Australian Government Department of Foreign Affairs and Trade, 2009

Download

Trade at a Glance 2009 [PDF 436 KB]

Minister for Trade's Foreword

Welcome to 'Trade at a Glance 2009', a concise summary of Australia's

trade performance that underlines the vital contribution that trade makes

to Australia's prosperity.

Trade is a stimulus to growth. It expands the

global economy, creates wealth and lifts living standards around the world.

While international trade has been affected by the global economic crisis,

it has on average been steadily expanding for the past 30 years.

Trade

creates jobs, lifts incomes and encourages business to become more innovative.

It gives consumers a greater choice of products at competitive prices and

offers firms more options when sourcing production inputs.

Australia is

part of a global trading system that is governed by the rules of the World

Trade Organization (WTO). These rules aim to create an open, fair and transparent

trading regime for all countries, including developing countries.

Australia

is committed not only to supporting the WTO, but also working with APEC

and our regional partners through free trade agreements and other mechanisms

to open markets and further boost the flow of trade.

I hope you find 'Trade

at a Glance 2009' to be a valuable trade resource.

Simon Crean

Trade Performance at a Glance

Profile of Australian Trade

Australia has a diverse export base and is a major exporter of food, resources, fuels and education. In 2008, Australia's two-way trade totalled $561 billion, up from $456 billion in 2007.

Japan, China, the United States and Singapore were the nation's top four trading partners in 2008. About 70 per cent of Australia's trade was with the member economies of the Asia-Pacific Economic Cooperation (APEC) forum.

Australia is an active and successful global trader of goods and services.

| ($ billion) | |

|---|---|

| Coal | 46.4 |

| Iron ore & concentrates | 30.2 |

| Education services (b) | 15.5 |

| Gold (c) | 14.7 |

| Personal travel (excl education) services | 11.7 |

| Crude petroleum | 10.4 |

| Natural gas | 9.1 |

| Professional, technical & other business services | 6.5 |

| Aluminium ores & conc (incl alumina) | 6.5 |

| Aluminium | 5.8 |

| Beef, fresh, chilled or frozen (f.c.f) | 5.0 |

| Other transportation services (d) | 4.6 |

| Other ores & concentrates | 4.2 |

| Copper ores & concentrates | 4.2 |

| Passenger transportation services (e) | 4.0 |

| Wheat | 3.8 |

| Passenger motor vehicles | 3.7 |

| Medicaments (incl veterinary) | 3.6 |

| Copper | 3.5 |

| Refined petroleum | 3.5 |

| Total exports (f) | 227.9 |

- Goods trade are on a recorded trade basis.

Services trade are on a BOP (BOP) basis. - Includes Education-related travel and Other education services.

- BOP basis.

- Other transportation services exports covers a range of services

provided in Australian airports and ports, including cargo and baggage handling services, agents fees associated with passenger and freight transportation and airport and port charges. - Includes related agency fees and commissions.

- Total exports on a BOP basis.

Sources: ABS trade data on DFAT STARS database and ABS catalogue 5368.0.

Australia's Trade Performance

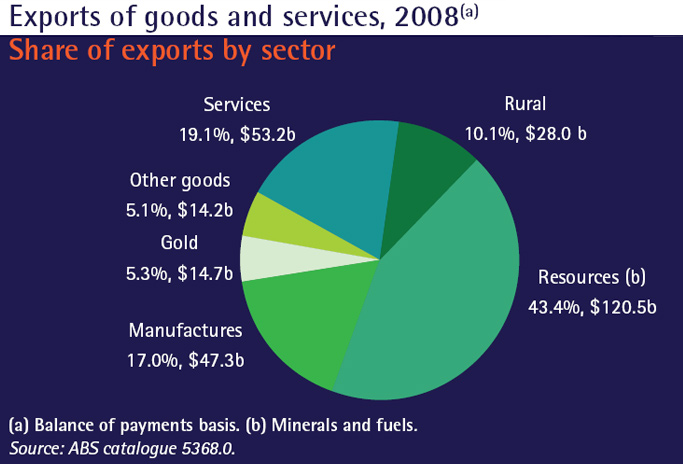

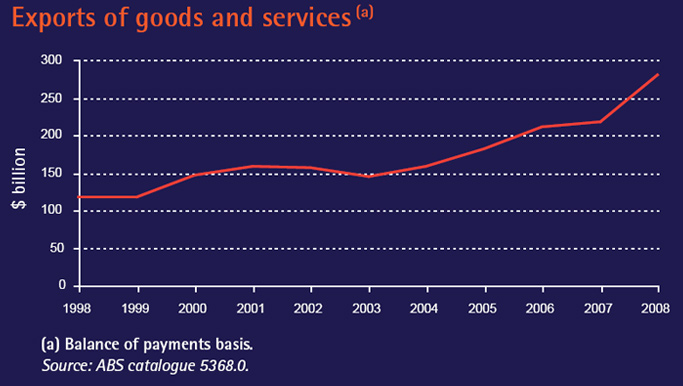

Australian exports of goods and services grew 27.6 per cent in 2008, to

$278 billion. The strong growth was led by resources exports which were

in very high demand, reaching $121.2 billion. Education services exports

rose 23 per cent to $15.5 billion and around two-thirds of Australia's farm

production was exported.

Imports increased 18.9 per cent to $283 billion.

Strong consumer demand, high oil prices and imports of capital goods by

business contributed to this growth in the first nine months of the year.

