html

Australia and the WTO

As a founding member of both the World Trade Organization (WTO) in 1995 and its predecessor, the General Agreement of Tariffs and Trade (GATT) in 1947, Australia has a longstanding commitment to the multilateral trading system operated by the WTO. This system provides the legal framework governing world trade. WTO Members agree on legally binding rules that provide important legal certainty for their exporters.

The Australian Government's key trade policy priority is a successful conclusion to the WTO Doha Round of trade negotiations, launched in Doha, Qatar, in November 2001. It seeks real improvements in market access for Australian exports across all negotiating sectors – agriculture, industrial goods and services.

For more information on Australia's participation in the WTO visit: www.dfat.gov.au/trade/negotiations

The Doha Round has a strong development focus. It aims to improve developing countries' market access, reduce agricultural subsidies and increase global Aid for Trade. Aid for Trade refers to development assistance that addresses trade-related needs (such as policy, infrastructure and productive capacity) to help increase developing country participation in trade and support economic growth. Australia's Aid for Trade represents about 10 per cent of the overall aid program, which was around $400 million in 2009-2010. Aid for Trade is part of the Government's support for the achievement of the United Nations' Millennium Development Goals.

For more information on Australia's development assistance visit: www.ausaid.gov.au

Agricultural Trade

The Australian Government's goal in the agriculture negotiations of the Doha Round is to reform agricultural trade, which is one of the most distorted and highly protected sectors of international trade.

As Chair of the Cairns Group, the Australian Government is pushing for agricultural trade reform through the WTO. In particular, Australia is pursuing significant reductions in agricultural tariffs, deep cuts to domestic support and tight disciplines on export competition.

- The Cairns Group is a coalition of 19 agricultural exporting countries, bringing together a diverse range of developed and developing countries from Latin America, Africa and the Asia-Pacific region.

- The Cairns Group has been an influential voice in the agricultural reform debate since its formation in 1986 and continues to play a major role in pressing the WTO membership to meet the Doha Round's far-reaching mandate.

Members of the Cairns Group

- Argentina

- Australia

- Bolivia

- Brazil

- Canada

- Chile

- Colombia

- Costa Rica

- Guatemala

- Indonesia

- Malaysia

- New Zealand

- Pakistan

- Paraguay

- Peru

- Philippines

- South Africa

- Thailand

- Uruguay

Non-Agricultural Trade

In the Doha Round, the Government is pushing for reductions in tariffs and other barriers to trade in non-agricultural goods (which include industrial, forestry and seafood products). these reforms would expand potential markets for Australian industry.

Non-agricultural trade accounts for around 90 per cent of global trade in goods. A strong Doha Round outcome would provide a significant boost to the world economy, with flow-on benefits to Australia.

Services Trade

The Government is working hard to achieve better access for Australia's services exports which accounted for approximately one fifth of Australia's total exports in 2009, at $53 billion. In coming years, the services sector is predicted to be the most strongly growing sector in global trade. Education and tourism services are Australia's top services exports.

The Doha Round negotiations aim to reduce barriers that services exporters face in overseas markets by recognising qualifications and standards and investment rules and regulations relating to the temporary entry of business people. Given the importance of this sector to the Australian economy, Australia takes a prominent role in the services negotiations. Australia also promotes improved services exports through APEC and the negotiation of comprehensive Free Trade Agreements.

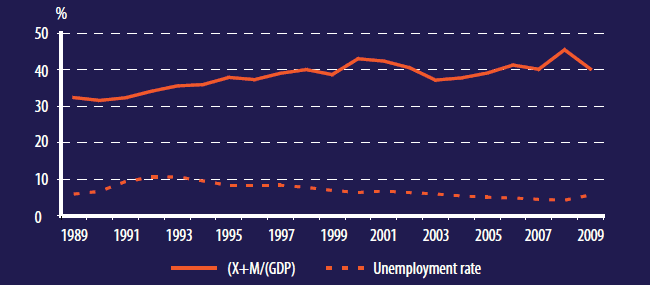

Trade Liberalisation and Jobs

Trade, both exports and imports, accounts for one in five Australian jobs. This equates to over 2 million jobs in today's workforce.

Trade's share of the economy has grown as barriers to trade have been liberalised. A 2009 study by the Centre for International Economics (CIE) showed that total trade – both exports and imports – supports jobs.

The myth that lower tariffs destroy jobs has been debunked. Trade liberalisation has made the economy more flexible. The number of people employed in Australia in export-related activity in services such as finance, property and business services is increasing.

The jobs created by trade are typically good jobs. According to a study by the Australian Trade Commission and the University of NSW, exporters:

- pay higher wages or salaries than non-exporters, even after allowing for differences in size;

- are more committed than non-exporters to providing a safe working environment;

- employ a higher percentage of staff on a full-time basis; and

- are more likely to offer training to workers than non-exporters.

Another 2010 US study called "Trade and American Jobs" prepared for the Business Roundtable concluded "as US trade, both exports and imports, has grown over the past decade, caused in part by trade liberalising international trade agreements, so has the number of jobs tied to trade. Indeed, trade dependent jobs have grown at a faster pace than US jobs generally."

