In 2015, the stock of foreign investment in Australia was made up of

foreign direct investment worth $735.5 billion and portfolio and other

investment worth $2.3 trillion. Portfolio investment occurs when a foreign

investor purchases Australian securities or equity and debt transact ions

which do not offer the investor any control over the operation or

enterprise. FDI occurs when an individual or entity from outside Australia

establishes a new business or acquires ten per cent or more of an

Australian enterprise and has some control over its operations. FDI is one

of the most stable forms of capital inflows and accounts for one quarter of

total foreign investment into Australia.

Australia's Investment by Type 2015

(a) Includes financial derivatives, loans, trade credit, currency and deposits.

Based on ABS catalogue 5352.0.

In 2015, Australia's total FDI stock increased by 7.2 per cent. The flow of

new FDI into Australia in 2015 decreased by $38.7 billion or 24.7 per cent,

to $117.9 billion, reflecting the slowing of the mining investment boom

and heightened international competition for investment amidst subdued

global growth.

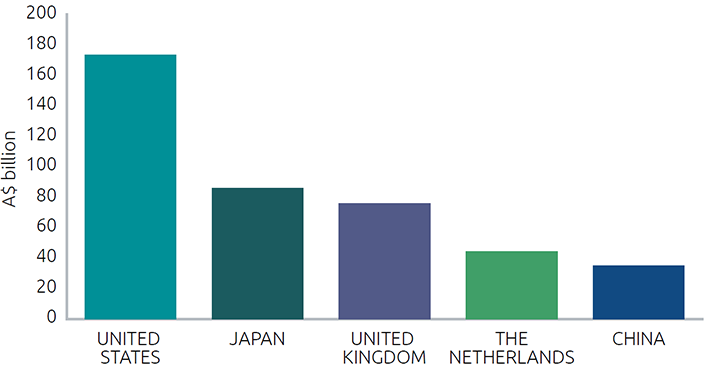

Australia's Foreign Direct Investment Sources 2015

Based on ABS catalogue 5352.0.

Foreign direct investment plays a critical role in

Australia's economy, providing businesses with the capital

they need to grow and prosper. It contributes to the

development of new industries, securing the jobs of today

and creating jobs of the future.– Steven Ciobo, Minister for Trade, Tourism and Investment

Australia's Inward Foreign Direct Investment Global Ranking 2015

| How we compare with the rest of the world (US$ billion) | ||||

|---|---|---|---|---|

| Rank | Country | 2015 | % change | % share |

| 1 | United States | 5,588 | 3.7 | 22.4 |

| 2 | Hong Kong(a) | 1,573 | 4.4 | 6.3 |

| 3 | United Kingdom | 1,457 | -16.4 | 5.8 |

| 4 | China | 1,221 | 12.5 | 4.9 |

| 5 | Germany | 1,121 | 2.9 | 4.5 |

| 6 | Singapore | 978 | 1.6 | 3.9 |

| 7 | Switzerland | 833 | 9.0 | 3.3 |

| 8 | France | 772 | 5.9 | 3.1 |

| 9 | Canada | 756 | -20.8 | 3.0 |

| 10 | The Netherlands | 707 | -1.2 | 2.8 |

| 11 | British Virgin Islands | 611 | 9.2 | 2.4 |

| 12 | Australia | 537 | -4.5 | 2.2 |

| 13 | Spain | 533 | -9.9 | 2.1 |

| 14 | Brazil | 486 | -21.0 | 1.9 |

| 15 | Belgium | 469 | -1.6 | 1.9 |

| World inward stock | 24,983 | -0.5 | ||

(a) Special Administrative Region of China.

Source: UNCTADstat database.

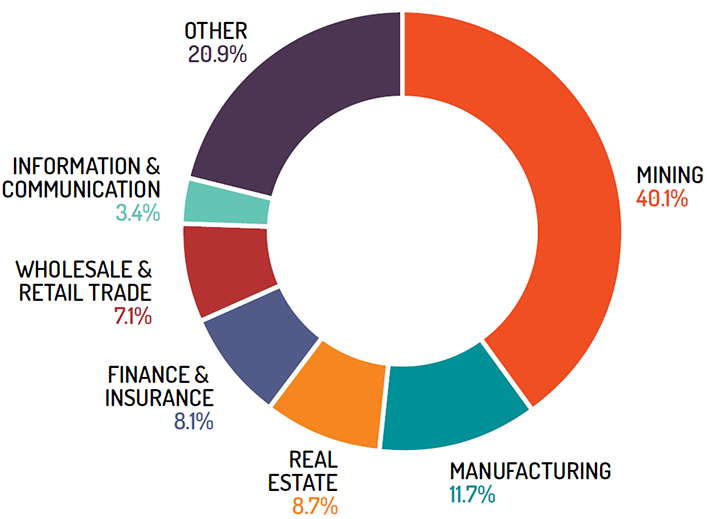

Australia's Foreign Direct Investment by Industry 2015

In 2015, FDI in real estate activities grew 36.8 per cent or $17.2 billion,

finance and insurance rose 20.5 per cent or $10.1 billion, mining and

other investment both recorded growth of 6.4 per cent or $17.8 billion

and $9.2 billion respectively. FDI in information and communication

grew 1.5 per cent or $0.4 billion, manufacturing increased 1.1 per

cent or $0.9 billion while investment in wholesale and retail trade fell

10.8 per cent or $6.3 billion.

FDI benefits Australia by:

- creating new employment opportunities – foreign companies setting

up subsidiaries and creating new businesses in Australia boost jobs

and build economic growth - helping drive productivity growth – through increased competition

in the market - facilitating access to new technologies – foreign companies often

transfer technology to Australia when they invest, making us more

innovative and internationally competitive, and - providing revenue to the government – profits of foreign-owned

companies are taxed, spreading the benefits of these investments to

all Australians.

A myriad of studies have examined the impact of foreign investment in

Australia. For example, a 2015 Economist Intelligence Unit(a) study found

that for every billion dollars of foreign investment in Australia, 1,000 jobs

were created. Similarly, a 2010 study by Access Economics(b) showed that

a ten per cent increase in foreign investment in Australia translates to a

growth in real GDP by 1.2 per cent, employment by 0.33 per cent and real

wages by 1.06 per cent.

(a) See Research note: The impact of foreign direct investment on employment in

Australia, The Economist Intelligence Unit 2015.

(b) See Report in Foreign Attraction: Building on Our Advantages through Foreign

Investment, Business Council of Australia 2010.