The fall in the value of the Australian dollar from a peak of 97 US cents

in July 2008 to below 70 US cents at the end of the year also increased

the value (in Australian dollar terms) of imports priced in foreign currencies.

The Australian Economy

Australia's economic fundamentals are strong and the Government is committed

to responsible economic management. The global financial crisis, which intensified

in mid-September 2008 and has resulted in the worst global recession since

WWII, is posing unique challenges for the Australian economy.

- Despite the global economy being in deep recession, Australia is

performing better than most other advanced economies. - Strong financial

institutions and sound regulatory frameworks

have enhanced Australia's ability to weather the global financial crisis. - Despite

the worsening of the global financial crisis, in the last

quarter of 2008 Australia had recorded 17 successive years of growth. - Australia

has an independent central bank. - Australia has one of the most multilingual

workforces in the

Asia-Pacific region.

| Goods(a) | $ million | % share |

|---|---|---|

| Coal | 46,403 | 20.6 |

| Iron ore & concentrates | 30,221 | 13.4 |

| Gold (b) | 14,702 | 6.5 |

| Crude petroleum | 10,360 | 4.6 |

| Natural gas | 9,053 | 4.0 |

| Aluminium ores & conc (incl alumina) | 6,467 | 2.9 |

| Aluminium | 5,794 | 2.6 |

| Beef, fresh, chilled or frozen (f.c.f) | 4,969 | 2.2 |

| Other ores & concentrates | 4,221 | 1.9 |

| Copper ores & concentrates | 4,194 | 1.9 |

| Wheat | 3,792 | 1.7 |

| Passenger motor vehicles | 3,716 | 1.7 |

| Medicaments (incl veterinary) | 3,578 | 1.6 |

| Copper | 3,506 | 1.6 |

| Refined petroleum | 3,479 | 1.5 |

| Alcoholic beverages (mainly wine) | 2,615 | 1.2 |

| Wool & other animal hair (incl tops) | 2,284 | 1.0 |

| Meat (excl beef) | 2,135 | 1.0 |

| Nickel ores & concentrates | 1,679 | 0.7 |

| Milk & cream | 1,541 | 0.7 |

| Total goods exports (b) | 224,718 | 100.0 |

(a) Recorded trade basis.

(b) BOP basis.

(c) Also including veterinary medicines.

Sources: ABS trade data on DFAT STARS database and ABS catalogue 5368.0.

| $ million | % share | |

|---|---|---|

| Transportation | ||

| Passenger (b) | 3,991 | 7.5 |

| Freight | 666 | 1.3 |

| Other (b)(c) | 4,583 | 8.6 |

| Total transportation | 9,240 | 17.4 |

| Travel | ||

| Business | 2,736 | 5.1 |

| Personal | 26,663 | 50.1 |

| Education-related | 15,002 | 28.2 |

| Other personal (d) | 11,661 | 21.9 |

| Total travel | 29,399 | 55.3 |

| Other | ||

| Communication (e) | 924 | 1.7 |

| Construction | 82 | 0.2 |

| Insurance | 738 | 1.4 |

| Financial | 1,055 | 2.0 |

| Computer and information | 1,673 | 3.1 |

| Royalties and licence fees | 817 | 1.5 |

| Other business services | 7,655 | 14.4 |

| Personal, cultural and recreational | 780 | 1.5 |

| Government services, nie | 848 | 1.6 |

| Total other services | 14,572 | 27.4 |

| Total services exports | 53,202 | 100.0 |

(a) BOP basis.

(b) Passenger services include air transport-related agency fees and commissions.

(c) Transportation operation lease fees are included.

(d) Inbound tourism for mainly recreational purposes.

(e) Communications services include other services nie (not included elsewhere).

Source: ABS catalogue 5368.0.

| Goods(a) | $ million | % share |

|---|---|---|

| Crude petroleum | 17,905 | 7.8 |

| Refined petroleum | 15,061 | 6.6 |

| Passenger motor vehicles | 14,751 | 6.4 |

| Gold | 9,732 | 4.2 |

| Telecom equipment & parts | 6,902 | 3.0 |

| Medicaments (incl veterinary) | 6,800 | 3.0 |

| Goods vehicles | 6,587 | 2.9 |

| Computers | 5,818 | 2.5 |

| Civil engineering equipment & parts | 4,165 | 1.8 |

| Aircraft, spacecraft & parts | 4,159 | 1.8 |

| Monitors, projectors & TVs | 3,019 | 1.3 |

| Measuring & analysing instruments | 2,891 | 1.3 |

| Furniture, mattresses & cushions | 2,802 | 1.2 |

| Prams, toys, games & sporting goods | 2,753 | 1.2 |

| Vehicle parts & accessories | 2,745 | 1.2 |

| Electrical machinery & parts, nie | 2,468 | 1.1 |

| Fertilisers (excl crude) | 2,251 | 1.0 |

| Mechanical handling equip & parts | 2,160 | 0.9 |

| Specialised machinery & parts | 2,146 | 0.9 |

| Heating & cooling equipment & parts | 2,122 | 0.9 |

| Total goods imports (b) | 229,407 | 100.0 |

(a) Recorded trade basis.