Trade liberalisation, along with other reforms such as the decentralisation of wage bargaining, deregulation of the financial system, opening the economy to foreign investment and the implementation of competition policy, has helped to reduce unemployment in Australia. As tariffs have fallen and Australia's engagement in international trade has increased, the unemployment rate has fallen from double digit levels in the early 1990s to around 5 per cent currently.

Australia: Trade and Unemployment

Based on ABS catalogues 5206.0 & 6202.0. "(X+M)/GDP" measures the ratio of exports plus imports of goods and services to GDP at current prices. "Unemployment rate" is the average rate of unemployment (not seasonally adjusted) for each year.

Free Trade Agreements (FTAs)

Comprehensive Free Trade Agreements enhance Australia s trading performance if they are truly liberalising across all sectors and consistent with WTO rules and complement the multilateral trading system.

Australia has concluded six FTAs:

- ASEAN-Australia-New Zealand (AANZFTA) - 2010

- Australia-Chile Free Trade Agreement (AClFTA) - 2009

- Australia-United States Free Trade Agreement (AUSFTA) - 2005

- Thailand-Australia Free Trade Agreement (TAFTA) - 2005

- Singapore-Australia Free Trade Agreement (SAFTA) - 2003

- Australia-New Zealand Closer Economic Relations Trade Agreement (ANZCERTA) - 1983

Australia is undertaking FTA negotiations with:

- China

- Japan

- Malaysia

- The Gulf Cooperation Council (Saudi Arabia, Qatar, Bahrain, Oman, Kuwait, United Arab Emirates)

- Republic of Korea

- Trans-Pacific Partnership Agreement

- Pacific Agreement on Closer Economic Relations - PACER Plus

- Indonesia

FTAs

Australia's FTAs aim to:

- Be fully consistent with WTO principles and rules, deliver WTO-plus outcomes and reinforce the multilateral trading system

- Comprehensively and substantially liberalise goods and services trade and investment

- Deliver substantial commercial and wider economic benefits to Australia more quickly than would be possible through multilateral or regional processes

- Promote stronger trade and commercial ties between participating countries, and open up opportunities for Australian exporters and investors to expand their business into key markets

- Secure Australia's competitiveness with key trading partners

For more information on Australia's FTAs and www.dfat.gov.au/trade/

Australia and the G20

Australia is a founding member of the Group of 20 (G20) which emerged in 2008 during the Global Financial Crisis becoming the premier forum for international economic cooperation.

The G20 has played a central role in the global response to the economic crisis and subsequent recovery, including through coordinated fiscal and monetary stimulus packages; support for institutions such as the International Monetary Fund (IMF) and World Trade organization (WTO); and leading the fight against trade protectionism. The first meeting of the G20 at leaders' level was held in Washington in November 2008.

G20 members are:

Argentina, Australia, Brazil, Canada, China, European Union, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, United Kingdom and the United States.

G20 countries make up:

- 87 per cent of global GDP

- 66 per cent of world population

- 78 per cent of world trade

Trade with our region: APEC

Asia-Pacific Economic Cooperation (APEC) is the pre-eminent economic forum in our region and has delivered major gains to Australia and regional trading partners through trade liberalisation, business facilitation, and economic cooperation and technical assistance.

- APEC has 21 member economies which account for 44 per cent of world trade and 69 per cent of Australia's total trade.

- Eight of Australia's 10 largest export markets are within APEC, including our top two export markets – China and Japan.

- APEC is driving an extensive trade and investment liberalisation and facilitation agenda.

- APEC is increasingly focused on structural economic reform as a means of strengthening competitiveness and the efficiency of trade and investment flows.

Members of APEC

Australia, Canada, Peoples Republic of China, Indonesia, Republic of Korea, Mexico, Papua New Guinea, Philippines, Singapore, Thailand, Vietnam, Brunei Darussalam, Chile, Hong Kong China, Japan, Malaysia, New Zealand, Peru, Russia, Chinese Taipei, United States

Australia hosted APEC in 2007, with the APEC Economic Leaders' Meeting held in Sydney in September 2007. Japan is the current host.

For more information on APEC: www.apec.org

Information and contacts

Department of Foreign Affairs and Trade (DFAT)

More information on trade policy and statistics.

Australian Trade Commission (Austrade)

For information on the range of services available to new and existing exporters visit: www.austrade.gov.au or contact 13 28 78

Export Finance and Insurance Corporation (EFIC)

To find out about EFIC's export credit and insurance services visit: www.efic.gov.au or call 1800 887 588

Further contacts

For information about the Australian Government visit www.australia.gov.au

| State Office | Phone | Fax |

|---|---|---|

| Adelaide, South Australia | 08 8403 4899 | 08 8403 4873 |

| Brisbane, Queensland | 07 3405 4795 | 07 3405 4782 |

| Canberra, (Head Office) Australian Capital Territory | 02 6261 1111 | 02 6261 3111 |

| Darwin, Northern Territory | 08 8982 4199 | 08 8982 4155 |

| Hobart, Tasmania | 03 6238 4099 | 03 6238 4024 |

| Melbourne, Victoria | 03 9221 5555 | 03 9221 5455 |

| Perth, Western Australia | 08 9231 4499 | 08 9221 2827 |

| Sydney, New South Wales | 02 9356 6222 | 02 9356 4238 |