Publications

Download PDF version

Contents

Ministerial foreword

Welcome to Trade and Investment at a Glance, a concise summary of Australia’s engagement with the global economy over 2018-19. Although 2020 is now the most difficult of years, Australian businesses will still rely on strong levels of trade and foreign investment for their future success.

An economy made stronger by trade and investment relationships that are more open means a brighter future for Australians. By strengthening our economy we can provide the essential services that all Australians rely upon.

Trade as a whole is equivalent to 45 per cent of Australian GDP and is directly responsible for one in five Australian jobs. Businesses with foreign investment generate around 40 percent of Australian exports, and foreign investment supports one in ten jobs in Australia.

To build an even stronger economy, the Australian Government continues to pursue an active and ambitious open trade and investment agenda. In the past six years, we have secured duty-free or preferential access to an extra 1.7 billion consumers in other economies. In January and February 2020, new trade agreements with Hong Kong and Peru entered into force. The Indonesia-Australia Comprehensive Economic Partnership will enter into force after Indonesia has completed its domestic ratification process.

In November 2019, we reached a milestone in joining 14 other economies in agreeing to sign the Regional Comprehensive Economic Partnership in 2020. This landmark trade agreement will boost export opportunities for Australian businesses in the world’s fastest growing region.

Senator the Hon Simon Birmingham

Minister for Trade, Tourism and Investment

Australia is a top 20 country

Australia’s key economic indicators 2016-17 to 2018-19

| 2016-17 | 2017-18 | 2018-19 | |||

|---|---|---|---|---|---|

| GDP and Trade (a) | |||||

| Gross domestic product (b) | % change | 2.4 | 2.9 | 1.9 | |

| Exports of goods & services (b) | % change | 5.5 | 4.1 | 3.8 | |

| Imports of goods & services (b) | % change | 4.7 | 7.2 | -0.2 | |

| Net exports contribution to GDP | % points | 0.2 | -0.6 | 0.8 | |

| Labour force | |||||

| Population (c) | '000 | 24,518 | 24,899 | 25,287 | |

| Labour force (d) | '000 | 12,799 | 13,159 | 13,421 | |

| Employed persons (d) | '000 | 12,071 | 12,437 | 12,753 | |

| - Annual growth | % | 1.5 | 3.0 | 2.4 | |

| Unemployment rate (d) | % | 5.7 | 5.5 | 5.1 | |

| Prices and interest rates | |||||

| Consumer prices | % change | 1.9 | 2.1 | 1.6 | |

| Interest rates - 90 day bills (d) | % pa | 1.8 | 1.8 | 1.8 | |

| (a) Reference year 2016-17. | |||||

| (b) Derived from annual movements in original data. | |||||

| (c) Year ended March. | |||||

| (d) Derived from original data on an annual average. | |||||

| Based on ABS and Reserve Bank, various catalogues. | |||||

Australia’s industry structure

| Gross value added(a) | Employed persons(b) | ||||

|---|---|---|---|---|---|

| $m | % share(c) | '000 | % share | ||

| Agriculture, forestry & fishing | 40,605 | 2.2 | 333.3 | 2.6 | |

| Mining | 185,754 | 10.2 | 246.6 | 1.9 | |

| Manufacturing | 109,979 | 6.0 | 905.7 | 7.1 | |

| Services | 1,326,449 | 72.9 | 11,267.6 | 88.4 | |

| Electricity, gas, water & waste | 48,797 | 2.7 | 153.9 | 1.2 | |

| Construction | 146,130 | 8.0 | 1,165.5 | 9.1 | |

| Wholesale trade | 71,353 | 3.9 | 389.9 | 3.1 | |

| Retail trade | 79,257 | 4.4 | 1,278.2 | 10.0 | |

| Accommodation & food services | 44,648 | 2.5 | 901.0 | 7.1 | |

| Transport, postal & warehousing | 90,105 | 5.0 | 657.6 | 5.2 | |

| Information, media & telecommunications | 42,883 | 2.4 | 214.9 | 1.7 | |

| Financial & insurance services | 169,440 | 9.3 | 445.4 | 3.5 | |

| Rental, hiring & real estate | 58,007 | 3.2 | 212.3 | 1.7 | |

| Professional, scientific & technical | 129,360 | 7.1 | 1,104.4 | 8.7 | |

| Administrative & support | 67,100 | 3.7 | 429.3 | 3.4 | |

| Public administration & safety | 100,905 | 5.5 | 835.6 | 6.6 | |

| Education & training | 91,237 | 5.0 | 1,041.7 | 8.2 | |

| Health care & social assistance | 136,792 | 7.5 | 1,684.2 | 13.2 | |

| Arts & recreation | 15,762 | 0.9 | 249.3 | 2.0 | |

| Other services | 34,673 | 1.9 | 504.5 | 4.0 | |

| Ownership of dwellings | 156,579 | 8.6 | |||

| Gross value added at basic prices(d) | 1,819,368 | 100.0 | |||

| Taxes less subsidies on products and statistical discrepancy | 127,878 | ||||

| Total (e) | 1,947,246 | 12,753 | 100.0 | ||

| (a) Based on current price GDP. Industry breakdown based on ANZSIC 2006. | |||||

| (b) Derived from original data on an annual average. Year ended June 2019. | |||||

| (c) As a share of GDP at basic prices. | |||||

| (d) Basic prices are amounts received by producers, including the value of any subsidies on products, but before any taxes on products. | |||||

| (e) GDP at purchasers' (market) prices is derived by adding Taxes less subsidies on products and Statistical discrepancy to Gross value added at basic prices. | |||||

| Based on ABS catalogues 5206.0, 6202.0 and 6203.0. | |||||

Australia’s trade balance

Australia’s trade balance is the difference between what we export and what we import. It is calculated by subtracting the value of the goods and services Australia buys from overseas from the value of the goods and services we sell to other countries.

As of December 2019, Australia’s trade balance was $5,223 million (seasonally adjusted).

Two-way trade

Asian partners dominate Australia’s two-way trade flows, as Australia’s economy continues to complement those of a growing Asia. Dynamic changes underway in our region will continue to drive our economy and offer Australia significant opportunities. Asia overall stands to deliver nearly two-thirds of global growth to 2030.

Australia’s two-way trade by region 2018-19

| $b | % share | |

|---|---|---|

| China | 235.0 | 26.4 |

| Japan | 88.5 | 9.9 |

| Republic of Korea | 41.4 | 4.6 |

| ASEAN | 123.7 | 13.9 |

| Other Asia | 97.4 | 10.9 |

| Europe | 127.5 | 14.3 |

| Americas | 98.7 | 11.1 |

| Oceania | 42.8 | 4.8 |

| Africa | 11.2 | 1.3 |

| Other (a) | 25.3 | 2.8 |

| World | 891.6 | 100 |

| Asia | 586.0 | 65.7 |

| Other | 34.3 | |

|

Regional breakdowns: Asia includes Central Asia; Middle East; North Asia; South East Asia and Southern Asia. Europe includes Eastern Europe; Northern Europe; South Eastern Europe, Southern Europe and Western Europe. Americas includes North America; the Caribbean; Central America and South America. Oceania includes Antarctica and Pacific Island countries and territories. Africa includes Central and West Africa; North Africa and Southern and East Africa. (a) Includes confidential items of trade. Based on ABS catalogues 5368.0 and 5368.0.55.003 and unpublished ABS data. |

||

Australia’s top two-way trading partners 2018-19

Australia’s top ten trading partners in 2018-19 in order were China, Japan, the United States, the Republic of Korea, Singapore, New Zealand, the United Kingdom, India, Malaysia and Thailand.