(b) BOP basis

Sources: ABS trade data on DFAT STARS database and ABS catalogue 5368.0.

| $ million | % share | |

|---|---|---|

| Transportation | ||

| Passenger | 7,214 | 13.4 |

| Freight | 9,753 | 18.1 |

| Other | 572 | 1.1 |

| Total transportation | 17,539 | 32.6 |

| Travel | ||

| Business | 3,111 | 5.8 |

| Personal | 15,629 | 29.1 |

| Education-related | 894 | 1.7 |

| Other personal (b) | 14,735 | 27.4 |

| Total travel | 18,740 | 34.8 |

| Other | ||

| Communication (c) | 1,162 | 2.2 |

| Construction | 0 | 0.0 |

| Insurance | 952 | 1.8 |

| Financial | 632 | 1.2 |

| Computer and information | 1,544 | 2.9 |

| Royalties and licence fees | 3,554 | 6.6 |

| Other business services | 7,372 | 13.7 |

| Personal, cultural and recreational | 1,439 | 2.7 |

| Government services, nie | 848 | 1.6 |

| Total other services | 17,503 | 32.5 |

| Total services imports | 53,783 | 100.0 |

(a) BOP basis.

(b) Inbound tourism for mainly recreational purposes.

(c) Communications services include other services (nie)

Source: ABS catalogue 5368.0.

| Goods(a) | Services(b) | Total(c) | % share | ||

|---|---|---|---|---|---|

| 1 | Japan | 71.0 | 5.0 | 76.0 | 13.6 |

| 2 | China | 67.6 | 6.2 | 73.8 | 13.2 |

| 3 | United States | 38.8 | 15.9 | 54.7 | 9.8 |

| 4 | Singapore | 22.3 | 8.7 | 31.0 | 5.5 |

| 5 | United Kingdom | 19.3 | 9.2 | 28.4 | 5.1 |

| 6 | Republic of Korea | 24.8 | 2.4 | 27.2 | 4.9 |

| 7 | New Zealand | 16.9 | 6.0 | 22.9 | 4.1 |

| 8 | India | 15.3 | 3.6 | 18.9 | 3.4 |

| 9 | Thailand | 15.5 | 2.8 | 18.3 | 3.3 |

| 10 | Germany | 13.4 | 2.2 | 15.7 | 2.8 |

| Total two-way trade (b) | 453.8 | 107.0 | 560.8 | 100.0 | |

| of which: | APEC | 320.9 | 60.9 | 381.9 | 68.1 |

| ASEAN | 70.7 | 18.2 | 88.9 | 15.8 | |

| EU27 | 71.0 | 20.3 | 91.3 | 16.3 | |

| OECD | 233.1 | 53.7 | 286.8 | 51.1 | |

(a) Recorded trade basis.

(b) BOP basis.

(c) Total may not sum due to rounding.

Sources: ABS trade data on DFAT STARS database and ABS catalogue 5368.0.

How we compare to the rest of the world 2008 (US$b)

(a) Recorded trade basis.

(b) Commercial services on BOP basis.

Sources: WTO online database and EIU Viewswire.

| Goods(a) | Services(b) | Total(c) | % share | ||

|---|---|---|---|---|---|

| 1 | Japan | 50.8 | 2.4 | 53.2 | 19.1 |

| 2 | China | 32.3 | 4.7 | 37.1 | 13.3 |

| 3 | Republic of Korea | 18.4 | 1.8 | 20.2 | 7.3 |

| 4 | United States | 12.1 | 6.1 | 18.3 | 6.6 |

| 5 | India | 13.5 | 3.0 | 16.5 | 5.9 |

| 6 | United Kingdom | 9.3 | 4.8 | 14.1 | 5.1 |

| 7 | New Zealand | 9.3 | 3.4 | 12.8 | 4.6 |

| 8 | Singapore | 6.1 | 3.9 | 10.1 | 3.6 |

| 9 | Taiwan | 8.3 | 0.5 | 8.7 | 3.1 |

| 10 | Thailand | 5.3 | 1.0 | 6.3 | 2.3 |

| Total exports (b) | |||||

| 224.7 | 53.2 | 277.9 | 100.0 | ||

| of which: | APEC | 162.4 | 30.7 | 193.1 | 69.5 |

| ASEAN | 22.9 | 8.5 | 31.4 | 11.3 | |

| EU27 | 23.5 | 9.0 | 32.5 | 11.7 | |

| OECD | 117.7 | 24.5 | 142.2 | 51.2 | |

(a) Recorded trade basis.

(b) BOP basis.

(c) Total may not sum due to rounding.

Sources: ABS trade data on DFAT STARS database and ABS catalogue 5368.0.

