Key points

- The transition to a clean energy economy is both the most significant challenge and an opportunity for Southeast Asia and Australia.

- Australia has the expertise and technology to assist the region with its transition needs, and there is also scope to attract investment to support Australia's clean energy manufacturing objectives.

- Diverse and resilient energy supply chains will be critical, and there is potential to collaborate on solar, electric vehicles and battery storage supply chains.

Sector overview

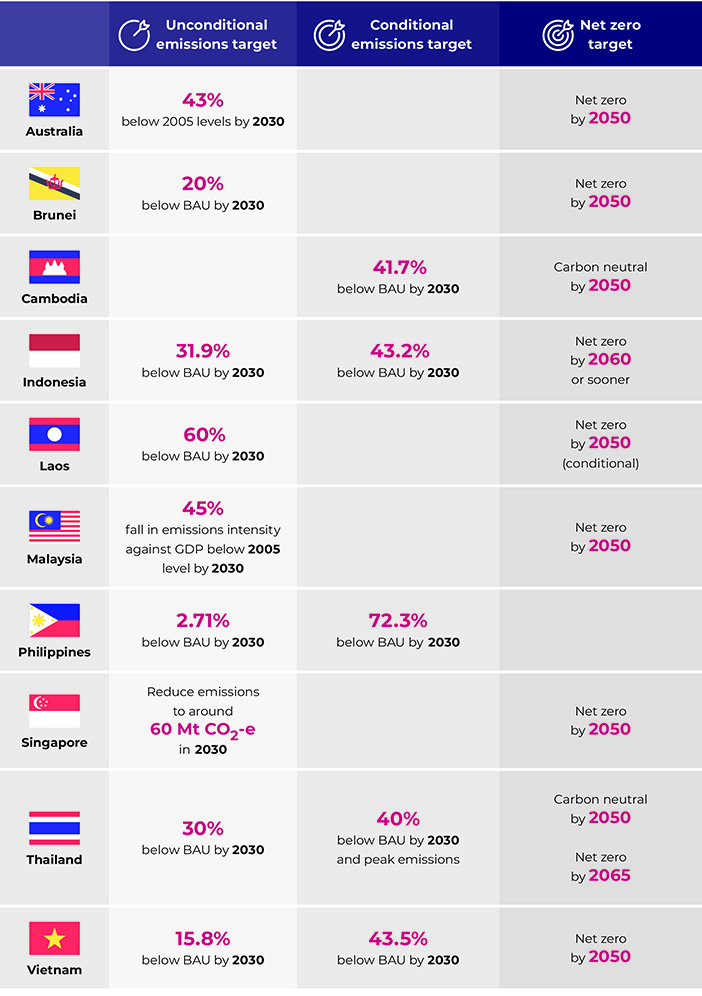

Australia and Southeast Asia share an ambition and imperative to act to combat climate change. We face many shared clean energy transition challenges, with energy systems traditionally reliant on fossil fuels, as outlined in Chapter 4 – 'Resources'.100 Southeast Asia faces the additional challenge of rising energy demand, with energy use expected to double by 2050.101 As clean energy technology improves, demand for cleaner trade and investment with Southeast Asia will rise as countries accelerate their energy transition to meet ambitious net zero and emissions reduction targets (Figure 5.1). Increasingly, governments and multilateral organisations are seeking to ‘mainstream’ climate into their policy settings. This means the green energy transition will increasingly inform policy decisions and planning beyond the energy sector, including in Southeast Asia and Australia.

For Australian and regional investors, low-emissions and sustainable technology needs will drive enormous growth in investment opportunities, with around A$4 trillion in green investment expected by 2030, potentially rising to A$15 trillion by 2050.102 With energy investment in Southeast Asia averaging around US$70 billion per year between 2016 and 2020,103 there is a significant financing gap that will need private sector support.

“Austrade’s help in navigating federal, state and local governments … has been critical in supporting our investment in Australia’s energy transition.” (ACEN)

