Key points

- Meeting Southeast Asia's estimated US$3 trillion infrastructure investment gap115 will require average annual investment of US$210 billion to 2040.116

- Rapid urbanisation, climate change, and digitalisation are driving current and future infrastructure needs in Southeast Asia.

- Australia's deep sectoral expertise means we are well placed to capitalise on the need for investment in the region's infrastructure.

- Assistance from governments across the infrastructure lifecycle, from policy development to project delivery and asset maintenance, will be key to meeting Southeast Asia's infrastructure gap to 2040.

Sector overview

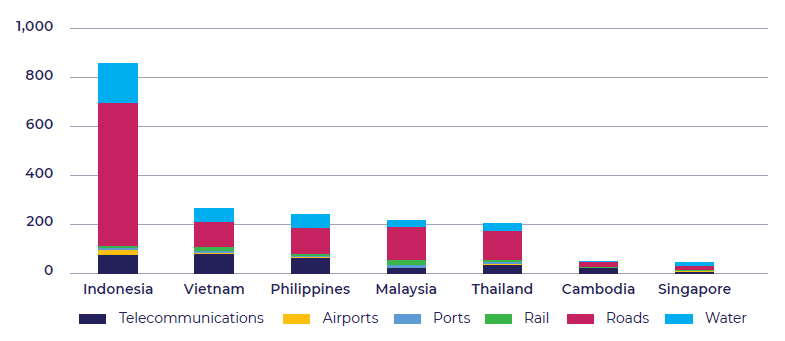

By 2040, Southeast Asia will need US$3 trillion in infrastructure investment to keep pace with economic and demographic changes and to close infrastructure gaps.117 Rapid urbanisation, the growing digitalisation of economies, and the challenges of climate change will all increase the need for greater investment in infrastructure (Figure 6.1). Closing these infrastructure gaps will require investments in transport to connect the region, in energy to meet the region's clean energy transition needs, and in digital infrastructure to enable future industries and support inclusive and sustainable growth.

As a number of submissions highlighted, rapid urbanisation in Southeast Asia is driving the need for greater infrastructure investment.118 By 2040, the population of Southeast Asia is anticipated to reach 766 million.119 Cities will absorb this growth, with an additional 115 million people living in urban areas by 2040.120 The rate of urbanisation will be fastest in Timor-Leste, Cambodia, Laos, Philippines and the Vietnam.121

Without significant investments in transport infrastructure, this will lead to greater congestion, pollution and inequitable access to basic services. For example, it is estimated that the Philippines could lose approximately A$150 million every day by 2035 if it does not resolve traffic congestion.122

Figure 6.1 Infrastructure investment need, by country and sector, 2023–2040

Note: Data unavailable for Brunei, Laos and Timor-Leste.

Source: Global Infrastructure Hub, Global Infrastructure Outlook, n.d., accessed 3 March 2023.

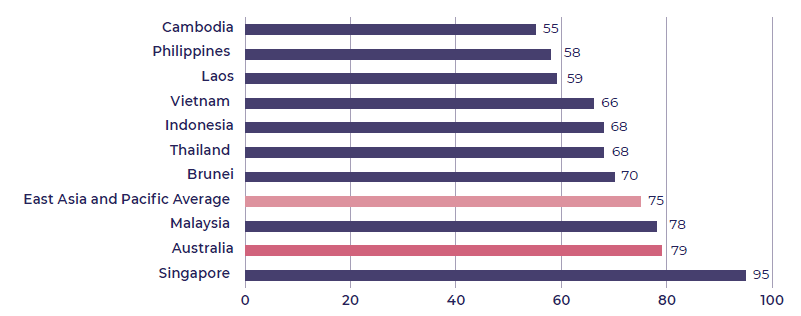

The scale and quality of infrastructure will be critical in supporting the productivity, liveability and prosperity of the region by improving connectivity and facilitating trade, while supporting the everyday life of local populations. Much of this investment will be in roads, water and telecommunications.123 At present, there are stark differences in the quality of infrastructure across the region (Figure 6.2).124 Improving infrastructure connectivity will remain a key priority for Southeast Asian governments to 2040. In 2019, ASEAN developed a list of 19 initial priority infrastructure projects, including road, rail, energy, digital, sea and airport infrastructure, aligned to the ASEAN connectivity agenda, and a further 21 projects in the potential pipeline.125 The Australian Government is working closely with ASEAN to help update this list through the Aus4ASEAN Futures Initiative.