| Rank | Country | Goods(a) | Services(b) | Total | % share |

|---|---|---|---|---|---|

| 1 | United States | 2,166 | 364 | 2,530 | 12.7 |

| 2 | Germany | 1,206 | 285 | 1,491 | 7.5 |

| 3 | China | 1,133 | 154 | 1,287 | 6.5 |

| 4 | Japan | 762 | 166 | 928 | 4.7 |

| 5 | France | 708 | 137 | 845 | 4.2 |

| 6 | United Kingdom | 632 | 199 | 831 | 4.2 |

| 7 | Italy | 556 | 132 | 689 | 3.5 |

| 8 | Netherlands | 574 | 92 | 666 | 3.3 |

| 9 | Belgium | 470 | 84 | 554 | 2.8 |

| 10 | Republic of Korea | 435 | 93 | 528 | 2.7 |

| 11 | Spain | 402 | 108 | 510 | 2.6 |

| 12 | Canada | 418 | 84 | 503 | 2.5 |

| 13 | Hong Kong (SAR of China) | 393 | 44 | 437 | 2.2 |

| 14 | Singapore | 320 | 76 | 396 | 2.0 |

| 15 | Russian Federation | 292 | 75 | 367 | 1.8 |

| 16 | Mexico | 323 | 25 | 348 | 1.7 |

| 17 | India | 292 | 53 | 344 | 1.7 |

| 18 | Taiwan | 240 | 34 | 274 | 1.4 |

| 19 | Australia | 200 | 45 | 246 | 1.2 |

| 20 | Poland | 204 | 30 | 234 | 1.2 |

| 21 | Brazil | 183 | 44 | 227 | 1.1 |

| 22 | Austria | 184 | 42 | 226 | 1.1 |

| 23 | Thailand | 179 | 46 | 225 | 1.1 |

| 24 | Sweden | 167 | 54 | 221 | 1.1 |

| 25 | Switzerland | 183 | 37 | 220 | 1.1 |

| 26 | Turkey | 202 | 16 | 218 | 1.1 |

| 27 | United Arab Emirates | 159 | 36 | 195 | 1.0 |

| 28 | Malaysia | 157 | 29 | 186 | 0.9 |

| 29 | Ireland | 83 | 103 | 186 | 0.9 |

| 30 | Denmark | 112 | 62 | 175 | 0.9 |

| Total imports | 16,415 | 3,469 | 19,884 | ||

(a) Recorded trade basis.

(b) Commercial services on BOP basis.

Sources: WTO online database and EIU Viewswire.

| Goods(a) | Services(b) | Total(c) | % share | ||

|---|---|---|---|---|---|

| 1 | China | 35.3 | 1.4 | 36.7 | 13.0 |

| 2 | United States | 26.7 | 9.8 | 36.5 | 12.9 |

| 3 | Japan | 20.2 | 2.6 | 22.8 | 8.1 |

| 4 | Singapore | 16.2 | 4.8 | 21.0 | 7.4 |

| 5 | United Kingdom | 10.0 | 4.4 | 14.4 | 5.1 |

| 6 | Germany | 11.4 | 1.2 | 12.6 | 4.4 |

| 7 | Thailand | 10.2 | 1.8 | 12.0 | 4.2 |

| 8 | New Zealand | 7.6 | 2.6 | 10.2 | 3.6 |

| 9 | Malaysia | 9.0 | 1.0 | 10.0 | 3.5 |

| 10 | Republic of Korea | 6.4 | 0.6 | 7.0 | 2.5 |

| Total imports(b) | |||||

| 229.4 | 53.8 | 283.2 | 100.0 | ||

| of which: | APEC | 158.5 | 30.2 | 188.7 | 66.6 |

| ASEAN | 47.7 | 9.7 | 57.4 | 20.3 | |

| EU27 | 47.5 | 11.3 | 58.7 | 20.7 | |

| OECD | 115.4 | 29.2 | 144.6 | 51.0 | |

(a) Recorded trade basis.

(b) BOP basis.

(c) Total may not sum due to rounding.

Sources: ABS trade data on DFAT STARS database and ABS catalogue 5368.0.

| Country | Level of direct investment in Australia | Level of total investment in Australia | |

|---|---|---|---|

| United Kingdom | 60,373 | 427,070 | |

| United States | 95,417 | 418,445 | |

| Japan | 35,959 | 89,511 | |

| Hong Kong (SAR of China) | 9,465 | 56,317 | |

| Singapore | 10,103 | 43,050 | |

| Switzerland | 19,509 | 38,133 | |

| Germany | 13,738 | 36,272 | |

| Netherlands | 25,085 | 32,901 | |

| France | 13,406 | 28,936 | |

| New Zealand | 5,362 | 27,061 | |

| Total all countries | 392,862 | 1,724,444 | |

| of which: | APEC | 176,328 | 685,644 |

| ASEAN | 15,435 | 58,271 | |

| EU27 | 133,243 | 567,457 | |

| OECD | 302,238 | 1,161,237 | |

(a) Foreign investment in Australia: level

of investment (stocks) as at 31 December 2008, by selected country and

country group.

Source: ABS catalogue 5352.0.

| Country | Level of direct investment abroad | Total Australian investment abroad | |

|---|---|---|---|

| United States | 121,435 | 394,614 | |

| United Kingdom | 23,002 | 158,079 | |

| New Zealand | 34,407 | 66,121 | |

| Canada | 27,910 | 38,848 | |

| France | 333 | 35,395 | |

| Netherlands | 5,647 | 30,020 | |

| Japan | 1,112 | 29,108 | |

| Germany | 7,942 | 24,390 | |

| Singapore | 6,726 | 21,994 | |

| Hong Kong (b) | 5,847 | 20,141 | |

| Total all countries | 281,064 | 1,010,642 | |

| of which: | APEC | 213,591 | 606,356 |

| ASEAN | 13,750 | 34,437 | |

| EU27 | 42,615 | 304,046 | |

| OECD | 231,638 | 829,088 | |

(a)Australian investment abroad: level of

investment (stocks) as at 31 December 2008,

by selected country and country group.

