Publications

ISSN 1839-1842 (Online)

ISBN [978-1-921612-94-7] (Web document)

ISBN [978-1-921612-93-0] (PDF document)

Print version

Trade at a Glance 2011 [PDF 1.36 MB]

Minister for Trade's Foreword

Welcome to Trade at a Glance 2011, an informative summary of Australia's trade performance.

Australia has long been an open and active trading country. This engagement in global commerce has helped us become a prosperous nation and also left us well-placed in recent years to weather the worst effects of the global financial crisis.

In 2010, Australia registered a $16.8 billion trade surplus, with our goods and services exported to more than 200 countries. These exports generated more than 20 per cent of Australia's gross domestic product. Both exports and imports create employment: one in five Australian jobs is related to trade and expanding our international trade will help secure a high-skill, high-wage future.

Australia's total trade with China in 2010 was $105 billion, almost 24 per cent more than in the previous year. It was the first time that Australia's two-way trade with a single nation had topped the $100 billion level.

China was Australia's largest two-way trading partner, our largest export market and biggest source of imports. As we develop our trading relationships, we build our nation's wealth and contribute to the Government's vision for Australia as a prosperous, sustainable nation providing opportunity for all.

I encourage you to read Trade at a Glance 2011, and trust you will find it a valuable resource.

The Hon Dr Craig Emerson MP

Minister for Trade

Trade Performance at a Glance

Profile of Australian Trade

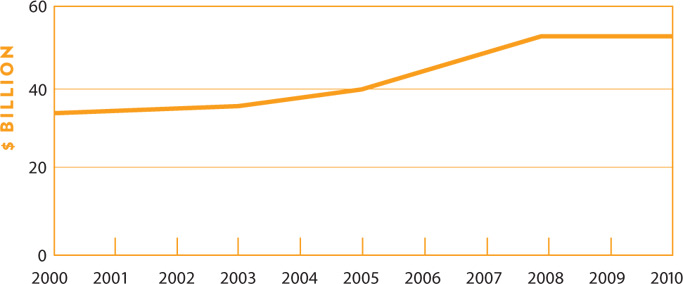

Australia's two-way trade totalled $552.4 billion in 2010. Resource commodities including iron ore and coal, made up 47.5 per cent of Australia's exports. Australia's total goods and services exports reached $284.6 billion.

Other leading exports included services such as education and tourism, manufactured goods (including pharmaceuticals) and farm produce.

China, Japan, United States and the Republic of Korea were the nation's top four trading partners in 2010. About 70 per cent of Australia's trade was with the member economies of the Asia-Pacific Economic Cooperation (APEC) forum.

One in five Australian jobs is related to trade, according to the Centre for International Economics report Benefits of Trade and Trade Liberalisation, 2009.

Australia's 2010 Trade Performance

Australia's trade in goods and services grew strongly in 2010.

Australia registered a $16.8 billion trade surplus in 2010, reversing a trade deficit of $4 billion in 2009. This represents a turnaround in our trade performance of $20.8 billion.

Two-way trade in goods and services grew 10 per cent to $552.4 billion in 2010, up from $503.9 billion in 2009.

The value of Australia's exports increased 13.9 per cent to a new record of $284.6 billion and export volumes were up 5.2 per cent in 2010. The surge was led by strong demand and firm prices for metal ores, minerals and coal.

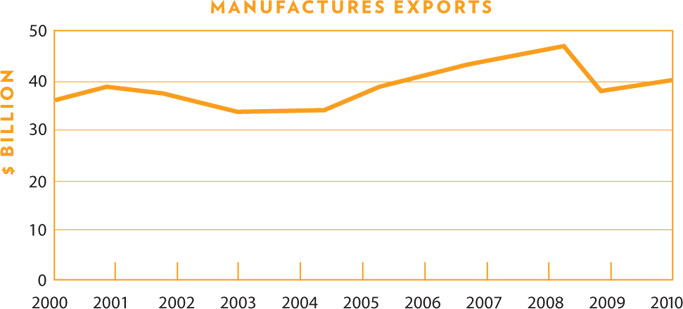

Australia's manufacturing exports also performed well in 2010, increasing by 4 per cent to $40.5 billion, despite a strong dollar.

These were welcome results following 2009, when global trade flows fell by 11 per cent, in volume terms, due to the global recession.

Australia's Trade & Economic Statistics

| Goods (a) | Services (b)(c) | Total(c)(d) | % share | ||

|---|---|---|---|---|---|

| 1 | China | 97.7 | 7.6 | 105.3 | 19.1 |

| 2 | Japan | 61.8 | 4.3 | 66.1 | 12.0 |

| 3 | United States(e) | 34.6 | 15.1 | 49.8 | 9.0 |

| 4 | Republic of Korea | 27.6 | 2.5 | 30.1 | 5.4 |

| 5 | United Kingdom | 14.1 | 8.5 | 22.6 | 4.1 |

| 6 | India | 18.4 | 3.8 | 22.2 | 4.0 |

| 7 | Singapore | 15.5 | 6.1 | 21.6 | 3.9 |

| 8 | New Zealand | 15.2 | 6.1 | 21.3 | 3.9 |

| 9 | Thailand | 16.9 | 3.0 | 19.8 | 3.6 |

| 10 | Malaysia | 12.7 | 2.8 | 15.6 | 2.8 |

| 444.0 | 108.3 | 552.4 | 100.0 | ||

| APEC(e) | 329.1 | 61.4 | 390.5 | 70.7 | |

| ASEAN10 | 62.5 | 18.0 | 80.5 | 14.6 | |

| EU27(c) | 57.0 | 21.0 | 78.0 | 14.1 | |

| OECD(e) | 207.0 | 54.1 | 261.1 | 47.3 | |

(a) Recorded trade basis.

