Summary

- Out to 2035, India can provide a new source of growth for Australia's agribusiness sector. Despite India's focus on domestic production, the gap between demand and supply will grow out to 2035.

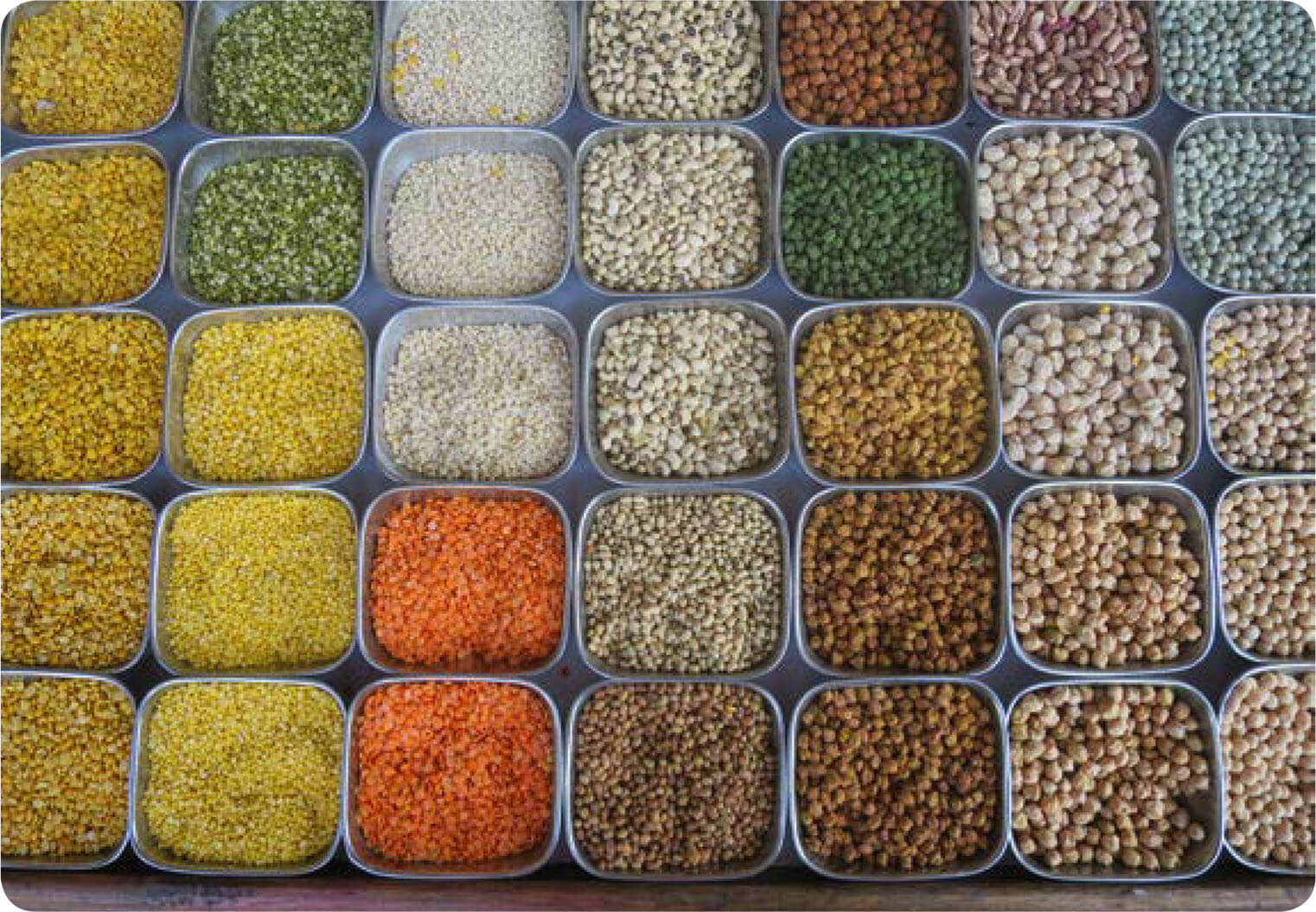

- Growth potential for Australian exports remains in commodities that India needs due to shortfalls in production (pulses, grains, horticulture, oilseeds). Opportunities also exist, or will emerge, for value-added products sought by the growing middle class (wine, processed food) and for providing specialised services to Indian Governments, institutions and farmers.

- India's agriculture sector is politically sensitive (with a protectionist sentiment that is unlikely to fade). The central and state governments seek to balance smallholder and consumer needs with the broader goals of minimising social disruption and maximising electoral rural support. The Indian Government has three objectives: food security, food self-sufficiency, and income support for farmers.

- So India will remain a difficult market, prone to fluctuating import demand and sharp policy changes – hedging against this volatility is part of spreading risk. But there is scope for it to become more predictable.