Source: ABS catalogue 5352.0.

| Gross value added(a) | Employed persons(b) | |||

|---|---|---|---|---|

| ($m) | %share(c) | ('000) | % share | |

| Agriculture, forestry and fishing | 25,386 | 2.5 | 371.6 | 3.5 |

| Mining | 84,585 | 8.4 | 180.3 | 1.7 |

| Manufacturing | 106,634 | 10.6 | 1,066.9 | 10.1 |

| Services | ||||

| Electricity, gas and water | 22,225 | 2.2 | 108.6 | 1.0 |

| Construction | 79,300 | 7.9 | 984.5 | 9.3 |

| Wholesale trade | 49,296 | 4.9 | 442.8 | 4.2 |

| Retail trade | 59,198 | 5.9 | 1,532.2 | 14.4 |

| Accommodation, cafes and restaurants | 20,228 | 2.0 | 515.9 | 4.9 |

| Transport and storage | 51,719 | 5.1 | 528.5 | 5.0 |

| Communication services | 26,726 | 2.7 | 198.7 | 1.9 |

| Finance and insurance | 80,463 | 8.0 | 383.8 | 3.6 |

| Property and business services | 131,616 | 13.1 | 1,291.4 | 12.2 |

| Government administration and defence | 40,863 | 4.1 | 486.4 | 4.6 |

| Education | 44,000 | 4.4 | 763.5 | 7.2 |

| Health and community services | 63,749 | 6.3 | 1,136.6 | 10.7 |

| Cultural and recreational services | 16,352 | 1.6 | 282.6 | 2.7 |

| Personal and other services | 20,067 | 2.0 | 413.5 | 3.9 |

| Total services | 705,802 | 70.1 | 9,069.2 | 85.5 |

| Ownership of dwellings | 84,565 | 8.4 | ||

| Gross value added at basic prices (d) | 1,006,972 | 100.0 | ||

| Taxes less subsidies on products | 84,111 | |||

| Statistical discrepancy (e) | -1,354 | |||

| Total (d) | 1,089,728 | 10,608 | 100.0 | |

(a) The term is used to describe gross product

by industry and by sector (Chain Volume Measures reference year 2006-07).

(b) Derived from seasonally adjusted data.

(c) As a share of GDP at basic prices.

(d) Basic prices are amounts received by producers, including the value of

any subsidies on products, but before any taxes on products. GDP at

purchasers' (market) prices is derived by adding Taxes less subisidies

on products to Gross value added at basic prices.

(e) Production approach.

Sources: ABS catalogues 5206.0, 6202.0 and 6203.0.

| 1998 | 2006 | 2007 | 2008 | ||

|---|---|---|---|---|---|

| Demand and production – chain volume measures, reference year 2006-07 |

|||||

| Gross domestic product (a) | % change | 5.1 | 2.6 | 4.2 | 2.0 |

| Exports of goods & services (a) | % change | 0.1 | 3.3 | 3.2 | 4.7 |

| Imports of goods & services (a) | % change | 6.5 | 7.3 | 11.8 | 10.5 |

| Labour force | |||||

| Population (b) | '000 | 18,814 | 20,874 | 21,238 | 21,543(e) |

| Labour force (c) | '000 | 9,375 | 10,910 | 11,144 | 11,319 |

| Employed persons (c) | '000 | 8,688 | 10,413 | 10,671 | 10,808 |

| - Annual growth | % | 2.0 | 3.3 | 2.5 | 1.3 |

| Unemployment rate (c) | % | 7.3 | 4.6 | 4.2 | 4.5 |

| Prices and interest rates | |||||

| Consumer prices | % change | 1.6 | 3.3 | 3.0 | 3.7 |

| Interest rates - 90 day bills (d) | % pa | 5.0 | 6.0 | 6.7 | 7.0 |

(a) Derived from annual movements in original data.

(b) At end of period.

(c) Derived from seasonally adjusted data.

(d) Annual average.

(e) September 2008 data.

Sources: Australian Bureau of Statistics and Reserve Bank, various catalogues.

Australia's Trade and Economic Statistics

Agriculture

- Australia exports around two-thirds of its total farm production.

- Agricultural products(a), including food and beverages, accounted

for 11.1 per cent of Australia's exports in 2008. - Most Australian agriculture tariffs are applied at rates between

zero and five per cent

| Rank | Commodity | $ million | % share |

|---|---|---|---|

| 1 | Beef | 4,969 | 16.0 |

| 2 | Wheat | 3,792 | 12.2 |

| 3 | Wine | 2,510 | 8.1 |

| 4 | Wool & other animal hair (incl tops) | 2,284 | 7.4 |

| 5 | Meat (excl beef) | 2,135 | 6.9 |

| 6 | Milk & cream | 1,541 | 5.0 |

| 7 | Barley | 1,245 | 4.0 |

| 8 | Wood in chips or particles | 1,146 | 3.7 |

| 9 | Live animals (excl seafood) | 1,119 | 3.6 |

| 10 | Animal feed | 1,106 | 3.6 |

| 11 | Cheese & curd | 904 | 2.9 |

| 12 | Cereal preparations | 741 | 2.4 |

| 13 | Crustaceans | 732 | 2.4 |

| 14 | Hides & skins, raw (excl furskins) | 718 | 2.3 |

| 15 | Vegetables | 600 | 1.9 |

| 16 | Fruit & nuts | 574 | 1.9 |

| 17 | Edible products & preparations | 505 | 1.6 |

| 18 | Cotton | 449 | 1.4 |

| 19 | Oil-seeds & oleaginous fruits, soft | 401 | 1.3 |

| 20 | Animal oils & fats | 393 | 1.3 |

| Total agricultural exports | 30,984 | 100.0 | |

(a) Based on the WTO definition of agriculture, which includes alcoholic

beverages but excludes confidential raw sugar in bulk. Data for

confidential raw sugar in bulk are released with a six-month lag. In

2006-07, raw sugar in bulk exports totalled $958 million.