(b) Balance of payments basis.

(c) Excludes imports of aircraft from regional import total from Sep-08 onwards (excl. the United States – see footnote (e). This has a significant impact on import totals for France (EU27).

(d) Total may not sum due to rounding.

(e) Based on unpublished ABS data and includes confidential aircraft imports for the US only.

Based on ABS trade data on DFAT STARS database, ABS catalogues 5302.0. & 5368.0.05.004 and ABS unpublished data.

| ($ billion) | |

| Iron ore & concentrates | 49.4 |

| Coal | 43.0 |

| Education-related travel services | 17.7 |

| Gold(b) | 15.0 |

| Personal travel (excluding education) services | 12.2 |

| Crude petroleum | 10.5 |

| Natural gas | 9.4 |

| Aluminium ores & concentrates (including alumina) | 5.3 |

| Copper ores & concentrates | 5.0 |

| Aluminium | 4.4 |

| Beef | 4.4 |

| Wheat | 4.2 |

| Medicaments (including veterinary) | 3.6 |

| Technical & other business services | 3.5 |

| Copper | 3.2 |

| Professional services | 3.1 |

| Business travel services | 3.0 |

| Passenger transport services(c) | 2.7 |

| Refined petroleum | 2.4 |

| Meat (excluding beef) | 2.3 |

| Total exports(d) | 284.6 |

(a) Goods trade is on a recorded trade basis. Services trade is on a balance of payments basis.

(b) Balance of payments basis.

(c) Includes related agency fees and commissions.

(d) Total exports on a BOP basis.

Based on ABS trade data on DFAT STARS database and ABS catalogue 5302.0.

(a) Totals are in $billions and percentage figures represent share of total market.

Based on ABS trade data on DFAT STARS database and ABS catalogues 5302.0.

and 5368.0.55.004.

(a) Totals are in $billions and percentage figures represent share of total market.

Based on ABS trade data on DFAT STARS database and ABS catalogues 5302.0. and 5368.0.55.004.

| Goods(a) | $ million | % share |

|---|---|---|

| Crude petroleum | 16,218 | 7.7 |

| Passenger motor vehicles | 15,917 | 7.5 |

| Refined petroleum | 9,970 | 4.7 |

| Medicaments (incl. veterinary) | 7,896 | 3.7 |

| Telecom equipment & parts | 7,534 | 3.6 |

| Computers | 6,526 | 3.1 |

| Gold(b) | 6,520 | 3.1 |

| Goods vehicles | 6,019 | 2.8 |

| Civil engineering equipment & parts | 3,049 | 1.4 |

| Monitors, projectors & TVs | 2,822 | 1.3 |

| Furniture, mattresses & cushions | 2,629 | 1.2 |

| Measuring & analysing instruments | 2,616 | 1.2 |

| Vehicle parts & accessories | 2,572 | 1.2 |

| Prams, toys, games & sporting goods | 2,565 | 1.2 |

| Electrical machinery & parts, not elsewhere specified | 2,447 | 1.2 |

| Heating & cooling equipment & parts | 2,247 | 1.1 |

| Pumps (excl. liquid pumps) & parts | 2,220 | 1.0 |

| Rubber tyres, treads & tubes | 2,173 | 1.0 |

| Household-type equipment, not elsewhere specified | 2,054 | 1.0 |

| Office machines | 2,025 | 1.0 |

| Total goods imports(c) | 211,850 | 100.0 |

(a) Recorded trade basis.

(b) Balance of payments basis.

(c) Total goods imports on a BOP basis.

Based on ABS trade data on DFAT STARS database and ABS catalogue 5302.0.

| Goods(a) | $ million | % share |

|---|---|---|

| Iron ore & concentrates | 49,376 | 21.3 |

| Coal | 42,967 | 18.5 |

| Gold (b) | 15,005 | 6.5 |

| Crude petroleum | 10,502 | 4.5 |

| Natural gas | 9,425 | 4.1 |

| Aluminium ores & concentrates (incl. alumina) | 5,293 | 2.3 |

| Copper ores & concentrates | 5,036 | 2.2 |

| Other ores & concentrates | 4,441 | 1.9 |

| Aluminium | 4,409 | 1.9 |

| Beef | 4,369 | 1.9 |

| Wheat | 4,178 | 1.8 |

| Medicaments (including veterinary) | 3,601 | 1.6 |

| Copper | 3,160 | 1.4 |

| Refined petroleum | 2,438 | 1.1 |

| Meat (excl. beef) | 2,258 | 1.0 |

| Alcoholic beverages (mainly wine) | 2,238 | 1.0 |

| Wool & other animal hair (incl. tops) | 2,225 | 1.0 |

| Passenger motor vehicles | 1,802 | 0.8 |

| Confidential mineral ores | 1,655 | 0.7 |

| Milk & cream | 1,171 | 0.5 |

| Total goods exports(c) | 232,188 | 100.0 |

(a) Recorded trade basis.

(b) Balance of payments basis.

(c) Total goods exports

on a BOP basis.