Rapid advances in technology and the impact of climate change will continue to shape the infrastructure needs of the region. Southeast Asian countries are already investing in automation (for example, Malaysia's green ports), public transportation (for example, the Philippines and Timor-Leste) and transport electrification (for example, Brunei, Vietnam, Indonesia, Thailand and Malaysia).126 Rapid urbanisation will see further opportunities to invest in smart cities and transport, including roads, rail, airports, port upgrades and freight digitalisation. Achieving the region's decarbonisation targets will drive significant investments in green energy, sustainable infrastructure and technologies.

Digitalisation is transforming how infrastructure is procured, built and operated. Smart grids, automation of trade and logistics and smart mobility are increasing the efficiency of the infrastructure sector and cutting emissions. Implementing ASEAN's Digital Masterplan 2025127 will require over US$330 billion of investment to 2040 in telecommunications infrastructure to provide the necessary information and communications technology (ICT) access and underpin digital adoption across the region.128

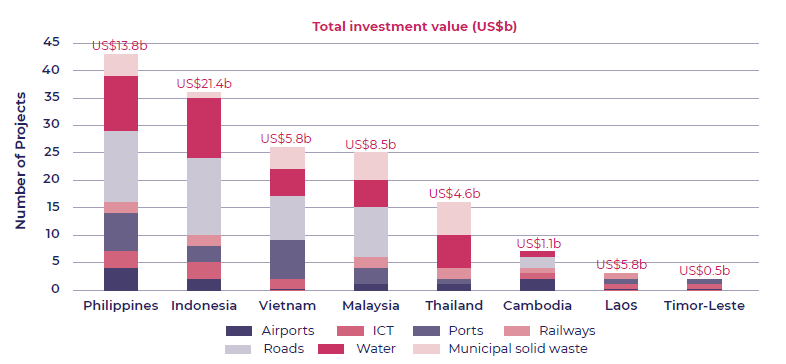

There is significant scope for Australia to help meet Southeast Asia's infrastructure needs through both private and public investment.129 Most Southeast Asian national budgets lack the capacity to cover the infrastructure gap amid other priorities. At present, public sector financing is estimated to cover up to 50 per cent of planned investment across ASEAN.130 Private participation in infrastructure over the past two decades has varied significantly between Southeast Asian countries, both in quantity of projects and monetary investment, with a strong focus on roads, water and sewerage projects (Figure 6.3). While most of Southeast Asia's infrastructure needs will continue to be in greenfield developments, attracting a higher level of risk compared to brownfield projects, there continue to be a broad range of opportunities for Australian companies to explore.

Figure 6.2 World Economic Forum infrastructure quality scores (out of 100)

Note: Data unavailable for Timor-Leste.

Source: World Economic Forum, Global Competitiveness Report 2019.

“Business networks, introductions and funding have all supported the growth of our business in the region.” (Aurecon)

Australian industry has deep expertise and can make a significant contribution to private financing of infrastructure in Southeast Asia. Consultations with the Australian private sector highlighted Australia's strengths in planning, design, engineering, construction and ICT. Australian companies – like Aurecon (see case study), Worley, BMD, BlueScope Steel, GHD, Lendlease, Linfox, Telstra and Macquarie Group (see case study) – are active in the region and there are more companies that have relevant expertise to support the delivery of infrastructure in Southeast Asia.

Figure 6.3 Private participation in infrastructure in select Southeast Asian countries, by sector, 2002–2022

Note: Data unavailable for Brunei and Singapore.

Source: World Bank, Private Participation in Infrastructure Database, accessed 3 March 2023.

Case study: Aurecon building on its longstanding presence in Vietnam

Aurecon established its Vietnam office in 1991. It has grown to be the largest international engineering, design, digital and advisory consultancy in the country, supporting both local and offshore work through the establishment of the Aurecon Global Design Centre.

Employing more than 360 professionals, Aurecon has a project portfolio spanning aviation, data and telecommunications, education, health, manufacturing, transport and property.

Aurecon sees tremendous opportunity for its services in Southeast Asian markets, given the increasing need for infrastructure to support growing and urbanising populations, a focus on climate-resilient infrastructure and a rapid growth in digital economy and corresponding infrastructure, such as data centres.