(b) Recorded trade basis.

Sources: ABS trade data on DFAT STARS database.

Minerals and fuels

- this was Australia's largest export sector in 2008 – at $120.5 billion

it accounted for 43.4 per cent of total exports. Coal and Iron ore were

the top two resources exports. - Japan and China were Australia's leading export markets for minerals

and fuels. - Almost all applied tariffs on mining and energy products in Australia

are between zero and five per cent.

| Rank | Commodity(a) | $ million | % share |

|---|---|---|---|

| 1 | Coal | 46,403 | 38.5 |

| 2 | Iron ore & concentrates | 30,221 | 25.1 |

| 3 | Crude petroleum | 10,360 | 8.6 |

| 4 | Natural gas | 9,053 | 7.5 |

| 5 | Aluminium ores & conc (incl alumina) | 6,467 | 5.4 |

| 6 | Other ores & concentrates | 4,221 | 3.5 |

| 7 | Copper ores & concentrates | 4,194 | 3.5 |

| 8 | Refined petroleum | 3,479 | 2.9 |

| 9 | Nickel ores & concentrates | 1,679 | 1.4 |

| 10 | Liquefied propane & butane | 1,220 | 1.0 |

| 11 | Confidential mineral ores | 1,206 | 1.0 |

| 12 | Ferrous waste & scrap | 822 | 0.7 |

| 13 | Uranium or thorium ores & conc | 736 | 0.6 |

| 14 | Non-ferrous waste & scrap | 722 | 0.6 |

| 15 | Coke & semi-coke | 245 | 0.2 |

| 16 | Crude minerals, nes | 229 | 0.2 |

| 17 | Precious metal ores & conc (excl gold) | 132 | 0.1 |

| 18 | Stone, sand & gravel | 116 | 0.1 |

| 19 | Natural abrasives | 48 | 0.0 |

| 20 | Residual petroleum products, nie | 19 | 0.0 |

| Total minerals and fuels exports(b) | 120,526 | 100.0 | |

(a) Recorded trade basis.

Sources: ABS trade data on DFAT STARS database and ABS catalogue 5368.0.

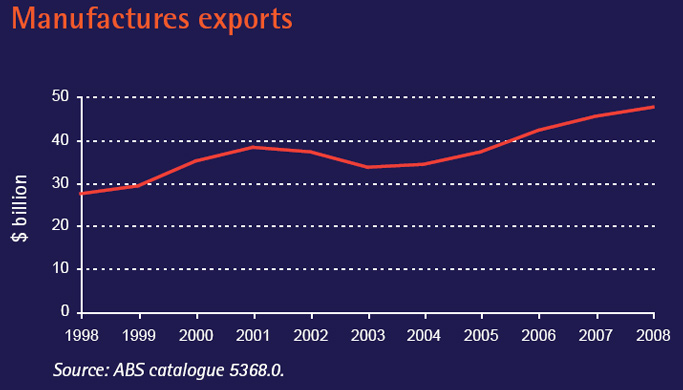

Manufacturing

- About 65 per cent

of Australia's manufactured exports are Elaborately transformed manufactures

- worth $31 billion. - Australian exports

of Simply transformed manufactures (mainly processed metals) were in demand

in North Asia and were valued at $16 billion. - the manufacturing

sector accounted for 17 per cent of Australia's total exports in 2008. - Australia's applied tariffs on manufactures are almost all either

five per cent or zero, with the main exceptions being:- Passenger motor vehicles and automotive parts and components, for

which tariffs are currently 10 per cent, but are scheduled to fall to

five per cent in 2010. - Textiles, clothing and footwear, which currently range from five

percent to 17.5 per cent and are scheduled to fall to five per cent

(by either 2010 or 2015 depending on the product).

- Passenger motor vehicles and automotive parts and components, for

| Rank | Commodity(a) | $ million | % share |

|---|---|---|---|

| 1 | Aluminium | 5,794 | 12.3 |

| 2 | Passenger motor vehicles | 3,716 | 7.9 |

| 3 | Medicaments (incl veterinary) | 3,578 | 7.6 |

| 4 | Copper | 3,506 | 7.4 |

| 5 | Lead | 1,129 | 2.4 |

| 6 | Medical instruments (incl veterinary) | 1,109 | 2.3 |

| 7 | Zinc | 1,045 | 2.2 |

| 8 | Aircraft, spacecraft & parts | 1,010 | 2.1 |

| 9 | Uncoated flat-rolled iron & steel | 991 | 2.1 |

| 10 | Measuring & analysing instruments | 913 | 1.9 |

| 11 | Telecom equipment & parts | 898 | 1.9 |

| 12 | Civil engineering equipment & parts | 791 | 1.7 |

| 13 | Specialised machinery & parts | 752 | 1.6 |

| 14 | Vehicle parts & accessories | 677 | 1.4 |

| 15 | Fertilisers (excl crude) | 649 | 1.4 |

| 16 | Internal combustion piston engines | 618 | 1.3 |

| 17 | Nickel | 605 | 1.3 |

| 18 | Pigments, paints & varnishes | 563 | 1.2 |

| 19 | Starches, inulin & wheat gluten | 558 | 1.2 |

| 20 | Paper & paperboard | 554 | 1.2 |

| Total manufactures exports(b) | 47,260 | 100.0 | |

(a) Recorded trade basis.