- A strategic decision by the Australian Government to work more closely with India on reducing the need for market distortions and developing import pathways can both respond to Indian priorities and ultimately help commercial engagement.

- Towards 2035, we should seek to pair exports of raw commodities with exports of value-added products, integrate into value chains, and export of services to work with India on productivity improvements and increasing farmer incomes.

- We should be seen as a trusted partner to India's agriculture reforms and land and water management priorities, and be the lead partner for these issues in key states.

- There are opportunities for Indian investment in Australian agriculture, including in Northern Australia.

1.0 The macro story

Key judgement

The structural gap between what India can produce and its demand for agricultural commodities and investment will grow out to 2035. India wants to minimise this gap and has a corresponding appetite for capital, technology and services to improve productivity and market efficiency. Diversifying Australian exports to a large and expanding market like India can spread risk and provide prospects for long term growth.

1.1 The scale and key structural drivers of the sector

Indian demand

India's overall food demand will grow at 2–3 per cent until 2025, and demand will outpace supply out to 2035 even if Indian productivity increases

- annual food demand in India is expected to increase up to 400 million tonnes per year by 2025 – a 37 per cent growth from 2015 levels – primarily in pulses, fruit and vegetables12

- this is driven by demographics and a corresponding increase in volume demand and the growing consumer class, changing diets and a shift in favour of higher value products (such as proteins, fruit, dairy, packaged goods, high end products) similar to the trends seen in other developing countries

- importantly, increased meat production can have a multiplier effect on demand for grains, protein meal, and fodder.

Growth is unevenly distributed regionally and across sector segments

- parts of India will be self-sufficient, but others deficient

- urbanisation is creating pockets of concentrated demand for high value products.

Indian supply

India is a major agricultural producer and agricultural output has grown at an average of 3.6 per cent per annum since 201144

- but the sector is highly inefficient and output is volatile.

Supply is constrained by:

- inadequate linkages to markets and distorted pricing mechanisms

- low resilience to the vagaries of nature, particularly fluctuations in monsoon rains

- scarcity of resources – especially water

- over extraction of groundwater by farmers will see some Indian states exhaust subterranean supplies by 2030, with significant implications for food security

- suboptimal acreage distribution and small holdings with challenges around development, appropriation, tree felling and land clearing

- food loss and wastage: by some estimates around 30 per cent of India's total yield is 'wasted' annually12

- land degradation: 40 per cent of India's land area is degraded through inefficient crop rotations or overuse of agrochemicals45

- infrastructure and storage gaps and logistical challenges for distributing produce

- India's reactive and retrospective policies exacerbate domestic production and price cycles.

Indian policy makers understand what is needed to improve the sector but political constraints make change difficult

- agriculture is the biggest employer in India with a highly migratory labour force and chronic underemployment

- nearly 60 per cent of the agricultural labour force is female

- poverty and debt of small farmers are region-wide problems and the government allocates a lot of unproductive capital in an attempt to alleviate these issues through subsidies.

Australia's competitive advantages

Australia's existing agribusiness trade relationship with India is strong, but sporadic

- India was Australia's sixth largest market for agricultural exports in 2016–17xix

- trade is prone to sharp changes related to Indian Government policy and the level of domestic Indian production.

Australia has a lot to contribute to India in the agribusiness space. Australia:

- can offer agricultural science expertise to improve Indian food security by increasing productivity, sustainability and food system resilience

- is an efficient exporter of staple and high value products

- has world-class expertise in agri-services and land and water resource management.

These offerings are based on the following Australian food and agribusiness comparative strengths46

- clean and green

- strong reputation

- low prevalence of food-borne illness

- high safety standards

- unique geography

- close to growing Asian markets

- diverse range of agro-ecological zones

- counter-seasonality to northern hemisphere

- world-class research

- strong research and development sector, especially in agricultural science

- established sector with a global mind-set

- strong knowledge, skills and infrastructure base

- globally focused industry

- high proportion of SMEs

- fast, agile and high innovation potential.

1.2 How the sector will likely evolve out to 2035

While there are unlikely to be big changes to Indian protectionism overall Indian demand for imports will be maintained or increase. Developments in technology, resources and attitudes will change the way the industry works.

The Government of India wants to improve the sector

India has set an aspirational target of doubling the income of farmers by 2022. To do this, NITI Aayog has laid out an agenda to

- ensure farmers receive adequate prices

- raise productivity through enhanced irrigation, faster seed replacement and precision agriculture

- shift to high-value commodities such as horticulture and fisheries.

CASE STUDY: Riverina Oils and Bio Energy: India is the fastest growing market for canola oil from Wagga Wagga

India's growing population means an ever-increasing demand for cooking oil, a major ingredient in Indian food. At the same time, with the incidence of diabetes rising, Indian consumers are becoming more aware of the health effects of the oils they consume. Canola and other vegetable oils are rapidly replacing tallow and palm oils.