China remained Australia’s largest two-way trading partner in 2018-19 and was our largest export market and import source. Two-way trade with China surged past $230 billion, well over double the second ranked trading partner, Japan. Australia’s top four two-way trading markets remained in the same order for a third consecutive year, with Singapore replacing India as Australia’s fifth-largest two-way trading partner – up from eighth in 2017-18.

Australia’s top 10 two-way trading partners 2018-19 ($ billion)

| Rank | Trading partners(a)(b) | Goods | Services | Total | % share |

|---|---|---|---|---|---|

| 1 | China | 213.0 | 22.0 | 235.0 | 26.4 |

| 2 | Japan | 81.4 | 7.1 | 88.5 | 9.9 |

| 3 | United States | 48.7 | 27.7 | 76.4 | 8.6 |

| 4 | Republic of Korea | 38.0 | 3.4 | 41.4 | 4.6 |

| 5 | Singapore | 21.4 | 11.3 | 32.7 | 3.7 |

| 6 | New Zealand | 17.8 | 12.8 | 30.6 | 3.4 |

| 7 | United Kingdom | 15.1 | 15.2 | 30.4 | 3.4 |

| 8 | India | 21.1 | 9.2 | 30.3 | 3.4 |

| 9 | Malaysia | 21.4 | 3.7 | 25.1 | 2.8 |

| 10 | Thailand | 20.7 | 4.0 | 24.7 | 2.8 |

| Total top 10 trading partners | 498.8 | 116.3 | 615.1 | 69.0 | |

| Total two-way trade (c) | 692.9 | 198.7 | 891.6 | 100.0 | |

| of which: | APEC | 534.1 | 118.3 | 652.4 | 73.2 |

| ASEAN | 92.4 | 31.3 | 123.7 | 13.9 | |

| EU28 | 76.8 | 37.5 | 114.3 | 12.8 | |

| OECD | 279.9 | 96.0 | 375.9 | 42.2 | |

| (a) All data is on a balance of payments basis, except for goods by country which are on a recorded trade basis. | |||||

| (b) May exclude selected confidential export and import commodities. Refer to the DFAT website (http://dfat.gov.au/about-us/publications/trade-investment/Pages/dfat-ad…) for more information and a list of the commodities excluded. | |||||

| (c) Totals may not add due to rounding. | |||||

| Based on ABS trade data on DFAT STARS database, ABS catalogue 5368.0.55.003 and unpublished ABS data. | |||||

Exports

Australia’s more than 53,000 goods exporters have seized opportunities amidst global headwinds to export a record $373 billion worth of goods in 2018-19. This represents an increase of 18.3 per cent from the previous year and continues an expansion in exports that commenced five years ago.

The minerals and fuels sector made the greatest contribution to Australia’s exports in 2018-19. Australia’s second-largest export sector, services, accounts for nearly three quarters of our economy and more than four out of five Australian jobs.

Australia’s exports (a) (b) A$ billion

| 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

|---|---|---|---|---|---|---|---|---|---|---|

| 289.9 | 257.8 | 303.7 | 322.1 | 306.6 | 336.3 | 324.7 | 319.7 | 373.8 | 403.4 | 470.2 |

(a) Balance of payments basis.

(b) By value.

Based on ABS catalogues 5302.0 & 5368.0.

Australia’s top 10 export markets 2018-19 ($ billion)

| Rank | Markets(a)(b) | Goods | Services | Total | % share |

|---|---|---|---|---|---|

| 1 | China | 134.7 | 18.5 | 153.2 | 32.6 |

| 2 | Japan | 59.1 | 2.6 | 61.7 | 13.1 |

| 3 | Republic of Korea | 25.6 | 2.2 | 27.8 | 5.9 |

| 4 | United States | 14.7 | 10.0 | 24.7 | 5.3 |

| 5 | India | 16.2 | 6.6 | 22.8 | 4.9 |

| 6 | New Zealand | 10.0 | 6.0 | 16.0 | 3.4 |

| 7 | Singapore | 10.6 | 5.4 | 16.0 | 3.4 |

| 8 | Taiwan | 12.4 | 1.5 | 13.9 | 2.9 |

| 9 | United Kingdom | 7.9 | 5.6 | 13.5 | 2.9 |

| 10 | Malaysia | 8.9 | 2.6 | 11.5 | 2.5 |

| Total top 10 markets | 300.1 | 61.1 | 361.1 | 76.8 | |

| Total exports(d) | 373.1 | 97.1 | 470.2 | 100.0 | |

| of which: | APEC | 311.5 | 60.1 | 371.6 | 79.0 |

| ASEAN | 41.3 | 14.1 | 55.4 | 11.8 | |

| EU28 | 20.5 | 12.9 | 33.4 | 7.1 | |

| OECD | 135.6 | 36.9 | 172.6 | 36.7 |

(a) All data is on a balance of payments basis, except for goods by country which are on a recorded trade basis.

(b) May exclude selected confidential export commodities. Refer to the DFAT website (http://dfat.gov.au/about-us/publications/trade-investment/Pages/dfat-ad…) for more information and a list of the commodities excluded.

(c) Special Administrative Region of China.

(d) Totals may not add due to rounding.

Based on ABS trade data on DFAT STARS database, ABS catalogue 5368.0.55.003 and unpublished ABS data.

Australia’s global export ranking 2018

| Rank | Economy | Goods(a) | Services(b) | Total exports | % share |

|---|---|---|---|---|---|

| 1 | China | 2,487 | 267 | 2,754 | 10.9 |

| 2 | United States | 1,666 | 828 | 2,494 | 9.9 |

| 3 | Germany | 1,561 | 331 | 1,892 | 7.5 |

| 4 | Netherlands | 724 | 242 | 966 | 3.8 |

| 5 | Japan | 738 | 192 | 930 | 3.7 |

| 6 | France | 582 | 291 | 873 | 3.5 |

| 7 | United Kingdom | 487 | 376 | 863 | 3.4 |

| 8 | Republic of Korea | 605 | 97 | 701 | 2.8 |

| 9 | Hong Kong(c) | 568 | 114 | 682 | 2.7 |

| 10 | Italy | 547 | 122 | 668 | 2.6 |

| 11 | Singapore | 413 | 184 | 597 | 2.4 |

| 12 | Belgium | 467 | 123 | 590 | 2.3 |

| 13 | Canada | 451 | 93 | 543 | 2.1 |

| 14 | India | 325 | 205 | 530 | 2.1 |

| 15 | Russian Federation | 443 | 65 | 508 | 2.0 |

| 24 | Australia | 258 | 69 | 328 | 1.3 |

| Total exports | 19,451 | 5,845 | 25,296 |

(a) Goods on recorded trade basis.

(b) Services on balance of payments basis.

(c) Special Administrative Region of China.

Source: WTO online database.

Australia’s exports by sector (a) 2018-19 $A billion

| Sector | 2018-19 |

|---|---|

| Minerals & fuels | 239.3 |

| Services | 97.1 |

| Rural | 47.9 |

| Manufactures | 54.0 |

| Gold | 19.7 |

| Other goods | 12.2 |

| Total exports | 470.2 |

(a) Balance of payments basis.

Based on ABS catalogues 5302.0 & 5368.0.