Based on ABS trade data on DFAT STARS database and ABS catalogue 5302.0.

| Services(a) | $ million | % share |

|---|---|---|

| Manufactured services on physical inputs owned by others | 6 | 0.0 |

| Maintenance & repair | 283 | 0.5 |

| Transport | ||

| Passenger(b) | 5,708 | 10.2 |

| Freight | 8,542 | 15.3 |

| Other(c) | 291 | 0.5 |

| Postal & courier services | 129 | 0.2 |

| Total transport | 14,670 | 26.2 |

| Travel | ||

| Business | 3,150 | 5.6 |

| Personal | 21,248 | 38.0 |

| Education-related | 906 | 1.6 |

| Other personal(d) | 20,342 | 36.4 |

| Total travel | 24,398 | 43.6 |

| Other | ||

| Construction | 0 | 0.0 |

| Insurance & pension | 615 | 1.1 |

| Financial | 664 | 1.2 |

| Intellectual property charges | 3,706 | 6.6 |

| Telecommunications, computer & information | 2,038 | 3.6 |

| Other business services | 7,277 | 13.0 |

| Personal, cultural and recreational | 1,377 | 2.5 |

| Government services, not included elsewhere | 888 | 1.6 |

| Total other services | 16,565 | 29.6 |

| Total services imports | 55,922 | 100.0 |

(a) Balance of payments basis.

(b) Passenger services include air transport-related agency

fees & commissions.

(c) Transportation operation lease fees are included.

(d) Outbound tourism for mainly recreational purposes.

Based on ABS catalogue 5302.0.

| Services(a) | $ million | % share |

|---|---|---|

| Manufactured services on physical inputs owned by others | 230 | 0.4 |

| Maintenance & repair | 54 | 0.1 |

| Transport | ||

| Passenger(b) | 2,713 | 5.2 |

| Freight | 425 | 0.8 |

| Other(c) | 2,251 | 4.3 |

| Postal & courier services | 950 | 1.8 |

| Total transport | 6,339 | 12.1 |

| Travel | ||

| Business | 2,966 | 5.7 |

| Personal | 29,851 | 57.0 |

| Education-related | 17,685 | 33.8 |

| Other personal(d) | 12,166 | 23.2 |

| Total travel | 32,817 | 62.6 |

| Other | ||

| Construction | 92 | 0.2 |

| Insurance & pension | 324 | 0.6 |

| Financial | 956 | 1.8 |

| Intellectual property charges | 1,027 | 2.0 |

| Telecommunications, computer & information | 1,816 | 3.5 |

| Other business services | 7,117 | 13.6 |

| Personal, cultural and recreational | 767 | 1.5 |

| Government services, not included elsewhere | 852 | 1.6 |

| Total other services | 12,951 | 24.7 |

| Total services imports | 52,391 | 100.0 |

(a) Balance of payments basis.

(b) Passenger services include air transport-related

agency fees and commissions.

(c) Transportation operation lease fees are included.

(d) Inbound tourism for mainly recreational purposes.

Based on ABS catalogue 5302.0.

| Country | Level of direct investment in Australia | Level of total investment in Australia |

|---|---|---|

| United States | 120,089 | 549,881 |

| United Kingdom | 52,525 | 472,649 |

| Japan | 49,417 | 117,633 |

| Singapore | 20,240 | 43,771 |

| Netherlands | 31,128 | 42,425 |

| Hong Kong (SAR of China) | 6,694 | 40,774 |

| Germany | 16,224 | 40,756 |

| Switzerland | 20,735 | 40,731 |

| New Zealand | 6,460 | 33,773 |

| France | 12,563 | 23,861 |

| Total all countries | 473,673 | 1,967,806 |

| Of which: | ||

| APEC | 241,863 | 858,798 |

| ASEAN10 | 27,477 | 61,332 |

| EU27 | 131,562 | 647,400 |

| OECD | 347,888 | 1,414,184 |

(a) Foreign investment in Australia: level of investment (stocks) as at 31 December

2010, by selected country and country group.

Source: ABS catalogue 5352.0.

| Country | Level of direct investment in Australia | Level of total investment in Australia |

|---|---|---|

| United States | 93,417 | 410,046 |

| United Kingdom | 72,046 | 192,336 |

| New Zealand | 38,947 | 73,934 |

| Canada | 23,447 | 39,174 |

| Germany | 9,251 | 37,231 |

| France | 419 | 29,415 |

| Japan | 518 | 29,111 |

| Singapore | 6,255 | 25,057 |

| Netherlands | 4,490 | 24,543 |

| Hong Kong (SAR of China) | 5,090 | 23,362 |

| Total all countries | 361,779 | 1,185,704 |

| Of which: | ||

| APEC | 200,791 | 661,882 |

| ASEAN10 | 15,366 | 42,732 |

| EU27 | 102,698 | 363,240 |

| OECD | 268,549 | 921,480 |

(a) Australian investment abroad: level of investment (stocks) as at 31 December 2010, by selected country and country group.

Source: ABS catalogue 5352.0.