Its landmark projects in Vietnam include design services for the Long Thanh International Airport, serving as the owner's engineer for the Dau Tieng 1 and 2 PV Solar Power Plant, and building services design for the 472-metre-high Landmark 81 skyscraper. Aurecon also provided engineering services for the FPT Data Centre, set to be the largest Tier 3 data centre in Vietnam on completion.

The market is not without its challenges – competition from local players and skills gaps in the local workforce can be barriers. Aurecon attributes its success in Vietnam to its ability to leverage strong local experts and leaders to build strong client relationships and a diverse client base. Attracting a talented local workforce has also been key. Aurecon established strong relationships with the Ho Chi Minh City University of Technology and the Ho Chi Minh City University of Technology and Education to provide a pipeline of talent for the business.

Aurecon's Chief Executive, William Cox, also acknowledges the role the Australian Government has played in its success. 'As a majority-Australian-owned business, Aurecon has been very well supported by the Australian Government over many years. Business networks, introductions and funding have all supported the growth of our business in the region,' he said.

Aurecon's Chief Operating Officer, Louise Adams, also worked to support other Australian businesses to succeed in Vietnam, appointed in her personal capacity as one of the three inaugural Business Champions under the Australia–Vietnam Enhanced Economic Engagement Strategy.

Case study: Macquarie Group investing in Southeast Asia's digital future

Macquarie has been active in Southeast Asia for over 20 years, with offices in Singapore, the Philippines, Malaysia, Thailand and Indonesia.

Macquarie Group Asia CEO and Senior Managing Director of Macquarie Asset Management, Verena Lim, said, 'Central to Macquarie's approach are our local teams with on-the-ground experience and market knowledge that enables them to realise opportunities for clients and communities. Macquarie has built deep local expertise in sectors ranging from energy and renewables to infrastructure, commodities, real estate and technology.'

Digital infrastructure is one area in which Macquarie is helping deliver positive social, economic and environmental outcomes and supporting the future economic prosperity of this high-growth region.

Through a fund managed by Macquarie Asset Management, Macquarie is supporting the growth of AirTrunk, a leading developer and operator of hyperscale data centres in the region, currently developing a 150+ megawatt data centre in Malaysia.

Macquarie Capital invested in PhilTower Consortium Inc., one of the fastest-growing independent telecommunications companies in the Philippines. DFAT and Austrade subsequently supported PhilTower as it applied for the Greenlane facility of the Philippines Department of Trade and Industry, which was designed by the Philippine Government specifically for strategic sectors to promote their successful operations.

Through a fund managed by Macquarie Asset Management, Macquarie is supporting Bersama, a leading independent telecommunication towers business in Indonesia, to pursue new investment opportunities in telecommunication towers, fibre and data centres across the region.

Macquarie's view is that strong long-term macroeconomic fundamentals in Southeast Asia will continue to drive demand for high-quality digital infrastructure. In turn, this will facilitate the ongoing rapid growth in digitalisation essential to ensuring the region's digital economy remains competitive, and delivering socio-economic outcomes by making technology more accessible to all.

Australia has an advanced and connected transport, research and development, and technology ecosystem, creating opportunities for collaboration with Southeast Asian partners in the development of sustainable transport systems and supporting infrastructure across the region.131 This includes recognised expertise in technologies such as electric vehicle components, charging infrastructure, cloud-based solutions, grid management and power storage.132

Leveraging Australia's strengths, there could also be opportunities for mutually beneficial partnerships across a number of key areas, including building passive infrastructure (for example, towers, poles and fibre),133 replacing ageing submarine cables in the region,134 protecting critical telecommunications infrastructure assets, and accelerating 5G innovation.

While strong demand for infrastructure investment in Australia will continue, collaborative business partnerships and delivery models with Southeast Asian companies – such as the Gamuda model (see case study) – can help ease these constraints and bring opportunities for two-way mobility of skilled and semiskilled workers.

There will be an important role for whole-of-cycle government assistance in the provision of infrastructure projects to meet Southeast Asia's forecasted infrastructure gap to 2040. There is a trend towards and demand for such public financing in Southeast Asia, particularly as sustainability objectives increasingly lean towards green solutions in infrastructure.