Services and technology are embedded in all of Australia’s export sectors. Land transport and electricity services used in the mining and export of resources are reflected in trade on a ‘value added’ basis. On a ‘gross exports’ basis, which is the more common statistical practice, these values are not separately identified. However, using the value added measure, Australia’s domestic services industries account for over 45 per cent of the value of exports.

Australia’s top 20 exports 2018-19

| Rank | Commodity(a) | $ million | % share | % change |

|---|---|---|---|---|

| 1 | Iron ores & concentrates | 77,189 | 16.4 | 25.7 |

| 2 | Coal | 69,592 | 14.8 | 15.3 |

| 3 | Natural gas | 49,731 | 10.6 | 60.9 |

| 4 | Education-related travel services (d) | 37,556 | 8.0 | 15.2 |

| 5 | Personal travel (excl education) services | 22,450 | 4.8 | 5.2 |

| 6 | Gold | 18,867 | 4.0 | -2.2 |

| 7 | Aluminium ores & concentrates (incl alumina) | 11,358 | 2.4 | 20.2 |

| 8 | Beef | 9,476 | 2.0 | 19.0 |

| 9 | Crude petroleum | 8,491 | 1.8 | 30.5 |

| 10 | Copper ores & concentrates | 5,936 | 1.3 | 4.1 |

| 11 | Professional services | 5,626 | 1.2 | 8.3 |

| 12 | Meat (excl beef) | 5,152 | 1.1 | 13.8 |

| 13 | Telecom, computer & information services | 5,081 | 1.1 | 20.4 |

| 14 | Financial services | 4,933 | 1.0 | 8.0 |

| 15 | Technical & other business services | 4,662 | 1.0 | 5.1 |

| 16 | Aluminium | 4,251 | 0.9 | 3.8 |

| 17 | Copper | 3,968 | 0.8 | 37.3 |

| 18 | Wool & other animal hair (incl tops) | 3,815 | 0.8 | -4.2 |

| 19 | Wheat | 3,657 | 0.8 | -21.4 |

| 20 | Other ores & concentrates | 3,554 | 0.8 | 13.2 |

| Total exports(c) | 470,170 | 100.0 | 16.6 |

(a) Goods trade is on a recorded trade basis. Services trade is on a balance of payments basis.

(b) Includes student expenditure on tuition fees and living expenses.

(c) Total exports on a balance of payments basis.

Based on ABS trade data on DFAT STARS database and ABS catalogues 5302.0 & 5368.0.

Minerals and fuels sector

In 2018-19, Australia’s minerals and fuels exports grew by 26.4 per cent. Australia’s exports of iron ore, coal and natural gas were our top three exports overall and recorded strong increases over the year of 25.7 per cent, 15.3 per cent and 60.9 per cent respectively.

The Australian Government released a Critical Minerals Strategy in 2019 to position Australia as a world leader in the exploration, extraction, production and processing of critical minerals. Australia has some of the world’s richest stocks of these important minerals that are considered essential for economic and industrial development.

Australia’s minerals and fuels exports (a) (b) A$m

| 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

|---|---|---|---|---|---|---|---|---|---|---|

| 127716 | 109413 | 147177 | 159333 | 144436 | 165853 | 142782 | 126506 | 168173 | 189401 | 239315 |

(a) Balance of payments basis.

(b) By value.

Based on ABS catalogues 5302.0 & 5368.0.

Australia’s top 20 minerals and fuels exports 2018-19

| Rank | Commodity(a)(b) | $ million | % share | % change |

|---|---|---|---|---|

| 1 | Iron ores & concentrates | 77,189 | 32.3 | 25.7 |

| 2 | Coal | 69,597 | 29.1 | 15.3 |

| 3 | Natural gas | 49,731 | 20.8 | 60.9 |

| 4 | Aluminium ores & concentrates (incl alumina) | 11,358 | 4.7 | 20.2 |

| 5 | Crude petroleum | 8,491 | 3.5 | 30.5 |

| 6 | Copper ores & concentrates | 5,936 | 2.5 | 4.1 |

| 7 | Other ores & concentrates | 3,554 | 1.5 | 13.2 |

| 8 | Refined petroleum | 3,005 | 1.3 | 14.4 |

| 9 | Crude minerals | 1,685 | 0.7 | -1.3 |

| 10 | Precious metal ores & conc (excl gold) | 1,454 | 0.6 | -4.3 |

| 11 | Non-ferrous waste & scrap | 1,357 | 0.6 | 10.9 |

| 12 | Ferrous waste & scrap | 1,075 | 0.4 | 20.1 |

| 13 | Liquefied propane & butane | 1,049 | 0.4 | 31.5 |

| 14 | Nickel ores & concentrates | 336 | 0.1 | 28.1 |

| 15 | Stone, sand & gravel | 153 | 0.1 | 2.6 |

| 16 | Natural abrasives | 103 | 0.0 | 4.8 |

| 17 | Petroleum gases | 39 | 0.0 | 181.1 |

| 18 | Residual petroleum products | 36 | 0.0 | -12.5 |

| 19 | Crude fertilisers | 11 | 0.0 | -18.1 |

| 20 | Sulphur & iron pyrites | 1 | 0.0 | -8.8 |

| Total minerals & fuels exports(d) | 239,315 | 100.0 | 26.4 |

(a) Recorded trade basis.

(b) Excludes confidential items of trade.

(c) Mainly Zinc ores & concentrates, Manganese ores & concentrates and Lead ores & concentrates.

(d) Total minerals and fuels exports on a balance of payments basis.

Based on ABS trade data on DFAT STARS database and ABS catalogues 5302.0 & 5368.0.

Services sector

Australia’s services exports rose 10.2 per cent to $97.1 billion in 2018-19. Services exports benefitted from strong demand from overseas students seeking a high-quality education and successful tourism campaigns attracting increasing numbers of international visitors. Tourism and international education together account for over 60 per cent of total services exports.

Education-related travel and personal travel services (mainly recreational travel for tourism) were Australia’s fourth and fifth largest exports overall in 2018-19. They also grew over the year by 15.2 per cent and 5.2 per cent respectively.

A further boost is coming from a growing trend among Australian businesses to sell complementary services along with goods exports, such as in the mining equipment, technology and services (METS) sector.

In November 2019, the Australian Government released the Government Response to Industry’s Action Plan to Boost Australian Services Exports. Through the Action Plan, the services industry proposes ambitious recommendations aimed at improving the competitiveness of Australia’s services sector and boosting services exports.

The Government response addresses three primary areas of focus: supporting business to ‘go global’, removing barriers facing exporters abroad and simplifying regulation. The Government response, and the industry-led Services Exports Action Plan, are available on the DFAT website.

Growth of Australia’s services exports (a) (b)

| 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

|---|---|---|---|---|---|---|---|---|---|---|

| 58,272 | 55,961 | 56,652 | 56,349 | 57,708 | 62,502 | 69,210 | 75,676 | 82,288 | 88,103 | 97,117 |

(a) Balance of payments basis.

(b) By value.

Based on ABS catalogues 5302.0 & 5368.0.