| Rank | Country | Goods(a) | Services(b) | Total imports | % share |

|---|---|---|---|---|---|

| 1 | United States | 1,968 | 358 | 2,236 | 12.3 |

| 2 | China | 1,395 | 192 | 1,587 | 8.4 |

| 3 | Germany | 1,067 | 256 | 1,323 | 7.0 |

| 4 | Japan | 693 | 155 | 848 | 4.5 |

| 5 | France | 606 | 126 | 732 | 3.9 |

| 6 | United Kingdom | 558 | 156 | 714 | 3.8 |

| 7 | Netherlands | 517 | 109 | 626 | 3.3 |

| 8 | Italy | 484 | 108 | 592 | 3.1 |

| 9 | Republic of Korea | 425 | 93 | 518 | 2.7 |

| 10 | Hong Kong(c) | 442 | 51 | 493 | 2.6 |

| 11 | Canada | 402 | 89 | 491 | 2.6 |

| 12 | Belgium | 390 | 75 | 466 | 2.5 |

| 13 | India | 323 | 117 | 440 | 2.3 |

| 14 | Singapore | 311 | 96 | 407 | 2.2 |

| 15 | Spain | 312 | 85 | 398 | 2.1 |

| 16 | Mexico | 311 | 23 | 334 | 1.8 |

| 17 | Russian Federation | 248 | 70 | 318 | 1.7 |

| 18 | Taiwan | 251 | 37 | 288 | 1.5 |

| 19 | Australia | 202 | 50 | 251 | 1.3 |

| 20 | Brazil | 191 | 60 | 251 | 1.3 |

| 21 | Thailand | 182 | 45 | 228 | 1.2 |

| 22 | Switzerland | 176 | 38 | 215 | 1.1 |

| 23 | United Arab Emirates | 170 | 39 | 209 | 1.1 |

| 24 | Turkey | 185 | 18 | 204 | 1.1 |

| 25 | Poland | 174 | 27 | 201 | 1.1 |

| 26 | Malaysia | 165 | 32 | 197 | 1.0 |

| 27 | Sweden | 148 | 48 | 196 | 1.0 |

| 28 | Austria | 159 | 36 | 195 | 1.0 |

| 29 | Saudi Arabia | 102 | 74 | 176 | 0.9 |

| 30 | Ireland | 59 | 106 | 165 | 0.9 |

| Total imports | 15,376 | 3,503 | 18,879 |

(a) Goods on recorded trade basis.

(b) Commercial services on balance of payments

basis.

(c) Special Administrative Region of China.

Sources: WTO online database and

EIU Viewswire.

| Rank | Country | Goods(a) | Services(b) | Total imports | % share |

|---|---|---|---|---|---|

| 1 | United States | 1,278 | 515 | 1,793 | 9.5 |

| 2 | China | 1,578 | 170 | 1,748 | 9.2 |

| 3 | Germany | 1,269 | 230 | 1,499 | 7.9 |

| 4 | Japan | 770 | 138 | 907 | 4.8 |

| 5 | Netherlands | 572 | 111 | 683 | 3.6 |

| 6 | France | 521 | 140 | 661 | 3.5 |

| 7 | United Kingdom | 405 | 227 | 632 | 3.3 |

| 8 | Republic of Korea | 466 | 82 | 548 | 2.9 |

| 9 | Italy | 448 | 97 | 545 | 2.9 |

| 10 | Hong Kong(c) | 401 | 108 | 509 | 2.7 |

| 11 | Belgium | 411 | 81 | 492 | 2.6 |

| 12 | Singapore | 352 | 112 | 464 | 2.5 |

| 13 | Canada | 387 | 66 | 453 | 2.4 |

| 14 | Russian Federation | 400 | 44 | 444 | 2.3 |

| 15 | Spain | 245 | 121 | 365 | 1.9 |

| 16 | India | 216 | 110 | 326 | 1.7 |

| 17 | Taiwan | 275 | 41 | 315 | 1.7 |

| 18 | Mexico | 298 | 16 | 315 | 1.7 |

| 19 | Switzerland | 195 | 76 | 272 | 1.4 |

| 20 | Saudi Arabia | 254 | 10 | 264 | 1.4 |

| 21 | Australia | 212 | 48 | 260 | 1.4 |

| 22 | United Arab Emirates | 235 | 11 | 246 | 1.3 |

| 23 | Brazil | 202 | 30 | 232 | 1.2 |

| 24 | Malaysia | 199 | 32 | 231 | 1.2 |

| 25 | Thailand | 195 | 34 | 229 | 1.2 |

| 26 | Sweden | 158 | 64 | 222 | 1.2 |

| 27 | Ireland | 117 | 95 | 212 | 1.1 |

| 28 | Austria | 152 | 53 | 205 | 1.1 |

| 29 | Poland | 156 | 32 | 188 | 1.0 |

| 30 | Indonesia | 158 | 17 | 175 | 0.9 |

| Total imports | 15,238 | 3,664 | 18,902 |

(a) Goods on recorded trade basis.

(b) Commercial services on balance of payments basis.

(c) Special Administrative Region of China.

Sources: WTO online database and EIU Viewswire.

The Australian Economy

The Australian economy remains strong and resilient in the face of new and ongoing challenges. Australia's economic growth in 2010 was 2.5 per cent and the average unemployment rate was one of the lowest in the OECD at 5.2 per cent. Despite continuing international uncertainty, prospects for Australia's economy remain positive, with low public debt, low unemployment and a surge in business investment expected.

Despite the impact of natural disasters and a decrease in tax receipts, Australia's budget position remains amongst the strongest in the developed world.

The strong performance of the Australian economy is due to a number of factors, including:

- Australia's strong economic institutions, in particular, a sound, stable financial and banking system – no Australian bank collapsed or required a government bail-out during the global financial crisis; four of the world's nine most highly rated banking groups are Australian.

- Australia's flexible and open trade and investment environment and well-targeted economic policies supporting business growth and innovation.

- Australia's close trade and economic links with the emerging economies of Asia which help to support growth and employment. In 2010, while world trade values rose 18.8 per cent, Australia's exports to China increased by 34 per cent and Korea by 28 per cent.

- The success of monetary and fiscal stimulus measures in supporting economic growth during the global financial crisis.