The Australian Government has well-respected technical assistance programs in the region, such as Partnerships for Infrastructure (P4I) (see Box 6.1), that support partner governments to lift standards and more effectively deploy public resources towards infrastructure. These programs tend to focus on providing technical assistance on upstream phases of the infrastructure lifecycle, including sector policy and regulation, project prioritisation and planning, and procurement processes.

The Australian Government can also provide infrastructure financing to Southeast Asia through export credit agencies such as Export Finance Australia, private sector–led blended financing facilities (for example, the Private Infrastructure Development Group) and financing initiatives under multilateral development banks (for example, the Asian Development Bank–managed Australian Climate Finance Partnership).135

Case study: Gamuda brings Southeast Asian innovation to Australia's infrastructure

Gamuda Berhad is a Malaysian engineering, infrastructure and property group that operates in nine countries, including Australia, the United Kingdom, Singapore, Taiwan and Vietnam.

Its engineering and property development projects include railways, roads and expressways, tunnels and bridges, water and sewage treatment plants, as well as new residential-commercial townships.

Gamuda Australia was established in 2019 as part of the company's strategy to expand and diversify in the region. It is also helping Gamuda to attract and retain Malaysian talent by offering them opportunities to work across its international business.

In March 2022, the New South Wales Government awarded Gamuda Australia the Sydney Metro West – Western Tunnelling Package project. In a consortium with construction company Laing O'Rourke, the A$2.16 billion project is expected to have created tens of thousands of jobs by its scheduled completion in 2025. The project will benefit from Gamuda's advanced technologies, including its artificial intelligence software powering Australia's first autonomous tunnel boring machines. This technology allows for greater precision while reducing excavation time.

Gamuda Group Managing Director, Dato' Lin Yun Ling, said key to Gamuda's success is establishing strategic partnerships with local Australian businesses to exchange knowledge and strengthen their market offering. 'Every operating environment and every Gamuda project is different,' he said. 'Our strong local partnerships are critical to the successes we have, and continue to seek, in the Australian market,' he said.

Austrade in Kuala Lumpur was instrumental in presenting a potential pipeline, facilitating initial scoping and providing introductions to Australian governments prior to Gamuda establishing a permanent entity in Australia. Gamuda's story demonstrates that Southeast Asian businesses can successfully invest in Australia with mutual benefits.

Box 6.1 Partnerships for Infrastructure – building capability in Southeast Asia

The Master Plan on ASEAN Connectivity 2025 aims to better connect markets across the region, which is key to growing and diversifying economic opportunities in developing markets like Laos. The upgrade to Laos's National Road 2 and its cross-border connections will help deliver this, providing a climate-resilient transport route for Laos's farmers to access markets in Thailand and Vietnam. The Australian Government is playing a critical role in this project through design of upgraded border facilities, support for development and implementation of a multimodal transport strategy, advice on logistics facilities, and training to increase the uptake of green design in infrastructure. This is key to accelerating World Bank funding for the project and attracting potential private sector finance.

Australia's assistance is being delivered under Partnerships for Infrastructure (P4I), a four-year Australian Government initiative assisting Southeast Asian governments and ASEAN address critical infrastructure needs through improved policy and regulation, project preparation and procurement. Strengthening the enabling environment supports development of a pipeline of investable projects, attracting quality finance and bolstering infrastructure productivity.

P4I provides expert technical advice and capacity-building support, including through partnerships between Australian agencies and their Southeast Asian counterparts, and is focused on the region's priorities in transport connectivity, energy transition and digitalisation. It is supporting ASEAN transport ministries to address structural constraints to improved shipping container networks and processing procedures in the region, assisting energy utilities develop and implement energy transition strategies, and helping countries assess the potential of various renewable energy options, such as battery and pumped hydro energy storage, clean hydrogen and green bunker ports. With more time and resourcing, P4I will be able to continue contributing to Southeast Asia's pipeline of infrastructure projects to 2040.

Pathways to 2040

In addition to the cross-cutting recommendations outlined in Chapter 2, which will have a broad economic impact, this chapter has additional specific recommendations on infrastructure. Opportunities for Australia to engage are diverse and can span the entire infrastructure lifecycle, including planning, delivery, operations and financing.