Australia’s services exports (a) 2018-19

| $ million | % share | % change | |

|---|---|---|---|

| Manufactured services on physical inputs owned by others | 0 | 0.0 | -100.0 |

| Maintenance & repair | 47 | 0.0 | 6.8 |

| Transport | 7,729 | 8.0 | 2.5 |

| - Passenger(b) | 3,075 | 3.2 | 4.7 |

| - Freight | 277 | 0.3 | 2.2 |

| - Other transport | 2,898 | 3.0 | 2.5 |

| - Postal & courier services | 1,479 | 1.5 | -1.9 |

| Travel | 62,887 | 64.8 | 11.1 |

| - Business | 2,881 | 3.0 | 8.3 |

| - Personal | 60,006 | 61.8 | 11.3 |

| - - Education-related | 37,556 | 38.7 | 15.2 |

| - - Other personal(c) | 22,450 | 23.1 | 5.2 |

| Other services | 26,454 | 27.2 | 10.6 |

| - Construction | 970 | 1.0 | 33.6 |

| - Insurance & pension | 625 | 0.6 | 13.4 |

| - Financial | 4,933 | 5.1 | 8.0 |

| - Intellectual property charges | 1,377 | 1.4 | 18.0 |

| - Telecommunications, computer & information | 5,081 | 5.2 | 20.4 |

| - Other business services | 11,119 | 11.4 | 6.5 |

| - Personal, cultural and recreational | 1,159 | 1.2 | 7.7 |

| - Government services | 1,190 | 1.2 | 2.0 |

| Total services exports | 97,117 | 100.0 | 10.2 |

(a) Balance of payments basis.

(b) Passenger services includes air transport-related agency fees & commissions.

(c) Inbound tourism for mainly recreational purposes.

Based on ABS catalogues 5302.0 & 5368.0.

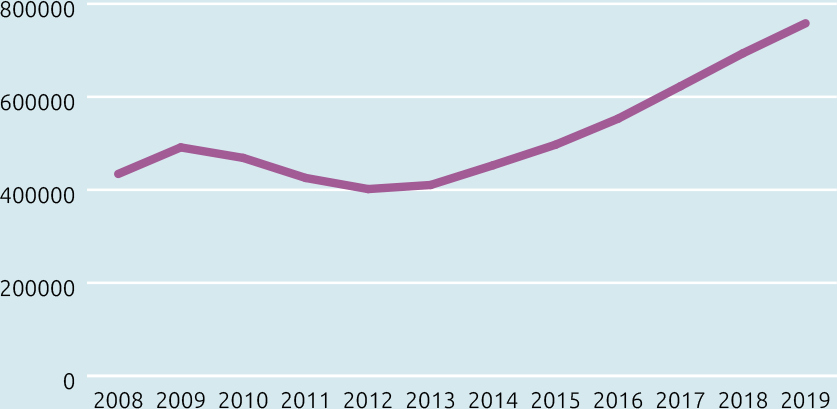

International student numbers

| Nationality | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Total | 434,261 | 491,338 | 468,722 | 425,605 | 401,726 | 410,493 | 452,908 | 497,156 | 553,063 | 622,932 | 693,750 |

Source: Dept of Education and Training International Student Data

Trade in education creates longer-term benefits for Australia including business and people-to-people linkages. It helps to strengthen our educational institutions through greater funding and diversity. Education is Australia’s largest services export. During the year to October 2019, Australian educational institutions received more than 917,000 international student enrolments.

The strong growth in exports of education-related travel services was driven by increases in student numbers from China (up 9 per cent) to $12.1 billion, India (up 44.3 per cent) to $5.5 billion and Nepal (up 60.6 per cent) to $2.6 billion.

Among short-term education visitors in 2017-18, more than 70 per cent were from Asian markets, 15 per cent had family come to visit while they were studying and 24 per cent travelled to regional Australia1.

Top 10 country of origin, international students in Australia 2019

| Nationality | 2019 |

|---|---|

| Total | 758,154 |

| China | 212,264 |

| India | 115,607 |

| Nepal | 53,723 |

| Brazil | 27,366 |

| Vietnam | 26,050 |

| Malaysia | 24,361 |

| Korea, Republic of (South) | 21,175 |

| Colombia | 20,718 |

| Indonesia | 18,091 |

| Thailand | 17,498 |

| Other | 221,301 |

Source: Dept of Education and Training International Student Data.

Australia’s international visitors 2018-19

| Rank | Economy | Number of visitors ('000) | % change on 2017-18 |

|---|---|---|---|

| 1 | China | 1,433 | 0.8 |

| 2 | New Zealand | 1,407 | 2.6 |

| 3 | United States | 812 | 3.1 |

| 4 | United Kingdom | 719 | -3.2 |

| 5 | Japan | 484 | 9.5 |

| 6 | Singapore | 465 | 7.4 |

| 7 | Malaysia | 389 | -1.1 |

| 8 | India | 372 | 11.1 |

| 9 | Hong Kong(a) | 310 | 3.7 |

| 10 | Republic of Korea | 281 | -7.8 |

(a) Special Administrative Region of China.

Source: Department of Home Affairs.

Australia’s $152 billion tourism industry is our single largest services export industry. It is a vital part of our economy, directly employing 666,000 people in 2018-19, up 3.3 per cent on the previous year.

Despite the competitive global market, the number of international visitors arriving in Australia continued to increase alongside the value of tourist spend.

Top 10 economies by expenditure 2018-19

| Rank | Economy | Total trip spend ($ million) | % change on 2017-18 |

|---|---|---|---|

| 1 | China | 11,918 | 5.9 |

| 2 | United States | 3,988 | 8.6 |

| 3 | United Kingdom | 3,389 | -3.0 |

| 4 | New Zealand | 2,581 | 1.3 |

| 5 | Japan | 2,047 | 16.0 |

| 6 | India | 1,764 | 17.4 |

| 7 | Singapore | 1,547 | -6.7 |

| 8 | Republic of Korea | 1,458 | 1.6 |

| 9 | Hong Kong(a) | 1,358 | 2.0 |

| 10 | Malaysia | 1,282 | -0.4 |

(a) Special Administrative Region of China.

Source: Tourism Research Australia, International Visitor Survey.

Manufactures sector

Australian manufacturing businesses employ around 900,000 Australians. The manufacturing sector’s future lies in embracing new technologies and developing high value-added products and services sought by the global market.

Australia’s manufactures exports (a) (b)

| 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

|---|---|---|---|---|---|---|---|---|---|---|

| 43985 | 39160 | 41322 | 41641 | 39552 | 42081 | 43499 | 44651 | 44237 | 46117 | 54048 |

(a) Balance of payments basis.

(b) By value.

Based on ABS catalogues 5302.0 & 5368.0.

Australia’s top 20 manufactures exports 2018-19

| Rank | Commodity(a)(b) | $ million | % share | % change |

|---|---|---|---|---|

| 1 | Aluminium | 4,251 | 7.9 | 3.8 |

| 2 | Copper | 3,968 | 7.3 | 37.3 |

| 3 | Pharmaceutical products (excl medicaments) | 2,953 | 5.5 | 86.6 |

| 4 | Medicaments (incl veterinary) | 2,627 | 4.9 | 12.1 |

| 5 | Aircraft, spacecraft & parts | 2,548 | 4.7 | 24.7 |

| 6 | Telecom equipment & parts | 2,197 | 4.1 | 21.2 |

| 7 | Nickel | 1,695 | 3.1 | 1560.1 |

| 8 | Medical instruments (incl veterinary) | 1,654 | 3.1 | 12.0 |

| 9 | Zinc | 1,608 | 3.0 | -5.9 |

| 10 | Measuring & analysing instruments | 1,514 | 2.8 | 43.0 |

| 11 | Paper & paperboard | 1,026 | 1.9 | 8.4 |

| 12 | Pigments, paints & varnishes | 984 | 1.8 | -1.1 |

| 13 | Perfumery & cosmetics (excl soap) | 950 | 1.8 | 7.8 |

| 14 | Lead | 931 | 1.7 | -4.8 |

| 15 | Computers | 912 | 1.7 | 7.7 |

| 16 | Vehicle parts & accessories | 881 | 1.6 | 2.2 |

| 17 | Miscellaneous manufactured articles | 871 | 1.6 | -20.4 |

| 18 | Specialised machinery & parts | 803 | 1.5 | -7.6 |

| 19 | Civil engineering equipment & parts | 728 | 1.3 | 9.1 |

| 20 | Ships, boats & floating structures | 712 | 1.3 | 172.2 |

| Total manufactures exports(c) | 54,048 | 100.0 | 17.2 |

(a) Recorded trade basis.