The boom in the mining and resources sector is expected to see Australia's terms of trade reach their highest sustained level in 140 years. The 2011 Budget introduced measures that invest in the country's productive capability to maximise the benefits of the mining boom by targeted skills training and measures to boost participation.

(a) The term is used to describe gross product by industry and by sector (Chain Volume Measures reference year 2008-09). Industry breakdown based on ANZSIC 2006.

(b) Derived from seasonally adjusted data on an annual average

(c) As a share of GDP at basic prices.

(d) Basic prices are amounts received by producers, including the value of any subsidies on products, but before any taxes on products.

Based on ABS catalogues 5206.0, 6202.0 and 6203.0.

| 2000 | 2008 | 2009 | 2010 | ||

|---|---|---|---|---|---|

| Demand and production – chain volume measures, reference year 2008-09 | |||||

| Gross domestic product(a) | % change | 3.4 | 2.4 | 1.4 | 2.5 |

| Exports of goods & services(a) | % change | 11.0 | 4.7 | 2.9 | 5.2 |

| Imports of goods & services(a) | % change | 7.4 | 11.3 | -9.0 | 13.5 |

| Labour force | |||||

| Population(b) | '000 | 19,273 | 21,731 | 22,152 | 22,408(d) |

| Labour force | '000 | 9,590 | 11,356 | 11,602 | 11,868 |

| Employed persons | '000 | 8,989 | 10,873 | 10,953 | 11,247 |

| – Annual growth | % | 2.6 | 2.8 | 0.7 | 2.7 |

| Unemployment rate | % | 6.3 | 4.3 | 5.6 | 5.2 |

| Prices and interest rates | |||||

| Consumer prices | % change | 5.8 | 3.7 | 2.1 | 2.7 |

| Interest rates – 90 day bills(c) | % pa | 6.2 | 7.0 | 3.4 | 4.7 |

(a) Derived from annual movements in original data

(b) At end of period

(c) Annual average

(d) September 2010 data.

Based on Australian Bureau of Statistics and Reserve Bank, various catalogues.

Trans-Pacific Partnership Agreement

Once concluded, the Trans-Pacific Partnership (TPP) will be a high-quality, comprehensive, 21st century free trade agreement.

The TPP is the Government's highest regional trade negotiation priority because:

- It has the potential to expand our access to some of the most dynamic economies in the Asia-Pacific region, providing great opportunities for Australia's exporters;

- It aims to comprehensively address all trade and investment issues between the TPP countries, with the goal of more closely integrating the economies of all members;

- It will simplify trade arrangements and be responsive to the needs of modern businesses, making it easier for Australian companies to operate in the region; and

- It can provide a pathway to a free trade area of the Asia-Pacific, which would further expand opportunities in the region for Australian exporters and investors.

Current members of the TPP are Australia, Brunei Darussalam, Chile, Malaysia, New Zealand, Singapore, Peru, the United States and Vietnam.

Australia's decision to participate in the TPP followed an extensive public consultation process. Overall, there was widespread interest in, and support for, Australia's participation in the TPP.

Key Interests and Benefits

- A successful TPP negotiation will provide a pathway towards greater Asia-Pacific regional economic integration – it's in Australia's interest to be involved in order to shape the direction of the initiative.

- Australia's trade and investment relationship with current TPP parties is significant. TPP parties composed 21 per cent of Australia's total trade with the world in 2010, and there are great opportunities in the TPP, particularly as membership expands, since more than 70 per cent of Australia's total trade is with APEC members; and

- The Asia-Pacific accounts for more than half of global GDP and more than 40 per cent of world trade.

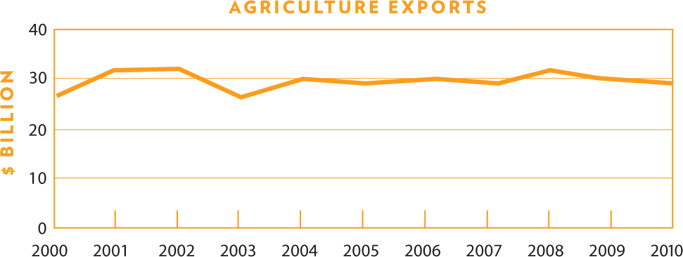

Agriculture

- Beef was Australia's largest agricultural export in 2010, at $4.4 billion.

- Agricultural products accounted for 10.6 per cent of Australia's exports in 2010.

- Australia exports around 60 per cent of its total farm production.

| Rank | Commodity | $ million | % share |

|---|---|---|---|

| 1 | Beef | 4,369 | 14.5 |

| 2 | Wheat | 4,178 | 13.9 |

| 3 | Meat (excluding beef) | 2,258 | 7.5 |

| 4 | Wool & other animal hair (including tops) | 2,225 | 7.4 |

| 5 | Wine | 2,126 | 7.1 |

| 6 | Milk & cream | 1,171 | 3.9 |

| 7 | Live animals (excluding seafood) | 1,144 | 3.8 |

| 8 | Cotton | 1,042 | 3.5 |

| 9 | Animal feed | 987 | 3.3 |

| 10 | Wood in chips or particles | 917 | 3.1 |

| 11 | Barley | 801 | 2.7 |

| 12 | Vegetables | 789 | 2.6 |

| 13 | Cheese & curd | 742 | 2.5 |

| 14 | Hides & skins, raw (excluding furskins) | 721 | 2.4 |

| 15 | Edible products & preparations | 699 | 2.3 |

| 16 | Cereal preparations | 692 | 2.3 |

| 17 | Crustaceans | 664 | 2.2 |

| 18 | Fruit & nuts | 585 | 1.9 |

| 19 | Oil-seeds & oleaginous fruits, soft | 569 | 1.9 |

| 20 | Animal oils & fats | 306 | 1.0 |

| Total | 30,071 | 100.0 |

(a) Based on the WTO definition of agriculture, which includes alcoholic beverages

but excludes confidential raw sugar in bulk. Data for confidential raw sugar in bulk

are released with a lag. In 2009-10, raw sugar in bulk exports totalled $1.8 billion.