Remove blockages

Australian companies looking to enter the region often need to navigate fragmented regulatory frameworks. Underdeveloped project preparation and pipeline development limit competitive market processes and increase risk for investors and businesses. For project delivery, this often results in unclear project and planning approval pathways, causing project stop-starts and increased costs to business.

The dominance of state-owned enterprises in some of these markets often sees contracts awarded to local companies, while fiscal constraints have seen governments further prioritise local companies to support domestic growth and development. A lack of transparency in procurement processes can be a major challenge for developers and financial institutions.

Australian diplomatic missions in the region need to be properly resourced to ensure there is expertise on infrastructure investment to work with partner countries to harmonise regulatory frameworks across the region. As noted during consultations, missions should engage regularly with Australian businesses invested in the region and complement the work of the proposed investment 'deal teams' (see Recommendation 45).

Recommendation

- Resource Australian missions in Southeast Asia to work with partner countries to harmonise regulatory frameworks across the region and lift infrastructure standards to de-risk investments.

Deepen investment

In order to influence a material growth in Australian investment in the region, Australia needs to implement a targeted outward investment approach. A strategic investment facility for Southeast Asian infrastructure projects, with a focus on the green economy transition, and connected to deal teams, technical assistance programs like P4I, and expanded support for project preparation, would support the necessary uplift in Australia's infrastructure investment. This would provide a more integrated approach to the full lifecycle of infrastructure development.

There are massive infrastructure needs in the region in green energy transition, rail, water, airports and roads. Major infrastructure projects necessarily involve government as well as private sector participation. Through targeted interventions, government can play a role in de-risking (including lowering risk perceptions) and crowding in private sector investment to help catalyse productive infrastructure projects. Australian Government participation with Australian investors and service providers will assist in managing often lengthy project development times, as well as helping manage the political risk involved in long-dated investments.

Australian investment vehicles can be drawn upon to provide direct infrastructure financing. In addition to financing infrastructure projects in the Pacific, Export Finance Australia (EFA) has started financing a pipeline of infrastructure projects in Southeast Asia, following legislative changes in 2019 to extend EFA's financing to overseas infrastructure. This includes two projects EFA has financed in Vietnam. However, the sum of this financing remains limited. Given the modest level of Australian FDI in the region in recent years and persistent perceptions of risk among major Australian investors, the establishment of a dedicated Southeast Asia financing facility would help support more Australian investment in the region. It would make available a valuable source of funding for these investments and also send an important signal of confidence that the Australian Government was willing to invest, helping crowd in private investors.

Recommendation

- Australian Government to establish a strategic investment facility for Southeast Asian infrastructure projects, utilising Export Finance Australia and other government-supported funding sources.

Through the establishment of new investment deal teams, the Australian Government will be better placed to deliver outcomes for Australian companies interested in investing in the region. The teams will need people with commercial expertise in landing bankable deals. Such a formalised collaboration between Austrade, DFAT and relevant agencies, such as EFA, with a greater number of private sector experts would assist prospective Australian investors to conclude deals in Southeast Asia. This would also assist proponents of investment projects in the region to target and partner with Australian investors, and support efforts to ensure projects are investor-ready.

The deal teams would work with various national authorities (such as the Indonesia Investment Authority) to create outward investment opportunities for Australian corporate and institutional investors. They would also collaborate with like-minded international players to expand financing options. The deal teams would identify assets in specific markets that Australian investors could be investing in, as well as appropriate structuring (corporate, blended funding, tax, risk structures and guarantees) so that opportunities are investor-ready for Australian participants.

Such deal teams could first be established in Jakarta, Singapore and Ho Chi Minh City, with a view to extending these elsewhere in the region once the model has proven successful.

Recommendation

- Establish new investment 'deal teams' for Southeast Asia, blending private sector and Australian Government capabilities to provide outward investment (including financing) services.

Infrastructure finance to the region is dominated by Japan, China, the United States, the Republic of Korea and European countries, some of whom directly link funding with involvement of their own domestic companies. In some instances, this embeds technology incumbencies and creates requirements for compatibility in infrastructure asset operation and maintenance services, limiting Australian participation.