(b) Excludes confidential items of trade.

(c) Total manufactures exports on a balance of payments basis.

Based on ABS trade data on DFAT STARS database and ABS catalogues 5302.0 & 5368.0.

Rural sector

Australia’s agriculture, forestry and fisheries exports (a) (b) A$billion

| 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

|---|---|---|---|---|---|---|---|---|---|---|

| 33568941 | 29993885 | 34259707 | 38549644 | 39919545 | 43431593 | 46667134 | 47599720 | 51869818 | 52042767 | 52987435 |

(a) Definition of agriculture, forestry and fisheries includes alcoholic beverages as set out in the WTO International Trade Statistics publication.

(b) By value.

Based on ABS catalgoue 5368.0 and ABS special data services.

Australia’s reputation as a provider of clean, green, safe and high-quality produce stands our agricultural exporters in good stead. Around two-thirds of Australia’s agricultural products are exported, contributing to food security in Australia and many other nations.

Exports of beef, Australia’s eighth-largest export overall, grew by 19 per cent in 2018-19, while other meat exports (excluding beef) and alcoholic beverages also performed strongly in export markets.

Australia’s top 20 agriculture, forestry and fisheries exports (a) 2018-19

| Rank | Commodity(a)(b) | $ million | % share | % change |

|---|---|---|---|---|

| 1 | Beef | 9,476 | 17.9 | 19.0 |

| 2 | Meat (excl beef) | 5,152 | 9.7 | 13.8 |

| 3 | Wool & other animal hair (incl tops) | 3,815 | 7.2 | -4.2 |

| 4 | Wheat | 3,657 | 6.9 | -21.4 |

| 5 | Wine | 2,950 | 5.6 | 4.4 |

| 6 | Edible products & preparations | 2,943 | 5.6 | -2.1 |

| 7 | Cotton | 2,558 | 4.8 | 19.9 |

| 8 | Fruit & nuts | 2,422 | 4.6 | 28.9 |

| 9 | Live animals (excl seafood) | 1,956 | 3.7 | 13.7 |

| 10 | Sugars, molasses & honey | 1,614 | 3.0 | -3.7 |

| 11 | Wood in chips or particles | 1,597 | 3.0 | 18.9 |

| 12 | Barley | 1,382 | 2.6 | -30.0 |

| 13 | Animal feed | 1,377 | 2.6 | 8.9 |

| 14 | Milk, cream, whey & yoghurt | 1,371 | 2.6 | 3.4 |

| 15 | Vegetables | 1,194 | 2.3 | -41.2 |

| 16 | Crustaceans | 1,022 | 1.9 | -3.7 |

| 17 | Oil-seeds & oleaginous fruits, soft | 997 | 1.9 | -29.1 |

| 18 | Cheese & curd | 989 | 1.9 | 4.5 |

| 19 | Cereal preparations | 929 | 1.8 | 18.7 |

| 20 | Hides & skins, raw (excl furskins) | 659 | 1.2 | -19.1 |

| Total agriculture, forestry & fisheries exports(c) | 52,987 | 100.0 | 1.8 |

(a) Recorded trade basis.

(b) Excludes confidential items of trade except sugar.

(c) Definition of agriculture, forestry and fisheries includes alcoholic beverages as set out in the WTO International Trade Statistics publication.

Based on ABS catalogue 5368.0 and ABS special data services.

Imports

Australia imports a wide range of goods and services. Since the start of the new millennium, at least half of our total imports have come from economies in Asia. The total value of Australian imports rose by 6.5 per cent to $421.4 billion in 2018-19.

Personal travel services received by Australians abroad was the largest component, accounting for around a tenth of total import values and almost double the second-largest import, refined petroleum.

The top five favourite short-term travel destinations abroad among Australians (measured by short-term resident returns), based on local data as at the year ended September 2019, were (in order) New Zealand, Indonesia, the United States, the United Kingdom and China.

Australia’s imports (a) (b) A$ billion

| 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

|---|---|---|---|---|---|---|---|---|---|---|

| 287.2 | 271.2 | 290.0 | 325.8 | 326.5 | 343.2 | 349.4 | 357.5 | 362.9 | 395.6 | 421.4 |

(a) Balance of payments basis.

(b) By value.

Based on ABS catalogues 5302.0 & 5368.0.

Australia’s top 20 imports 2018-19

| Rank | Commodity(a)(b) | $ million | % share | % change |

|---|---|---|---|---|

| 1 | Personal travel (excl education) services | 46,343 | 11.0 | 8.6 |

| 2 | Refined petroleum | 25,083 | 6.0 | 15.7 |

| 3 | Passenger motor vehicles | 21,574 | 5.1 | -7.4 |

| 4 | Telecom equipment & parts | 14,590 | 3.5 | 8.8 |

| 5 | Crude petroleum | 13,412 | 3.2 | 14.3 |

| 6 | Goods vehicles | 10,571 | 2.5 | 3.8 |

| 7 | Freight transport services | 10,114 | 2.4 | 7.3 |

| 8 | Computers | 9,763 | 2.3 | 10.5 |

| 9 | Professional services | 7,775 | 1.8 | 16.8 |

| 10 | Passenger transport services(c) | 7,534 | 1.8 | 5.5 |

| 11 | Medicaments (incl veterinary) | 7,481 | 1.8 | 4.4 |

| 12 | Gold | 5,517 | 1.3 | -15.6 |

| 13 | Technical & other business services | 5,457 | 1.3 | 5.6 |

| 14 | Civil engineering equipment & parts | 5,085 | 1.2 | 19.8 |

| 15 | Charges for the use of intellectual property nie | 4,996 | 1.2 | 8.0 |

| 16 | Furniture, mattresses & cushions | 4,990 | 1.2 | 11.0 |

| 17 | Telecom, computer & information services | 4,878 | 1.2 | 14.7 |

| 18 | Pharm products (excl medicaments) | 4,842 | 1.1 | 13.0 |

| 19 | Business travel services | 4,296 | 1.0 | 2.1 |

| 20 | Electrical machinery & parts | 3,960 | 0.9 | 7.2 |

| Total imports(d) | 421,394 | 100.0 | 6.5 |

(a) Goods trade is on a recorded trade basis. Services trade is on a balance of payments basis.

(b) Excludes imports of large aircraft which are treated confidentially by the ABS. DFAT estimates aircraft imports would rank within Australia's top 20 imports with a value around $4.6 billion in 2018-19.

(c) Includes Related agency fees & commissions.

(d) Total imports on a balance of payments basis.

Based on ABS trade data on DFAT STARS database and ABS catalogues 5302.0 & 5368.0.