(b)Total manufactures exports on a BOP basis.

Source: ABS trade data on DFAT STARS database and ABS catalogue 5368.0.

Services

- Services

accounted for 19.1 per cent of Australia's total exports in 2008 at $53

billion. - Education

was Australia's largest services export, more than 543,898 international

students were enrolled in Australia in 2008. - the

United States, the United Kingdom and China are Australia's top export

markets for services.

The details of Australia's services exports are set out here.

Trade Policy at a Glance

Australia's Trade Policy

A Strong, Prosperous and Outward Looking Nation

Trade is vital to Australia's economy and the prosperity of its people.

Australia's

trade policy aims to open new markets, reduce barriers to trade and

improve market access for Australian goods and services. The Government

is also working to improve competition, innovation and productivity

behind the border. Australia is committed to full participation in the

global economy and supports an open, transparent and rules-based global

trading system.

The Government is pursuing improved market

access for Australian exporters in global markets through multilateral

trade negotiations in the World Trade Organization (WTO).

At

a regional level, the Government actively engages with the Asia-Pacific

Economic Cooperation (APEC) forum and the Association of South East

Asian Nations (ASEAN).

The Australian Government also

undertakes bilateral negotiations with key trading partners through

comprehensive Free Trade Agreements.

The international trading regime of the WTO is open, equitable and enforceable.

the WTO's dispute settlement system is central to that regime. It gives

member countries and exporters confidence that the commitments and obligations

contained in the WTO agreements will be respected. Regional fora (APEC

and ASEAN) and comprehensive bilateral agreements provide exporters with

further rules-based systems and a more open, fair and predictable trading

environment in which to operate.

For more information on Australia's trade policy visit: www.dfat.gov.au/trade

Trade and the Global Recession

World trade has been adversely affected by the global recession, with trade

volumes experiencing the largest falls since the end of WWII. East Asian

economies have been particularly affected by the fall in trade flows because

exports make up a large proportion of their economies.

the Government considers that keeping trade flows open by resisting protectionism

and continuing to liberalise international trade are important parts of the

solution to the economic downturn.

At the G20 Leaders' meeting in London in April 2009, governments from

the twenty largest economies in the world agreed not to engage in protectionist

measures until the end of 2010. G20 Leaders also agreed to promptly notify

the WTO of protectionist measures taken. they endorsed the WTO's recent initiative

to monitor and report on the impact of the financial crisis on the trade

policies and trade finance of its members. the Australian Government supports

the WTO in this important monitoring role.

the G20 Leaders also re-committed to reaching an ambitious and balanced

conclusion to the WTO Doha Round of trade negotiations (see over). In addition,

a new $250 billion trade finance facility will be established to assist the

restoration of normal trade flows involving developing countries.

Australia and the WTO

As a founding member of both the WTO in 1995 and its predecessor, the

General Agreement of Tariffs and Trade (GATT) in 1947, Australia has a

longstanding commitment to the multilateral trading system operated by the

WTO. This system provides the legal framework governing world trade. WTO

Members agree on legally binding rules governing trade providing important

legal certainty for their exporters.

The Australian Government's key trade policy priority is a successful conclusion

to the WTO Doha Round of trade negotiations, launched in Doha, Qatar, in

November 2001. It seeks real improvements in market access for Australian

exports across all negotiating sectors – agriculture, industrials and services.

For more information on Australia's participation in the WTO visit: www.dfat.gov.au/trade/negotiations

The Doha Round has a strong development focus. It aims to improve developing

countries' market access, reduce agricultural subsidies and increase global

Aid for Trade. Aid for Trade refers to development assistance that addresses

trade-related needs (such as policy, infrastructure and productive capacity)

to help increase developing country participation in trade and support

economic growth. Australia's Aid for Trade represents a large component

of the overall aid program – about 10% – and is expected to reach around $400

million in 2009-10. Aid for Trade is part of the Government's support for

the achievement of the Millennium Development Goals.

For more information on Australia's development

assistance visit:

www.ausaid.gov.au

Agricultural Trade

The Australian Government's goal in the agriculture negotiations of the

Doha

Round is to reform agricultural trade, which is one of the most distorted

and

highly protected sectors of international trade.

As Chair of the Cairns Group, the Australian Government is pushing for

agricultural trade reform through the WTO. In particular, Australia is

pursuing

significant reductions in agricultural tariffs, deep cuts to domestic support

and

tight disciplines on export competition.

- The Cairns Group is a coalition of 19 agricultural exporting countries,

bringing

together a diverse range of developed and developing countries from Latin

America, Africa and the Asia-Pacific region. - The Cairns Group has been an influential voice in the agricultural reform

debate since its formation in 1986 and continues to play a major role

in pressing the WTO membership to meet the Doha Round's far-reaching

mandate.

Members of the Cairns Group

- Argentina

- Australia

- Bolivia

- Brazil

- Canada

- Chile

- Colombia

- Costa Rica

- Guatemala

- Indonesia

- Malaysia

- New Zealand

- Pakistan

- Paraguay

- Peru

- Philippines

- South Africa

- Thailand

- Uruguay

Non-Agricultural Trade

In the Doha Round, the Government is pushing for reductions in tariffs and

other barriers to trade in non-agricultural goods (which include industrial,

forestry and seafood products). these reforms would expand potential markets

for Australian industry.