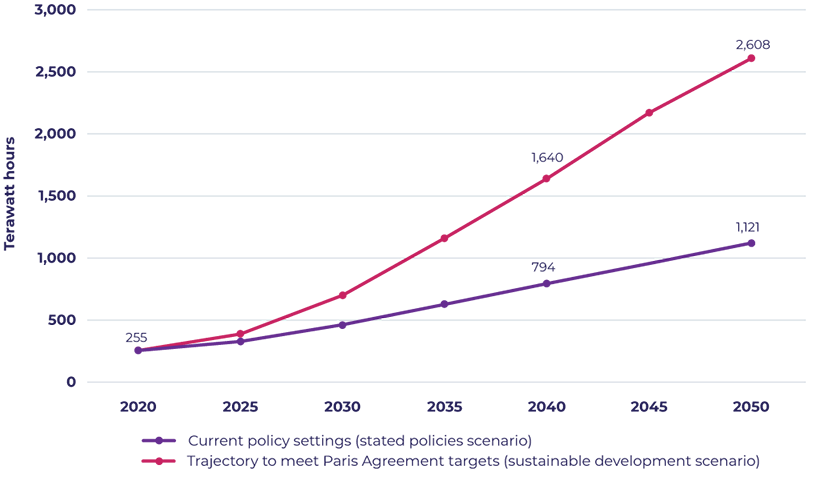

Southeast Asia will need an estimated 454 gigawatts in new electricity generation capacity to 2050, with 60 per cent of this in renewables.104 This would see an estimated investment of A$640 billion in hydropower, solar and wind projects by 2030.105 Estimated demand for renewables is projected to dramatically increase, particularly if countries meet their Paris Agreement climate targets (Figure 5.2).

Cross-border interconnections and electricity trading will provide the most cost-effective pathway to increase the share of renewables in the region's grid.106 Export-oriented investment in renewables generation and grid infrastructure is expected across Laos, Vietnam, Indonesia and Cambodia, and potentially Australia and Singapore, which are developing architecture for cross-border electricity trading under the bilateral Green Economy Agreement. Reducing energy intensity will also play a major role in meeting emissions targets, with energy efficiency projects estimated to see A$580 billion in investment by 2030.107 Energy affordability and security will remain critical for continued economic development and prosperity. Growing electrification will reduce traditional energy security risks from fossil fuel supply chains. But grid and market operators will need more sophisticated tools and expertise to manage reliability.

Figure 5.1 Southeast Asian countries' and Australia's emissions reduction and net zero targets

BAU = business as usual; Mt = megatonne; CO2-e = carbon dioxide equivalent

Notes: Timor-Leste has not yet set a target and is still developing its policy. Conditional targets include both unconditional and conditional components.

Source: DFAT analysis of national policies.

Figure 5.2 Estimated demand for renewable energy in Southeast Asia, 2020–2050

Note: Estimated demand is based on current policy settings and trajectory needed to achieve Paris Agreement climate targets.

Source: IEA, Southeast Asia Energy Outlook 2022, May 2022.

Australia seeks to become a renewable energy superpower, meeting our own emissions reduction goals and supporting the stable and secure decarbonisation of economies in our region. There is great potential for Australia to support Southeast Asia's energy transition, to position clean and cheap energy as Australia's competitive advantage, via the export of renewables, clean energy expertise and technology. Southeast Asia's clean energy transition presents opportunities to provide project engineering, design, construction and advisory services, and technology. The total value of this market could be up to US$10 billion per year by 2030.108 Submissions to the strategy noted Australia is well placed to service this demand, with clean energy transition expertise highly relevant to the region.109 For example, Powerledger is an Australian company seeing growing demand for its technology supporting peer-to-peer renewable energy trading (see case study).

Case study: Powerledger powering ahead in clean energy trade

In Bangkok, Thailand, Powerledger is partnering with renewable energy business BCPG and the Metropolitan Electricity Authority to trial rooftop solar energy trading between seven buildings across two precincts in Bangkok.

Vinod Tiwari, Global Head of Business Development and Partnerships, said, 'The dynamism of Southeast Asia, the increasing adoption of rooftop solar and the region's ability to rapidly absorb new technologies is making the region very attractive for Powerledger's expansion. The similarities in the energy transition challenges faced in Southeast Asia and Australia also make Australia's expertise highly valued in the region.'

Each building is allocated energy from installed solar photovoltaic systems. Energy is sold at a price cheaper than the grid, with transactions facilitated through the Powerledger xGrid platform. If a building consumes less than the system generates, it is able to trade the surplus energy with any other building in its network. For renewable energy developers like BCPG, the Powerledger platform enables new business models and better returns for investing in renewables by maximising renewable energy consumption. For building owners, it provides cheaper energy and the ability to monetise surplus energy. For energy market operators, this pilot has helped them to understand technical readiness, identify challenges and mitigations, and understand regulatory enhancements needed to facilitate a nationwide rollout.

Working with Austrade's market experts and using the network of Australian embassies in Southeast Asia have also been important factors in promoting Powerledger's business. 'Powerledger has joined a number of Austrade-led trade missions to the region, including the Australia Energy Mission to Thailand and Vietnam in March 2023. These are invaluable experiences, allowing us to hear directly from key decision-makers and meet new business contacts and explore opportunities in the region,' said Mr Tiwari.