Australia’s top 10 import sources (a) (b) 2018-19 ($ billion)

| Rank | Sources(a)(b) | Goods | Services | Total | % share |

|---|---|---|---|---|---|

| 1 | China | 78.3 | 3.5 | 81.8 | 19.4 |

| 2 | United States | 34.0 | 17.6 | 51.6 | 12.3 |

| 3 | Japan | 22.3 | 4.5 | 26.8 | 6.4 |

| 4 | Germany | 15.1 | 3.8 | 18.9 | 4.5 |

| 5 | Thailand | 14.6 | 2.7 | 17.3 | 4.1 |

| 6 | United Kingdom | 7.2 | 9.6 | 16.9 | 4.0 |

| 7 | Singapore | 10.9 | 5.9 | 16.7 | 4.0 |

| 8 | New Zealand | 7.9 | 6.7 | 14.6 | 3.5 |

| 9 | Republic of Korea | 12.4 | 1.2 | 13.6 | 3.2 |

| 10 | Malaysia | 12.4 | 1.1 | 13.6 | 3.2 |

| Total top 10 sources | 215.1 | 56.8 | 271.8 | 64.5 | |

| Total imports(c) | 319.8 | 101.6 | 421.4 | 100.0 | |

| of which: | APEC | 222.6 | 58.2 | 280.8 | 66.6 |

| ASEAN | 51.1 | 17.2 | 68.2 | 16.2 | |

| EU28 | 56.3 | 24.6 | 80.8 | 19.2 | |

| OECD | 144.3 | 59.0 | 203.3 | 48.3 |

(a) All data is on a balance of payments basis, except for goods by country which are on a recorded trade basis.

(b) May exclude selected confidential import commodities. Refer to the DFAT website (http://dfat.gov.au/about-us/publications/trade-investment/Pages/dfat-ad…) for more information and a list of the commodities excluded.

(c) Totals may not add due to rounding.

Based on ABS trade data on DFAT STARS database, ABS catalogue 5368.0.55.003 and unpublished ABS data.

Australia’s imports by sector (a) 2018-19 A$b

| Sector | 2018-19 |

|---|---|

| Intermediate & other | 132.3 |

| Consumption goods | 103.7 |

| Services | 101.6 |

| Capital goods | 78.3 |

| Gold | 5.5 |

| Total goods & services imports | 421.4 |

(a) Balance of payments basis.

Based on ABS catalogues 5302.0 & 5368.0.

Australia’s global import ranking 2018

| Rank | Economy | Goods(a) | Services(b) | Total imports | % share |

|---|---|---|---|---|---|

| 1 | United States | 2,612 | 559 | 3,172 | 12.5 |

| 2 | China | 2,136 | 525 | 2,661 | 10.4 |

| 3 | Germany | 1,286 | 351 | 1,637 | 6.4 |

| 4 | Japan | 748 | 200 | 949 | 3.7 |

| 5 | France | 673 | 257 | 929 | 3.6 |

| 6 | United Kingdom | 674 | 235 | 909 | 3.6 |

| 7 | Netherlands | 645 | 229 | 874 | 3.4 |

| 8 | Hong Kong(c) | 627 | 82 | 708 | 2.8 |

| 9 | India | 514 | 177 | 691 | 2.7 |

| 10 | Republic of Korea | 535 | 124 | 659 | 2.6 |

| 11 | Italy | 501 | 125 | 626 | 2.5 |

| 12 | Canada | 471 | 113 | 583 | 2.3 |

| 13 | Belgium | 450 | 129 | 579 | 2.3 |

| 14 | Singapore | 371 | 187 | 558 | 2.2 |

| 15 | Mexico | 477 | 37 | 514 | 2.0 |

| 22 | Australia | 237 | 73 | 310 | 1.2 |

| Total imports | 19,867 | 5,604 | 25,471 |

(a) Goods on recorded trade basis.

(b) Services on balance of payments basis.

(c) Special Administrative Region of China.

Source: WTO online database.

Australia’s investment landscape

Foreign investment plays an important role in the Australian economy by promoting economic activity that helps sustain and generate jobs. There are a number of types of foreign investment: portfolio, direct, financial derivatives and ‘other’ investment, for example loans and reserve assets.

Portfolio investment includes the purchase of securities, such as stocks or bonds, or equity and debt transactions where the investor does not gain any control over the operation of the enterprise. This is the largest type of investment overall for Australia and many other developed economies.

Foreign direct investment (FDI) occurs when a foreign individual or entity establishes a new business or acquires 10 per cent or more share of a local enterprise and, importantly, has some control over its operations.

FDI though both majority and minority ownership supported the employment of nearly 1.2 million people or 1 in 10 jobs in Australia in 2014-15. Businesses with foreign investment generated around 40 per cent of Australia’s total exports, worth around $132 billion.

The global marketplace for foreign investment is highly competitive and businesses must show the potential for an attractive return. Many firms seek investment to help purchase innovative technology or to diversify their product range with the intention of expanding their market share, making savings on running costs or increasing productivity.

FDI is also often associated with knowledge transfers, particularly from a foreign head office to a local subsidiary. This process expands the domestic skills-base available to employers in Australia over time.

Two-way investment

Two-way Australian investment of all types amounted to $6.05 trillion dollars at the end of 2018. Of the total, $3.5 trillion was invested in Australia by foreign entities or persons, while Australians or Australian entities invested $2.5 trillion overseas.

The United States and the United Kingdom were the top two sources and destinations for Australian investment, while Japan was the third-largest destination and fourth-largest source. Neither Belgium nor Hong Kong were among Australia’s top 10 destinations for investment, instead their ranking as top five two-way investment partners comes from their large investments in Australia, as our third and fifth-largest sources.

Australia’s top 5 two-way investment partners 2018 ($ million)

| Rank | Economy | 2018 |

|---|---|---|

| 1 | United States | 1,658,410 |

| 2 | United Kingdom | 982,796 |

| 3 | Japan | 342,342 |

| 4 | Belgium | 322,509 |

| 5 | Hong Kong (SAR of China) | 170,967 |

Source: ABS catalogue 5352.0.

Inbound investment

The United States and United Kingdom are Australia’s largest investors, followed by Belgium, Japan and Hong Kong. At the end of 2018, total foreign investment in Australia reached $3.5 trillion, a record level in this country.

The United States was Australia’s largest foreign investor by a wide margin, accounting for $939.5 billion in investments in Australia at the end of 2018, up 3.7 per cent on 2017. The United States also received the largest portion of Australian investment overseas, again by a wide margin, accounting for $718.9 billion of the total at the end of 2018, up 6.2 per cent on 2017.

Australia’s top 10 investment sources (a) 2018 ($ million)

| Rank(b) | Economy | Direct investment | Total investment(c) |

|---|---|---|---|

| 1 | United States | 214,291 | 939,476 |

| 2 | United Kingdom | 98,747 | 574,788 |

| 3 | Belgium(d) | 5,380 | 316,902 |

| 4 | Japan | 105,898 | 229,346 |

| 5 | Hong Kong(e) | 16,350 | 118,761 |

| 6 | Singapore | 28,025 | 85,402 |

| 7 | Netherlands | 49,262 | 81,491 |

| 8 | Luxembourg | 8,918 | 78,439 |

| 9 | China | 40,105 | 63,588 |

| 10 | France | 28,741 | 50,193 |

| Total all economies | 967,505 | 3,514,406 | |

| of which: | APEC | 473,200 | 1,602,937 |

| ASEAN | 47,722 | 118,017 | |

| EU28 | 225,669 | 1,221,301 | |

| OECD | 605,358 | 2,566,429 |

(a) Foreign investment in Australia: level of investment (stocks) as at 31 December 2018.