(b) Recorded trade basis.

Based on ABS trade data on DFAT STARS database.

Based on ABS trade data on DFAT STARS database.

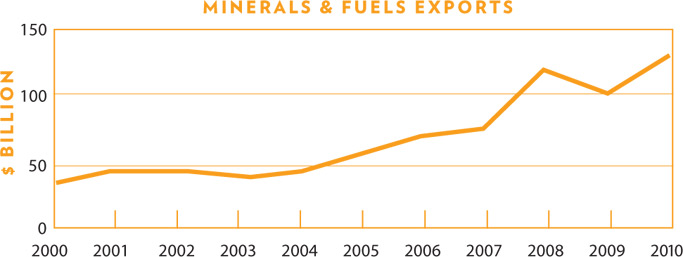

Minerals and fuels

- Minerals and fuels was Australia's largest export sector in 2010, valued

at $135.0 billion. - Iron ore and coal were Australia's largest minerals exports, while crude petroleum was the leading fuels export.

- China and Japan were Australia's two largest markets for minerals and fuels.

| Rank | Commodity(a) | $ million | % share |

|---|---|---|---|

| 1 | Iron ore & concentrates | 49,376 | 36.6 |

| 2 | Coal | 42,967 | 31.8 |

| 3 | Crude petroleum | 10,502 | 7.8 |

| 4 | Natural gas | 9,425 | 7.0 |

| 5 | Aluminium ores & concentrates (including alumina) | 5,293 | 3.9 |

| 6 | Copper ores & concentrates | 5,036 | 3.7 |

| 7 | Other ores & concentrates | 4,441 | 3.3 |

| 8 | Refined petroleum | 2,438 | 1.8 |

| 9 | Confidential mineral ores | 1,655 | 1.2 |

| 10 | Liquefied propane & butane | 1,081 | 0.8 |

| 11 | Nickel ores & concentrates | 889 | 0.7 |

| 12 | Precious metal ores & concentrates (excluding gold) | 871 | 0.6 |

| 13 | Non-ferrous waste & scrap | 839 | 0.6 |

| 14 | Ferrous waste & scrap | 722 | 0.5 |

| 15 | Crude minerals | 220 | 0.2 |

| 16 | Coke & semi-coke | 155 | 0.1 |

| 17 | Stone, sand & gravel | 106 | 0.1 |

| 18 | Natural abrasives | 32 | 0.0 |

| 19 | Residual petroleum products | 19 | 0.0 |

| 20 | Crude fertilisers | 3 | 0.0 |

| Total(b) | 135,025 | 100.0 |

(a) Recorded trade basis.

(b) Total minerals and fuels exports on a Balance of Payments

(BOP) basis.

Based on ABS trade data on DFAT STARS database and ABS catalogue

5302.0.

Based on ABS catalogue 5302.0.

Manufacturing

- Aluminium, medicines and copper were Australia's largest exports of manufactured goods.

- Exports of manufactures rose from $38.8 billion in 2009 to $40.5 billion in 2010.

- The manufacturing sector accounted for 14.2 per cent of Australian exports in 2010.

| Rank | Commodity(a) | $ million | % share |

|---|---|---|---|

| 1 | Aluminium | 4,409 | 10.9 |

| 2 | Medicaments (including veterinary) | 3,601 | 8.9 |

| 3 | Copper | 3,160 | 7.8 |

| 4 | Passenger motor vehicles | 1,802 | 4.5 |

| 5 | Medical instruments (including veterinary) | 994 | 2.5 |

| 6 | Zinc | 934 | 2.3 |

| 7 | Uncoated flat-rolled iron & steel | 933 | 2.3 |

| 8 | Measuring & analysing instruments | 911 | 2.3 |

| 9 | Civil engineering equipment & parts | 851 | 2.1 |

| 10 | Telecom equipment & parts | 836 | 2.1 |

| 11 | Lead | 787 | 1.9 |

| 12 | Specialised machinery & parts | 760 | 1.9 |

| 13 | Aircraft, spacecraft & parts | 677 | 1.7 |

| 14 | Vehicle parts & accessories | 658 | 1.6 |

| 15 | Nickel | 647 | 1.6 |

| 16 | Paper & paperboard | 641 | 1.6 |

| 17 | Pigments, paints & varnishes | 637 | 1.6 |

| 18 | Computer parts & accessories | 632 | 1.6 |

| 19 | Misc manufactured articles | 557 | 1.4 |

| 20 | Starches, inulin & wheat gluten | 549 | 1.4 |

| Total(b) | 40,484 | 100.0 |

(a) Recorded trade basis.

(b) Total manufactures exports on a BOP basis.

Based on ABS trade data on DFAT STARS database and ABS catalogue 5302.0.

Based on ABS catalogue 5302.0.

Services

- Education, recreational travel, technical and other business services were Australia's leading services exports.

- Australia's services exports stood at $52.4 billion in 2010.

- The services sector accounted for 18.4 per cent of Australian exports in 2010.

Based on ABS catalogue 5302.0.