Canola oil produced by Riverina Oils and Bio Energy (ROBE) in Wagga Wagga is marketed in India to appeal to this demand. It is labelled as 'pure and chemical free, from pollution free lands' and as an oil to help reduce blood sugar levels, assisting with diabetes control. The high-grade Australian oil is a natural product, processed from non-genetically modified canola seeds and with the high smoke point required for Indian cooking.

ROBE was founded by Indian born Australian entrepreneur Dhruv Deepak Saxena, known as DD Saxena. At a custom-built oilseed crushing and refining plant at Wagga Wagga, in New South Wales, it is crushing 25 per cent of the state's canola crop, producing 250 tonnes of refined oil a year.

In 2016 ROBE formed a joint venture with a major Indian food group that has put its canola oil on the shelves of 20,000 shops in India. Should the consumer penetration achieve predicted levels, ROBE will be sending a significant percentage of their oil to India and in time the plant may require additional capacity.

It took DD Saxena half a decade to build the plant and then only a year reach full capacity. When it was difficult to find finance in Australia, banks in India and other international investors provided capital. Planning approval took longer than expected and the cost of the project doubled, to $150 million. But perseverance has paid off, with DD Saxena hoping to double the plant's capacity in the next few years.

CASE STUDY: ACIAR: Improving incomes through climate science

Agriculture is the biggest employer in India. Climate change is posing a new kind of threat to rural livelihoods. Partnering with Indian researches and farmers, Australian services and expertise in agriculture and climate science can contribute to increasing productivity and farmer incomes.

Adapting to Climate Change in Asia (2010 - 2015) was a collaborative project between Indian and Australian institutions and funded by the Australian Centre for International Agricultural Research (ACIAR). The project, based in Telangana, tested options for farming communities to enhance their ability to adapt to a changing climate and manage climate risk. The research team worked with policy makers, government departments, NGOs and farmers.

Climate Information Centres (CLICs) were one outcome of the project. The CLICs are a platform which combines ICT, traditional and scientific knowledge of weather, and local rainfall measurements to inform farm management decisions. This improves decisions on when to sow crops based on soil moisture and climatic conditions, and increases local capacity to manage climate risk and variability.

Three pilot CLICs were established in the districts of Warangal, Mahboobnagar and Nalgonda. Their success led to subsequent funding and a further 33 centres in Telangana State alone. CLICs will also form an important component of an International Fund for Agriculture Development's Drought Mitigation Project in Andhra Pradesh's five dryland districts.

This partnership improves the ability of smallholder farmers to improve their livelihoods and increase their incomes through resilience to climate variability.

What Australia would like the agribusiness relationship in 2035 to look like

By 2035, we should aspire to have a bilateral agribusiness relationship where Australia has:

- Greater predictability of Indian market interventions

- and is able to manage exposure to India through advanced warning of changes to Indian domestic production, particularly those that will trigger increased tariffs and other penalties on imports.

- Captured a greater share of Indian commodity imports, even as the size of India's imports has grown

- having maintained our agricultural commodity exports in established markets in North Asia and beyond

- having tapped into growing Indian urban centres as established markets with mature export paths and involved in all links of the value chain

- having increased and improved engagement with Indian policy makers.

- Matched our strengths in exporting unprocessed goods with exports of value-added commodities

- having paired our wealth in raw ingredients with world-class science to create new exports of premium and unique products.

- Established itself as a leading provider of professional services to improve India's productivity

- targeting commodities in which we do not compete in the Indian domestic market

- having built comprehensive agricultural partnerships with leading states

- be a leading contributor to Indian conservation agriculture and water management.

The sector is already being re-shaped consistent with global trends

Out to 2035, the global agribusiness sector, including in India, will see:

- Fewer and less predictable resources

- water scarcity and weather events will make supply more volatile

- water shortages could derail production in certain parts of India and could force a shift to less water-intensive crops

- to increase productivity, NITI Aayog says India's area under irrigation needs to be expanded by 1.7 million hectares47 but groundwater level is dropping at a metre per year and two-thirds of India's irrigation comes from groundwater

- groundwater is also being progressively contaminated

- increasing consumer demand for environmental credentials will put a premium on sustainable produce at the high-end of the market.

- Smarter food chains

- big data, digital connectedness, e-commerce, vertically integrated and decentralised value chains will lead to more agile and low waste logistics.

- More efficient markets

- e-commerce will improve business to consumers links

- online retail sales (not just foodstuffs) in India are growing at 140 per cent per year45

- cheap data will underpin market information services and universal agriculture marketplaces.