Non-agricultural trade accounts for around 90 per cent of global trade

in goods. A strong Doha Round outcome would provide a significant boost

to the world economy, with flow-on benefits to Australia.

Services Trade

The Government is working hard to achieve better access for Australia's

services exports which accounted for approximately one fifth of Australia's

total exports in 2008, at $53 billion. In coming years, the services sector

is predicted to be the most strongly growing sector in global trade. Education

and tourism services are Australia's top services exports.

The Doha Round negotiations aim to reduce barriers that services exporters

face in overseas markets by recognising qualifications and standards and

investment rules and regulations relating to the temporary entry of business

people. Given the importance of this sector to the Australian economy, Australia

takes a prominent role in the services negotiations. Australia also promotes

improved services exports through APEC and the negotiation of comprehensive

Free Trade Agreements.

Trade with our region: APEC

Asia-Pacific Economic Cooperation (APEC) is the pre-eminent economic forum

in our region and has delivered major gains to Australia and regional trading

partners through trade liberalisation, business facilitation, and economic

cooperation and technical assistance – the three pillars of APEC.

- APEC has 21 member economies which account for 48 per cent of world trade

and 68 per cent of Australia's total trade. - Together, APEC economies account for 57 per cent of world GDP, and 40

per

cent of the world's population. - Eight of Australia's 10 largest export markets are within APEC, including

our

top three export markets – Japan, China and the United States. - APEC is driving an extensive trade and investment liberalisation and

facilitation agenda, working towards a future Free Trade Area of the

Asia-Pacific. - APEC is increasingly focused on structural economic reform

as a means of

strengthening economies' competitiveness and trade and investment flows.

Members of APEC

- Australia

- Canada

- People's Republic of China

- Indonesia

- Republic of Korea

- Mexico

- Papua New Guinea

- Philippines

- Singapore

- Thailand

- Vietnam

- Brunei Darussalam

- Chile

- Hong Kong, China

- Japan

- Malaysia

- New Zealand

- Peru

- Russia

- Chinese Taipei

- United States

Australia hosted APEC in 2007, with the APEC Economic Leaders' Meeting held

in Sydney in September 2007. Singapore is the 2009 host. The United States

will

be the host in 2010.

For more information on Australia's role in APEC visit:

Free Trade Agreements (FTAs)

Comprehensive bilateral and regional FTAs can enhance the trading

relationship if they are truly liberalising across all sectors and consistent

with WTO rules and complement the multilateral trading system.

Australia has negotiated six FTAs:

- ASEAN-Australia-New Zealand (AANZFTA) 2009

- Australia-Chile Free Trade Agreement (AClFTA) 2009

- Australia-United States Free Trade Agreement (AUSFTA) 2005

- Thailand-Australia Free Trade Agreement (TAFTA) 2005

- Singapore-Australia Free Trade Agreement (SAFTA) 2003

- Australia-New Zealand Closer Economic Relations Trade Agreement (ANZCERTA)

1983

Australia is undertaking FTA negotiations with:

- China

- Japan

- Malaysia

- The Gulf Cooperation Council (Saudi Arabia, Qatar, Bahrain, Oman, Kuwait,

United Arab Emirates) - Republic of Korea

- Trans-Pacific Partnership Agreement

FTAs

In addition, Australia is considering a number of FTAs:

- Australia – India joint FTA feasibility

study, due for completion in 2009 - Australia – Indonesia joint FTA feasibility

study, completed February 2009 - Pacific Agreement on Closer Economic

Relations – PACER Plus

Australia's FTAs aim to:

- Be fully consistent

with WTO principles and rules, deliver WTO-plus outcomes and reinforce the

multilateral trading system - Comprehensively and

substantially liberalise goods and services trade and investment - Deliver substantial

commercial and wider economic benefits to Australia more quickly than would

be possible through multilateral or regional processes - Promote stronger trade

and commercial ties between participating countries, and open up opportunities

for Australian exporters and investors to expand their business into key

markets - Secure Australia's competitiveness with key trading partners

- Significantly enhance Australia's broader economic, foreign policy and strategic interests

More information on Australia's FTAs and negotiations

Information and contacts

Department of Foreign Affairs and Trade (DFAT) - More information on trade policy and statistics.

Australian Trade Commission (Austrade) - For information on the range of services available to new and existing exporters visit: www.austrade.gov.au or contact 13 28 78

Export Finance and Insurance Corporation (EFIC) - To find out about EFIC's export credit and insurance services visit: www.efic.gov.au or call 1800 887 588

Further contacts

For information about the Australian Government visit www.australia.gov.au

| State Office | Phone | Fax |

|---|---|---|

| Adelaide, South Australia | 08 8403 4899 | 08 8403 4873 |

| Brisbane, Queensland | 07 3405 4795 | 07 3405 4782 |

| Canberra, (Head Office) Australian Capital Territory | 02 6261 1111 | 02 6261 3111 |

| Darwin, Northern Territory | 08 8982 4199 | 08 8982 4155 |

| Hobart, Tasmania | 03 6238 4099 | 03 6238 4024 |

| Melbourne, Victoria | 03 9221 5555 | 03 9221 5455 |

| Perth, Western Australia | 08 9231 4499 | 08 9221 2827 |

| Sydney, New South Wales | 02 9356 6222 | 02 9356 4238 |