Trade Policy at a Glance

Australia's Trade Policy

Trading our way to more jobs and prosperity

The Government's vision for the nation is of a prosperous, sustainable Australia providing opportunity for all. International trade contributes to the fulfilment of that vision by increasing productivity, international competitiveness, creating a high-skill, high-wage workforce and building national prosperity.

With these objectives in mind the Government's trade policy statement, Trading our way to more jobs and prosperity, released by Trade Minister Dr Craig Emerson on 12 April 2011, sets out five guiding principles:

- unilateralism – a commitment to the pursuit of ongoing, trade-related economic reform without waiting for other countries to reform their own economies;

- non-discrimination – Australia will not seek exclusive or entrenched preferential access to other countries' markets;

- separation – foreign policy considerations will not override trade policy assessments in determining the choice of negotiating partners and consideration of proposed trade deals;

- transparency – the public will be kept well informed about the progress of trade negotiations and will have the opportunity to provide input; and

- the indivisibility of trade policy and wider economic reform – domestic economic reform, improved international competitiveness and increased market access work together to create jobs and prosperity.

Consistent with these principles the Government will continue to pursue improved market access for Australian exporters in global markets. The number one priority remains the Doha Round of multilateral trade negotiations in the World Trade Organization (WTO), as a successful outcome to these negotiations offers Australia the most potential economic benefit.

Apart from its role in facilitating trade liberalisation at a global level, the WTO also provides the core set of commitments and rules for its 153 members, creating an open, equitable and enforceable international trading regime. The WTO's dispute settlement system is central to that regime, and gives member countries and exporters confidence that the commitments and obligations contained in the WTO agreements will be respected.

At a regional level, the Government will continue to champion the Asia-Pacific Economic Cooperation (APEC) forum, which has proved its effectiveness as a driver of trade liberalisation in the Asia Pacific.

The Government will also pursue high-quality, comprehensive free trade agreements where these are clearly in Australia's interests.

Australia and the WTO

As a founding member of both the World Trade Organization (WTO) in 1995 and its predecessor, the General Agreement of Tariffs and Trade (GATT) in 1947, Australia has a longstanding commitment to the multilateral trading system operated by the WTO. This system provides the legal framework governing world trade. WTO Members agree on legally binding rules that provide important legal certainty for their exporters.

The Australian Government's key trade policy priority is a successful conclusion to the WTO Doha Round of trade negotiations, launched in Doha, Qatar, in November 2001. It seeks real improvements in market access for Australian exports across all negotiating sectors – agriculture, industrial goods and services.

For more information on Australia's participation in the WTO visit: www.dfat.gov.au/trade/negotiations

The Doha Round has a strong development focus. It aims to improve developing countries' market access, reduce agricultural subsidies and increase global Aid for Trade. Aid for Trade refers to development assistance that addresses trade-related needs (such as policy, infrastructure and productive capacity) to help increase developing country participation in trade and support economic growth. Australia's Aid for Trade represents about 10 per cent of the overall aid program, which was around $400 million in 2009-2010. Aid for Trade is part of the Government's support for the achievement of the United Nations' Millennium Development Goals.

For more information on Australia's development assistance visit: www.ausaid.gov.au

Agricultural Trade

The Australian Government's goal in the agriculture negotiations of the

Doha Round is to reform agricultural trade, which is one of the most distorted

and highly protected sectors of international trade.

As Chair of the Cairns Group, the Australian Government is pushing for

agricultural trade reform through the WTO. In particular, Australia is

pursuing significant reductions in agricultural tariffs, deep cuts to domestic support

and tight disciplines on export competition.

- The Cairns Group is a coalition of 19 agricultural exporting countries,

bringing together a diverse range of developed and developing countries from Latin

America, Africa and the Asia-Pacific region. - The Cairns Group has been an influential voice in the agricultural reform

debate since its formation in 1986 and continues to play a major role

in pressing the WTO membership to meet the Doha Round's far-reaching mandate.

Members of the Cairns Group

- Argentina

- Australia

- Bolivia

- Brazil

- Canada

- Chile

- Colombia

- Costa Rica

- Guatemala

- Indonesia

- Malaysia

- New Zealand

- Pakistan

- Paraguay

- Peru

- Philippines

- South Africa

- Thailand

- Uruguay

Non-Agricultural Trade

Non-agricultural trade accounts for around 90 per cent of global trade in goods. A strong Doha Round outcome would provide a significant boost to the world economy, with flow-on benefits to Australia.

In the Doha Round, the Government is pushing for reductions in tariffs and other barriers to trade in non-agricultural goods (which include industrial, forestry and seafood products). These reforms would expand potential markets for Australian industry.

Services Trade

The Government is working hard to achieve better access for Australia's services exports, which accounted for almost one fifth of Australia's total exports in 2010, at $52.4 billion.

Through negotiations in the WTO Doha Round and the negotiation of comprehensive Free Trade Agreements, including the Trans-Pacific Partnership Agreement, the Australian Government aims to reduce barriers facing our services exporters in overseas markets.

In particular, the Government is aiming to reduce foreign equity caps on overseas investments, improve regulatory transparency and make it easier for business people to pursue opportunities in foreign markets, through improved business mobility.

Given the importance of this sector to the Australian economy, Australia is working to ensure that services are prominent in all its trade negotiations.

Australia is active in promoting regulatory reform and services market access through the Asia-Pacific Economic Cooperation (APEC) process.

In coming years, the services sector is predicted to be the most strongly growing sector in global trade. Education and tourism services are Australia's top services exports.