Powerledger's project in Bangkok has opened further opportunities to showcase its solutions across Southeast Asia, including in Malaysia, Vietnam, the Philippines and Chiang Mai, Thailand.

Australia also represents a sizeable opportunity for Southeast Asian investment towards the clean energy transition. Malaysia's Gentari has recently invested in solar, as well as battery energy storage, in Australia through its acquisition of WIRSOL Energy, building on investments by Thailand's RATCH Group and Banpu, and the Philippines' ACEN in Australian renewables (see case study).

Case study: ACEN Australia shines bright with Philippines foreign investment

ACEN is the energy platform of the Ayala Group, one of the Philippines' largest and most diversified conglomerates.

In 2023, ACEN reached 4,200 megawatts of attributable capacity in the Philippines, Australia, Vietnam, Indonesia and India, with a renewable share of 98 per cent, which is among the highest in the region. The Philippines-based company entered Australia in 2018, with an initial investment of US$30 million in partnership with UPC Renewables.

The venture launched its first project in 2021, a A$700 million investment in the first phase of New England Solar in New South Wales. Since then, ACEN Australia's role in the renewable energy sector has grown, with around 60 staff and a development portfolio of 8 gigawatts. In October 2022, ACEN Australia secured around A$600 million of corporate financing from international finance institutions, including a A$75 million investment from Australia's Clean Energy Finance Corporation, to accelerate development of its project portfolio.

According to Patrice Clausse, ACEN International CEO, Austrade has played a key role facilitating ACEN's investment in Australia. 'Austrade's help in navigating federal, state and local governments and facilitating the movement of people to and from Australia has been critical in supporting our investment in Australia's energy transition,' Mr Clausse said. ACEN's confidence in the Australian market saw it acquire full control of its joint venture in early 2022.

ACEN sees its investment in Australia as a way to accelerate capability building and skills transfer across the region. ACEN's regional footprint and focus on mobility for staff is starting to see two-way exchanges between the Philippines, Australia and the region, sharing expertise and know-how on our shared energy transition challenges. This is a strong example of how deepening engagement between Australia and Southeast Asia will support energy transition across our region.

Supply chain security in the region will become increasingly important as global demand rises for critical clean energy products like solar panels, wind turbines, batteries and electrolysers. More of these products, and their raw material inputs, will be needed to meet demand. Southeast Asia will be a key beneficiary of efforts to grow and diversify these supply chains.

Australia's own investments in clean energy manufacturing, including through the National Reconstruction Fund, the Australian Made Battery Plan and the Clean Energy Finance Corporation, will support the necessary supply chain expansion for our own decarbonisation and export goals. This will set up Australian companies to work with Southeast Asia as it invests in expanded clean energy supply chains and new clean energy manufacturing capabilities (see Redflow case study).

Case study: Redflow charging forward on clean energy storage solutions

Australian stationary energy storage company Redflow aims to lead the clean energy transition by delivering the world's safest and cleanest energy storage solution.

Its ZBM3 battery is the world's smallest commercially available zinc–bromine flow battery and, due to its unique form factor, can be deployed for a range of applications, including commercial, industrial, telecommunications and grid-scale storage.

In 2018, Redflow set up manufacturing operations in Chonburi, one of Thailand's free trade regions and a major automotive and electronics manufacturing and logistics hub.

Redflow's Chief Executive Officer, Tim Harris, said the company moved manufacturing to Thailand because of its advanced manufacturing capability, including a skilled and internationally competitive labour force, and supply chain connections via a deep seaport with shipping routes to its target markets.

Looking to the future, Mr Harris said, 'Redflow will continue investing to further develop our manufacturing in Thailand. The strong local supply base is a fantastic resource and our Thai national general manager demonstrates the ongoing and long-term commitment we have to manufacturing in the region, while also adding significant value to the ongoing operational success of the facility.'

'We also appreciate the backing we've had from the Australian Government. The support from the Australian embassy and Austrade in Thailand has really helped us navigate the challenges in establishing our manufacturing presence, including providing market insights to our Australian executive team and boosting our profile by nominating Redflow for a Thai Government APEC Bio-Circular-Green Award and a visit from the Australian Ambassador to our factory.'

Regional consultations highlighted the substantial interest in Australia's expertise and capabilities in emerging low-emissions technologies. For example, clean hydrogen and derivative fuels are being considered for a range of different uses in Southeast Asia. Singapore will be an important market, with uses across maritime, fuel bunkering, electricity, transport and industrial sectors. Vietnam, Malaysia, Brunei, Thailand, Laos, the Philippines and Indonesia are exploring hydrogen's potential in electricity and industrial sectors. Australian technical assistance is already helping build hydrogen expertise and may open future commercial opportunities, including clean hydrogen exports, two-way investment, and partnerships to accelerate commercialisation of new technology.