(b) Ranked on level of total investment in Australia.

(c) Includes portfolio investment.

(d) The majority of total investment from Belgium is portfolio investment liabilities in the form of debt securities (Belgium hosts a major clearing house and despository for euro-denominated bonds and other securities, Euroclear).

(e) Special Administrative Region of China.

Source: ABS catalogue 5352.0.

Australia’s top 10 investment destinations (a) 2018 ($ million)

| Rank(b) | Economy | Direct investment | Total investment(c) |

|---|---|---|---|

| 1 | United States | 120,659 | 718,934 |

| 2 | United Kingdom | 118,658 | 408,008 |

| 3 | Japan | 1,313 | 112,996 |

| 4 | New Zealand | 56,401 | 96,720 |

| 5 | Cayman Islands | np | 77,457 |

| 6 | Germany | np | 77,337 |

| 7 | Canada | 33,814 | 77,291 |

| 8 | China | 13,540 | 75,324 |

| 9 | Singapore | 24,437 | 72,693 |

| 10 | France | 3,156 | 58,541 |

| Total all economies | 695,644 | 2,538,756 | |

| of which: | APEC | 288,654 | 1,298,100 |

| ASEAN | 39,652 | 106,988 | |

| EU28 | 163,579 | 713,043 | |

| OECD | 381,406 | 1,742,186 |

(a) Australian investment abroad: level of investment (stocks) as at 31 December 2018.

(b) Ranked on total Australian investment abroad.

(c) Includes portfolio investment.

np = not published.

Source: ABS catalogue 5352.0.

Foreign investment in Australia by type 2018 (a)

| Type | 2018 |

|---|---|

| Direct investment | 967.5 |

| Portfolio investment | 1,836.3 |

| Financial derivatives | 202.6 |

| Other investment (a) | 508.0 |

(a) Includes loans, trade credit, currency, deposits and reserve assets.

Based on ABS catalogue 5352.0.

Australia’s top 5 foreign direct investment sources 2018 (a) A$ billion

| Source | 2018 |

|---|---|

| United States | 214.3 |

| Japan | 105.9 |

| United Kingdom | 98.7 |

| Netherlands | 49.3 |

| China | 40.1 |

Based on ABS catalogue 5352.0.

Australia’s foreign direct investment by industry 2018 (a) $ billion

| Industry | 2018 |

|---|---|

| Mining | 365.5 |

| Manufacturing | 107.7 |

| Financial & insurance activities | 107.5 |

| Real estate activities | 102.9 |

| Wholesale & retail trade | 56.7 |

| Information & communication | 26.9 |

| Other | 200.4 |

(a) Data at year end.

Based on ABS catalogue 5352.0.

The majority share of FDI went to Australia’s mining industry at 37.8 per cent of the total, up by 6.4 per cent over 2017. Manufacturing, the second most popular sector for FDI, grew by 5.8 per cent, while financial and insurance activities recorded the largest increase in FDI over the year of 45.6 per cent.

Australia’s inward foreign direct investment global ranking 2018

| Rank | Economy | US$b | % change | % share |

|---|---|---|---|---|

| 1 | United States | 7,465 | -4.8 | 23.1 |

| 2 | Hong Kong (a) | 1,997 | 2.7 | 6.2 |

| 3 | United Kingdom | 1,890 | 4.7 | 5.9 |

| 4 | Netherlands | 1,674 | -0.9 | 5.2 |

| 5 | China | 1,628 | 9.3 | 5.0 |

| 6 | Singapore | 1,481 | 6.3 | 4.6 |

| 7 | Switzerland | 1,063 | -8.0 | 3.3 |

| 8 | Germany | 939 | -1.9 | 2.9 |

| 9 | Ireland | 910 | 1.9 | 2.8 |

| 10 | Canada | 894 | -16.7 | 2.8 |

| 11 | France | 825 | 0.8 | 2.6 |

| 12 | British Virgin Islands | 745 | 6.3 | 2.3 |

| 13 | Brazil | 684 | 9.8 | 2.1 |

| 14 | Australia | 683 | -0.9 | 2.1 |

| 15 | Spain | 659 | 2.1 | 2.0 |

| World inward stock | 32,272 | -1.1 |

(a) Special Administrative Region of China.

Source: UNCTADstat database.

Outbound investment

The stock of Australian investment abroad rose by $180.2 billion or 7.6 per cent to $2.5 trillion at the end of 2018. The top destination for Australian direct investment abroad was the United States, followed by the United Kingdom in a narrowing margin.

Australia’s top 5 total investment abroad destinations 2018 (a) A$ billion

| Destinations | 2018 |

|---|---|

| United States | 718.9 |

| United Kingdom | 408.0 |

| Japan | 113.0 |

| New Zealand | 96.7 |

| Cayman Islands | 77.5 |

Based on ABS catalogue 5352.0.

The most attractive industry for Australian direct investment abroad at the end of 2018 was financial and insurance activities. Although investment in this sector decreased by 3.9 per cent to $169.0 billion at the end of 2018, it accounted for 24.3 per cent of the total. Mining received the second-highest share at 21.4 per cent, with stock up 14.4 per cent to $149.0 billion. Investment in manufacturing grew by 27.0 per cent to reach $144.4 billion, or 20.8 per cent of the total.

Australia’s direct investment abroad by industry 2018 (a) A$ billion

| Industry | 2018 |

|---|---|

| Financial & insurance activities | 169.0 |

| Mining | 149.0 |

| Manufacturing | 144.4 |

| Real estate activities | 20.1 |

| Construction | 8.0 |

| Unallocated & confidential items (b) | 172.5 |

| Other | 32.7 |

(a) Data at year end.

(b) Amounts either suppressed by confidentiality or not attributable to a specific category.

Based on ABS catalogue 5352.0.

Australia’s top 5 total foreign investment sources 2018 (a) A$ billion

| Sources | 2018 |

|---|---|

| United States | 939.5 |

| United Kingdom | 574.8 |

| Belgium | 316.9 |

| Japan | 229.3 |

| Hong Kong (a) | 118.8 |

(a) Data at year end.

(b) Special Administrative Region of China.

Based on ABS catalogue 5352.0.

Australia’s top 5 direct investment abroad destinations 2018 (a) A$ billion

| Destinations | 2018 |

|---|---|

| United States | 120.7 |

| United Kingdom | 118.7 |

| New Zealand | 56.4 |

| Canada | 33.8 |

| Bermuda(a) | 33.0 |

(a) Data at year end.

(b) DFAT estimate.

Based on ABS catalogue 5352.0.

Australia’s direct investment abroad global ranking 2018

| Rank | Economy | US$b | % change | % share |

|---|---|---|---|---|

| 1 | United States | 6,475 | -17.3 | 20.9 |

| 2 | Netherlands | 2,427 | -3.8 | 7.8 |

| 3 | China | 1,939 | 7.2 | 6.3 |

| 4 | Hong Kong (a) | 1,870 | 3.1 | 6.0 |

| 5 | United Kingdom | 1,697 | -4.3 | 5.5 |

| 6 | Japan | 1,665 | 11.4 | 5.4 |

| 7 | Germany | 1,645 | 0.0 | 5.3 |

| 8 | France | 1,508 | 2.8 | 4.9 |

| 9 | Canada | 1,325 | -10.8 | 4.3 |

| 10 | Switzerland | 1,263 | 0.0 | 4.1 |

| 11 | Singapore | 1,021 | 6.1 | 3.3 |

| 12 | Ireland | 912 | 6.1 | 2.9 |

| 13 | British Virgin Islands | 898 | 6.7 | 2.9 |

| 14 | Belgium | 578 | -16.2 | 1.9 |

| 15 | Spain | 563 | -3.5 | 1.8 |

| 17 | Australia | 491 | -1.0 | 1.6 |

| World outward stock | 30,975 | -4.3 |

(a) Special Administrative Region of China.