Australia's P4I program is both limited in resourcing and time, with Phase 1 concluding in 2024. Though it only commenced in 2021, P4I’s contribution is recognised and valued by the region. Noting that the benefits of upstream infrastructure assistance take time to be realised, a longer-term approach to funding this program would be valuable. Maintaining the resources necessary to implement P4I's existing service offerings will reinforce Australia's value as a reliable, flexible and trusted infrastructure partner through access to high-quality expertise and advice. As Macquarie's submission highlighted, government assistance in Southeast Asia would be better deployed at the development stage of a project lifecycle.136

Consultations highlighted assistance with early-stage project preparation and development activities could provide a critical boost to the region's project pipeline and accelerate infrastructure development. The Australian Government should consider expanding its project preparation support, including for key projects of commercial, economic or other strategic value, with appropriate measures in place to mitigate risk. Expanding this capability would complement other strategy recommendations, including deal teams and a strategic investment platform.

Recommendation

- Australian Government to extend Partnerships for Infrastructure and expand into early-stage project preparation support.

115 Global Infrastructure Hub, Forecasting infrastructure investment needs and gaps, [dataset], 2018, accessed 30 June 2023.

116 Asian Development Bank (ADB), Meeting Asia's Infrastructure Needs, ADB, 2017, p. 43.

117 Global Infrastructure Hub, Forecasting infrastructure investment needs and gaps, [dataset], 2018, accessed 30 June 2023.

118 Submissions from the Australian Institute of Landscape Architects, Macquarie and Aurecon.

119 United Nations, Department of Economic and Social Affairs, Population Division. World Population Prospects 2022 [dataset], 2022, accessed 24 May 2023.

120 United Nations, Department of Economic and Social Affairs, World Urbanization Prospects 2018 [dataset], 2018, accessed 29 June 2023.

121 United Nations, Department of Economic and Social Affairs, World Urbanization Prospects 2018 [dataset], 2018, accessed 29 June 2023.

122 Japan International Cooperation Agency (JICA) and ALMEC Corporation, Follow-up Survey on Roadmap for Transport Infrastructure Development for Greater Capital Region: Final Report Summary, JICA, 2019, p. 8.

123 Global Infrastructure Hub, Forecasting infrastructure investment needs and gaps, [dataset], 2018, accessed 30 June 2023. Based on publicly available information, real investment need could be larger. Data does not include Timor-Leste, Laos and Brunei. Excludes energy infrastructure, which is analysed in Chapter 5 – 'Green energy transition'.

124 World Economic Forum, The Global Competitiveness Report 2019, World Economic Forum, 2019.

125 ASEAN Secretariat and World Bank, Enhancing ASEAN Connectivity: Initial Pipeline of ASEAN Infrastructure Projects, ASEAN Secretariat, 2019.

126 R Farmer, R Gupta, V Lath and N Manuel, Capturing growth in Asia's emerging EV ecosystem, McKinsey, 2022, accessed 5 July 2023.

127 ASEAN, ASEAN Digital Masterplan 2023, ASEAN Secretariat, 2021.

128 Global Infrastructure Hub, Forecasting infrastructure investment needs and gaps, [dataset], 2018, accessed 29 June 2023. Based on publicly available information, real investment need could be larger. Estimates exclude Timor-Leste, Laos and Brunei.

129 Asian Development Bank, Meeting Asia's Infrastructure Needs, Asian Development Bank, 2017.

130 Standard Chartered, ASEAN – A Region Facing Disruption, Standard Chartered; 2019.

131 Austrade, Future Transport & Mobility, Austrade website, n.d., accessed 29 June 2023.

132 Austrade, Insights: Fresh opportunities as electric vehicles power up in India, Austrade website, n.d., accessed 29 June 2023.

133 NERA Economic Consulting, Telecommunications Infrastructure International Comparison, Report for the United Kingdom Department for Digital, Culture, Media and Sports, 2018, p. 40.

134 Infrapedia's timeline estimates availability of current submarine cable stock in 10 years based on a 25-year life from the date the submarine cable was ready for service, with 50 per cent being an estimate of the upper limit of reduced stock due to combined effect of technical obsolescence.

135 See Asian Development Bank (ADB), Australian Climate Finance Partnership, ADB website, n.d., accessed 22 June 2023. Department of Foreign Affairs and Trade (DFAT), Private Finance for Development, DFAT website, n.d., accessed 22 June 2023.

136 Submission by Macquarie Group.