High-integrity carbon markets and regional trading in carbon offsets could accelerate investment in emissions reduction. Southeast Asia's nature-based solutions, including blue carbon, have technical abatement potential of around 5.2 gigatonnes of carbon dioxide equivalent abatement in 2030.110 Carbon trading is already taking place in Singapore and Thailand, and will begin in Indonesia in 2023.111 Vietnam, Malaysia and the Philippines are also planning carbon markets in the next five years.

Government collaboration with industry will remain critical to achieving the region's decarbonisation needs. This includes bilateral partnerships like the A$200 million Australia–Indonesia Climate and Infrastructure Partnership and the Singapore–Australia Green Economy Agreement, developing regional rules and standards through the Indo-Pacific Economic Framework (IPEF), and capacity-building work in APEC to support sustainable economic growth. Export Finance Australia has invested US$62 million in clean energy projects and is working on a US$200 million facility to support Indonesia's energy transition. Australia's development financing instruments have invested A$67.2 million in climate projects in the region, mobilising A$177.5 million in private investment and providing 127,291 people in Southeast Asia access to clean energy.

Pathways to 2040

In addition to the cross-cutting recommendations outlined in Chapter 2, which will have a broad economic impact, this chapter has additional specific recommendations on the green energy transition.

Remove blockages

Consultations for this strategy highlighted key barriers for Australian businesses and investors, including construction risks (such as lengthy approvals and land acquisition), as well as policy and regulatory uncertainty. Other barriers include a lack of consistent data on environmental, social and governance and climate risk, investors' limited knowledge of regional energy markets, and a mismatch between the small deal sizes and costs of due diligence.

Countries in the region are developing new sustainable finance requirements and climate disclosure rules. Ensuring interoperability with Australia's emerging standards will ensure investors and businesses on both sides do not face new barriers.

Recommendation

- Australia's Treasury should lead expanded work with Southeast Asian partners on high-quality and interoperable sustainable finance classifications and climate-related disclosure rules.

Carbon trading represents an important economic opportunity for Australia and the region. Already more than 5,000 companies globally have committed to setting voluntary targets, including over 500 Australian brands under Climate Active, which could source carbon offsets from Southeast Asia.112 Regional trading in carbon offsets, for both compliance and voluntary markets, will need to be underpinned by harmonised and robust standards of carbon accounting and carbon market governance. The Australian Government could work with international partners and countries in the region to build the infrastructure and technical capability, including monitoring, reporting and verification standards. This would also generate opportunities for Australian companies to provide a range of carbon services, project development and project finance to support market development.

Recommendation

- Explore establishing standards and regulations to allow for a regional market in low-energy goods, including electricity and carbon, with interested Southeast Asian partners.

Build capability

Australian and Southeast Asian companies will have major opportunities to partner in solar, battery storage and electric vehicle supply chains. Malaysia and Vietnam have the largest solar manufacturing capacity outside of China. With Australia's demand for solar expected to triple by 2040, partnerships with Southeast Asia could help to commercialise Australia's leading solar research and development, secure Australian supplies of solar panels and boost Australian silica exports.113

In battery storage, Malaysia, Thailand, Indonesia, the Philippines and Vietnam are emerging as regional players in the value chain, with existing manufacturing, growing electric vehicle industries, and policy incentives. There will be opportunities for Australian companies to move up the battery value chain and supply high-value battery material exports.

IPEF is laying the foundation for Australia, Southeast Asian countries and other partners to collectively develop resilient and diverse clean energy supply chains. With Australia as chair, Quad leaders also committed in May 2023 to encourage greater public and private investment and collaboration in clean energy supply chains, research, development and demonstration, and innovation in the Indo-Pacific. The Australian Government should seek opportunities through these platforms to form partnerships with Southeast Asian counterparts to support clean energy supply chains.

Recommendation

- Draw upon regional clean energy supply chain initiatives to support strategic projects involving Australian and Southeast Asian partners in the battery, electric vehicle and solar sectors.

Consultations in Southeast Asia showed high levels of interest in Australian technical assistance, which could help to create a market for future commercial opportunities. Submissions to the strategy recommended that assistance focus on continued development of detailed decarbonisation pathways, international best practice regulation, and technology transfer. Australia's CSIRO is already working with the region, including on power system transformation and electrification, but there is more CSIRO could do in partnership with regional counterparts, industry, policy agencies and the research sector to advance the clean energy transition.