Source: UNCTADstat database.

Multilateral and regional organisations

Australia is one of 164 members of the World Trade Organization (WTO) the sole global body responsible for the rules of trade between nations. We want to see the WTO reinvigorated with a more effective dispute settlement mechanism and a broader remit to deal with e-commerce and the opportunities created by the digital economy. This will make it stronger and more relevant to today’s trade environment.

To this end, we are leading an initiative to develop international rules for e-commerce and are pushing for global agricultural reforms to address trade-distorting agricultural subsidies. At the same time, we are working to strengthen global trade in services rules and supporting the extension of rules into new areas, such as investment.

Australia is an active and effective member of the Group of Twenty or G20, the world’s premier forum for international economic cooperation. The G20’s geographically dispersed membership of 19 countries and the European Union represent over 85 per cent of the world economy, more than 75 per cent of global trade and almost two-thirds of the world’s population. Australia hosted the G20 in 2014. We are working with Saudi Arabia as it has the 2020 Presidency.

We promote our regional trade and investment interests through our membership of the Asia-Pacific Economic Cooperation (APEC) forum. APEC is the premier economic organisation in a region with 2.9 billion people that generates around 60 per cent of world GDP. The collaborative approach to breaking down barriers to trade across our region has yielded a wide range of reforms over APEC’s 30-year history. These reforms have directly benefitted Australian businesses and consumers and added to the region’s prosperity.

Australia supports policies, cooperation and dialogue to facilitate trade and investment though our membership of a range of other bodies including the Organisation for Economic Cooperation and Development, the World Customs Organization and the World Intellectual Property Organization.

Australia’s trade and investment framework

As part of a comprehensive trade and investment strategy, the Australian Government has an active agenda of negotiating, implementing, reviewing and advocating bilateral and regional free trade agreements (FTAs) that yield significant trade and investment opportunities, and support multilateral liberalisation efforts.

Australia currently has 13 free trade agreements with 20 partners. Most of these are bilateral and two are regional agreements. Regional free trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, include rules governing trade and investment between several parties. They facilitate the involvement of Australian businesses in regional value chains and more seamless trade and investment between businesses in the parties. The Government is also working hard to negotiate new free trade agreements that open up entirely new export and investment opportunities for our nation’s businesses in the future. Our free trade agreement negotiations with the European Union, a bloc of 27 countries and a market of around 450 million people, is just one example of this work.

Where possible, Australia also reviews free trade agreements to upgrade the benefits business obtain from them. One example is the ASEAN-Australia-New Zealand Free Trade Area (AANZFTA), which entered into force in January 2010 for Australia and eight other countries (Laos, Cambodia and Indonesia became parties in 2011-12). AANZFTA has been upgraded since its entry into force, and Australia and other AANZFTA parties agreed to begin another upgrade in 2020.

The Government has a goal of increasing the coverage of Australia’s two-way trade with free trade agreement partners to around 90 per cent of total trade by 2022.

FTAs in force

Australia had 13 regional and bilateral FTAs as at March 2020, including new agreements with Hong Kong and Peru that came into force on 17 January and 11 February 2020 respectively.

FTAs concluded but not yet in force

Indonesia-Australia Comprehensive Economic Partnership Agreement

Australia completed its domestic treaty-making processes for the Indonesia-Australia Comprehensive Economic Partnership Agreement (IA-CEPA) on 18 December 2019 and the Indonesian parliament passed the IA-CEPA legislation in early February 2020. The agreement will enter into force 60 days after Indonesia notifies Australia that it has completed its remaining domestic treaty making procedures.

Pacific Agreement on Closer Economic Relations Plus

Australia, New Zealand, Samoa and Kiribati have ratified the Pacific Agreement on Closer Economic Relations Plus (PACER Plus). PACER Plus will come into force 60 days after the eighth signatory notifies the Depositary in Tonga that their domestic ratification processes are complete.

Free trade agreements under negotiation

Australia’s active free trade agreement negotiating agenda includes the following:

- Australia-European Union Free Trade Agreement

- Pacific Alliance Free Trade Agreement

- Regional Comprehensive Economic Partnership

- Australia-United Kingdom Free Trade Agreement negotiations are expected to commence when the United Kingdom is ready.

FTA Portal

DFAT’s FTA Portal helps businesses explore the benefits of FTAs. Goods and services exporters and importers can find comprehensive information on tariffs and services commitments, guidance on rules of origin to determine whether goods qualify for FTA concessions, and market data for prospective exporters.

The Portal is updated to include information on new agreements as they come into force. Find it at ftaportal.dfat.gov.au

Trade and development assistance

Australia supports a range of bilateral and regional development partnerships around the globe and is the single largest development partner of Pacific Island nations. Our assistance helps to boost prosperity and stability, while expanding opportunities for two-way trade.

Supporting countries in our region to access and benefit from trade is a core part of our work as members of the WTO, APEC and the OECD. In 2018-19, two-way goods trade with our bilateral development partnership countries[1] reached $42.0 billion, an average increase of 4.0 per cent per year over the past decade. Least Developed Countries[2] (LDC) exports of goods to Australia, which receive duty and quota-free access, reached $1.6 billion in 2018-19, an average increase of 22.1 per cent per year over the past decade.

Australia also provides preferential treatment for LDC service suppliers in tourism, transport (maritime, air, rail, road and auxiliary services) and business services (computer, professional and other business services).

[1] Afghanistan, Bangladesh, Bhutan, Cambodia, Comoros, Cook Islands, Fiji, Indonesia, Kenya, Kiribati, Laos, Madagascar, Maldives, Mauritius, Mongolia, Mozambique, Myanmar, Nauru, Nepal, Niue, Pakistan, Papua New Guinea, Philippines, Samoa, Seychelles, Solomon Islands, Somalia, South Africa, Sri Lanka, Tanzania, Timor-Leste, Tokelau, Tonga, Tuvalu, Vanuatu, Vietnam.

[2] Afghanistan, Angola, Bangladesh, Benin, Bhutan, Burkina Faso, Burundi, Cambodia, Central African Republic, Chad, Comoros, Democratic Republic of the Congo, Djibouti, Eritrea, Ethiopia, Former Sudan, Gambia, Guinea, Guinea-Bissau, Haiti, Kiribati, Laos, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mozambique, Myanmar, Nepal, Niger, Rwanda, Sao Tome & Principe, Senegal, Sierra Leone, Solomon Islands, Somalia, South Sudan, Sudan, Tanzania, Timor-Leste, Togo, Tuvalu, Uganda, Vanuatu, Yemen, Zambia.

Australia in value chains

A Global Value Chain (GVC) is a network of interlinked stages of production in the manufacture of goods and services that cross international borders.

Typically, a GVC involves combining imported intermediate goods and domestic goods and services into products that are then exported for use as intermediates in subsequent stages of production.

Fremantle-based traffic monitoring technology company MetroCount uses a range of inputs to produce a vehicle classifier system that contributes to safer roads in Australia and 120 other countries. Visit the DFAT website for more trade and investment stories: www.dfat.gov.au/tradeandinvestmentstories