Free Trade Agreements (FTAs)

The Government will pursue WTO-consistent, high-quality, comprehensive free trade

agreements with key trading partners, where they offer net benefits to Australia and

are supportive of global trade liberalisation.

Australia has concluded six FTAs:

- ASEAN-Australia-New Zealand (AANZFTA) 2010

- Australia-Chile Free Trade Agreement (ACFTA) 2009

- Australia-United States Free Trade Agreement (AUSFTA) 2005

- Thailand-Australia Free Trade Agreement (TAFTA) 2005

- Singapore-Australia Free Trade Agreement (SAFTA) 2003

- Australia-New Zealand Closer Economic Relations Trade Agreement (ANZCERTA) 1983

Australia is undertaking FTA negotiations with:

- China

- The Gulf Cooperation Council (Saudi Arabia, Qatar, Bahrain, Oman, Kuwait,

United Arab Emirates) - India

- Indonesia

- Japan

- Republic of Korea

- Malaysia

- Pacific Agreement on Closer Economic Relations – PACER Plus

- Trans-Pacific Partnership Agreement

Australia's FTAs should:

- Be fully consistent

with WTO principles and rules, deliver WTO-plus outcomes and reinforce the

multilateral trading system; - be comprehensive and genuinely liberalising, eliminating or substantially reducing

barriers to goods and services trade and investment; - deliver substantial net economic benefit to Australia;

- be negotiated in a way that ensures the public is well informed about trade

negotiations and has an opportunity for input; - avoid entrenching preferential market access, while ensuring that Australian

exporters and investors have an opportunity to compete on terms as favourable

as anyone else's; and - not delay domestic economic reform.

For more information on Australia's FTAs visit: www.dfat.gov.au/trade/

Australia and the G20

Australia is a founding member of the Group of 20 (G20), the premier forum for international economic cooperation. The G20 comprises 19 countries and the European Union.

The G20 played a key role in responding to the global financial crisis and averting a global depression, including through coordinated fiscal and monetary stimulus packages.

Its focus has now shifted to strengthening the global economy, reforming international financial institutions and improving financial regulation.

France is the current chair of the G20, and will host the next G20 Summit in Cannes in November 2011. Mexico will host in 2012.

G20 members are:

Argentina, Australia, Brazil, Canada, China, European Union, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, United Kingdom and the United States.

G20 countries make up:

- 87 per cent of global GDP

- 65 per cent of world population

- 77 per cent of world trade

Trade with our Region: APEC

Asia-Pacific Economic Cooperation (APEC) is the pre-eminent economic forum in our region and has delivered major gains to Australia and regional trading partners through trade liberalisation, business facilitation, and economic cooperation and technical assistance.

- APEC has 21 member economies which account for 44 per cent of world trade and 71 per cent of Australia's total trade.

- Eight of Australia's 10 largest export markets are within APEC, including our top three export markets – China, Japan and Korea.

- APEC is driving an extensive trade and investment liberalisation and facilitation agenda aimed at creating a seamless regional economy.

- APEC is increasingly focused on structural economic reform as a means of strengthening competitiveness and the efficiency of trade and investment flows.

Members of APEC

Australia, Canada, Peoples Republic of China, Indonesia, Republic of Korea, Mexico, Papua New Guinea, Philippines, Singapore, Thailand, Vietnam, Brunei Darussalam, Chile, Hong Kong China, Japan, Malaysia, New Zealand, Peru, Russia, Chinese Taipei, United States

Australia hosted APEC in 2007, with the APEC Economic Leaders' Meeting held in Sydney in September 2007.The United States is the current host.

For more information on APEC: www.apec.org

Trade Liberalisation and Jobs

One in five Australian jobs is related to trade. This equates to over 2 million jobs in today's workforce.

A study by the Centre for International Economics (CIE) in 2009 showed that both exports and imports create jobs in our economy.

The jobs created by trade are typically good jobs. According to a discussion paper by the Australian Trade Commission and the University of NSW, exporters:

- pay higher wages or salaries than non-exporters, even after allowing for differences in size; n are more committed than non-exporters to providing a safe working environment;

- employ a higher percentage of staff on a full-time basis; and

- are more likely to offer training to workers than non-exporters.

Trade liberalisation, along with other reforms such as the deregulation of the financial system, opening the economy to foreign investment and the implementation of competition policy, has helped to reduce unemployment in Australia.

As tariffs have fallen and Australia's engagement in international trade has increased, the unemployment rate has fallen from double digit levels in the early 1990s to around 5 per cent currently.

Information and Contacts

- Department of Foreign Affairs and Trade (DFAT)

- For more information on trade policy and statistics visit www.dfat.gov.au/trade

- DFAT Statistical and consultancy services

- Australian Trade Commission (Austrade)

- For information on the range of services available to new and existing exporters visit www.austrade.gov.au or contact 13 28 78

- Export Finance and Insurance Corporation (EFIC)

- To find out about EFIC's export credit and insurance services visit www.efic.gov.au or call 1800 887 588

- Further Contacts

- For information about the Australian Government visit www.australia.gov.au

DFAT has a network of offices around the country

| Head Office | Phone |

|---|---|

| Canberra, Australian Capital Territory |

02 6261 1111 |

| State Offices | Phone |

| Adelaide, South Australia |

08 8403 4899 |

| Brisbane, Queensland |

07 3405 4795 |

| Darwin, Northern Territory |

08 8982 4199 |

| Hobart, Tasmania |

03 6238 4099 |

| Melbourne, Victoria |

03 9221 5555 |

| Perth, Western Australia |

08 9231 4499 |

| Sydney, New South Wales |

02 9356 6222 |