Recommendation

- Develop a clean energy science and technology engagement strategy to work with regional counterparts on technical challenges to meet net zero.

Regional consultations highlighted the significant future green economy workforce needs. Southeast Asia will require an additional 5.5 million trained workers in the renewables sector alone by 2050, as well as workers across grid infrastructure, clean energy supply chains, energy efficiency and low-emissions technologies.114

Australia will have its own workforce needs. There is an opportunity to build and share a regional green workforce through future-focused investment in workforce training and dedicated labour mobility programs for green skilled workers. Such a program would see skilled workers from the region undertake training and work in Australia before returning to their home country. This would benefit all sides, delivering the labour force for clean energy transition across the region. Collaboration between industry and education and training providers to develop green qualifications will be key. There is a potential role for the Australian Government to help facilitate this.

Recommendation

- Support industry and education and training providers to develop and promote green qualifications for the Southeast Asian market.

100 In Australia, fossil fuels accounted for around 90 per cent of the primary energy mix in 2020–21, while 85 per cent of ASEAN's current energy supply is from fossil fuels. See Department of Climate Change, Energy, the Environment and Water (DCCEEW), Australian Energy Update 2022, DCCEEW, Australian Government, 2022, p. 8.

101 International Renewable Energy Agency (IRENA) and the ASEAN Centre for Energy (ACE), Renewable Energy Outlook for ASEAN: Towards a regional transition, IRENA and ACE, 2022, pp. 40, 43. https://www.irena.org/publications/2022/Sep/Renewable-Energy-Outlook-fo…

102 Boston Consulting Group (BCG), Southeast Asia Green Trade and Investment Opportunities, report to Australian Government Department of Foreign Affairs and Trade, BCG, March 2023. BCG estimates draw from International Renewable Energy Agency (IRENA) and the ASEAN Centre for Energy (ACE), Renewable Energy Outlook for ASEAN: Towards a regional transition, IRENA and ACE, 2022. United Nations Environment Program and DBS, Green Finance Opportunities in ASEAN, UNEP and DBS, 2017.

103 International Energy Agency (IEA), Southeast Asia Energy Outlook 2022, IEA, 2022, p. 13.

104 ASEAN Centre for Energy (ACE), The 7th ASEAN Energy Outlook 2020–2050, ACE, 2022, p. 86.

105 Boston Consulting Group (BCG), Southeast Asia Green Trade and Investment Opportunities, report to Australian Government Department of Foreign Affairs and Trade, BCG, March 2023. BCG estimates draw from International Renewable Energy Agency (IRENA) and the ASEAN Centre for Energy (ACE), Renewable Energy Outlook for ASEAN: Towards a regional transition, IRENA and ACE, 2022. United Nations Environment Program and DBS, Green Finance Opportunities in ASEAN, UNEP and DBS, 2017.

106 International Renewable Energy Agency (IRENA) and the ASEAN Centre for Energy (ACE), Renewable Energy Outlook for ASEAN: Towards a regional transition, IRENA and ACE, 2022, p. 76.

107 Boston Consulting Group (BCG), Southeast Asia Green Trade and Investment Opportunities, report to Australian Government Department of Foreign Affairs and Trade, BCG, March 2023. BCG estimates draw from International Renewable Energy Agency (IRENA) and the ASEAN Centre for Energy (ACE), Renewable Energy Outlook for ASEAN: Towards a regional transition, IRENA and ACE, 2022. United Nations Environment Program and DBS, Green Finance Opportunities in ASEAN, UNEP and DBS, 2017.

108 Boston Consulting Group (BCG), Southeast Asia Green Trade and Investment Opportunities, report to Australian Government Department of Foreign Affairs and Trade, BCG, March 2023.

109 Submissions from Aurecon and Worley.

110 Boston Consulting Group (BCG), Southeast Asia Green Trade and Investment Opportunities, report to Australian Government Department of Foreign Affairs and Trade, BCG, March 2023

111 Reuters, 'Indonesia launches carbon trading mechanism for coal power plants', Reuters, 22 February 2023, accessed 27 February 2023.

112 See Science Based Targets Initiative, Companies taking action, SBTi website, n.d., accessed 28 June 2023,, and Climate Active, Certified Brands, Climate Active website, n.d., accessed 28 June 2023.

113 Boston Consulting Group (BCG), Southeast Asia Green Trade and Investment Opportunities, report to Australian Government Department of Foreign Affairs and Trade, BCG, March 2023.

114 ASEAN Centre for Energy (ACE), The 7th ASEAN Energy Outlook 2020–2050, ACE, 2022, p. 99.