- More choosy customers

- rising wealth, urbanisation, greater demand for convenience and tailored products, and willingness to switch brands will lead to more dynamic markets

- increasing societal health awareness and the importance of food safety will shift demand up the value chain

- the desire for convenience and indulgence will shift consumption patterns to high value and nutritional products, especially in growing urban centres

- improved cold chain infrastructure and new distribution channels like online retail will support this trend.

- Greater connectivity

- as food and beverage chains become increasingly global, new competition will be introduced

- connectivity will increase risks of biosecurity threats and supply shocks including livestock or plant disease.

- New farming techniques

- along with precision agriculture, concepts like hydroponics, enabled by research in bioengineering and biotechnology, could change how and where we grow food

- modular refrigeration units could make cold chain storage more affordable

- regional take up of innovative farm management platforms using data from multiple sources (for example soil, weather, aerial imagery)

- yield improvements and food waste reduction could increase India's food supply by 45 per cent by 2025, increasing India's agriculture output by $230 billion by 2025 over 2015 figures12

- automation in farm operations and logistics

- the introduction of new and better plant varieties

- acreage shifts towards high value crops and broad acre cropping.

- Better access to financing

- enabled by direct benefit transfers and digital financing and insurance pay-outs (credit, insurance, payments, risk management)

- supported by data from digitised land records, images and digital sales that will enable producers and processors to invest in new technology

- the emergence of Farmer Producer Organisations and Farmer Producer Companies will give the fragmented Indian sector a more united voice and purchasing power for inputs, services and research and development.

2.0 Opportunities for partnership

Key judgement

Growth potential for Australian exports remains in commodities that India needs due to shortfalls in production (pulses, grains, horticulture, oilseeds). Opportunities also exist, or will emerge, for value-added products sought by the growing consumer class (wine, processed food) and for providing specialised services to Indian Governments, institutions and farmers.

2.1 Export opportunities

Given the profile of our respective sectors, there is a spread of opportunities out to 2035 as shown in Table 3.

| Near term | Medium/Long term | ||

|---|---|---|---|

| Goods | Raw commodities | Export commodities Investment in import pathways |

Export commodities Investment in different links in the supply chain (food processing, packaging, cold chain) |

| Processed products | Export processed value-added products Investment in import pathways |

Exports Invest in food processing in India |

|

| Services | On-farm | Precision farming Seed treatment and soil health solutions Plant and animal genomics |

Supply full range of agri-services Collaborate with Indian scientists and start-ups working on plant and animal genomics |

| Post-farm | Logistics and bulk storage solutions Food processing |

Logistics and bulk storage solutions Food processing |

|

| Safety and quality | Safety and quality consultancy to government and large export oriented businesses | Provision of food safety management systems | |

| Water | Policy engagement Research and development projects Water information systems Water use efficiency Water governance Irrigation projects |

Policy engagement Research and development projects Water information systems Water use efficiency Water governance Irrigation projects |

CASE STUDY: Australian Pulses: Australia the biggest exporter of chickpeas in the world

Pulses, which include chickpeas, lentils, mung beans and dried peas, are an essential component of the Indian diet, providing a valuable source of protein, especially for the hundreds of millions of vegetarians in India.

For Australian farmers, pulses provide an essential 'break crop' in their cropping cycle. Pulses provide a necessary disease break within the wheat and barley cropping cycle, while returning valuable nitrogen from the atmosphere to the soil.

Australia exports more than 700,000 tonnes of pulses to India each year, worth more than half a billion dollars per annum. As India strives towards self-sufficiency, growing enough pulses for its domestic market, Australia supplies 'top up' pulses in times of crop shortage in India, due to climatic or supply variations. The superior quality of Australian pulses helps ensure strong and resilient demand from Indian buyers while pulses become more firmly entrenched in Australian broad-acre farming.

While the Australia-India trade in pulses fluctuates from year to year, with supply and demand fundamentals in any one season contributing to a volatile trading environment, the underlying prospects remain very positive.

Pulses

- India's demand for pulses is likely to increase from 21.5 million tonnes in 2015 to 32–37 million tonnes by 2025, and could reach 40–46 million tonnes by 2035.12

- India has set a target of producing 28 million tonnes of pulses by 2025 under its 'Pulse Program' but even if this is achieved India might need to import 5–10 million tonnes. Australia could potentially export 4 million tonnes by 2035.12

- Processed and packaged pulses, although small in their current share of pulse consumption, will be key pockets of growth with demand for packaged and branded pulses growing at 12 per cent per annum to 2025.12

Wool

- As a growing market, India offers diversification for Australian wool exporters

- 7 per cent (by value) of Australian wool exports currently go to India, compared to 74 per cent to China.

- India's textile industry (currently worth USD108 billion) is the second largest employer after agriculture, especially for women.145

- Australian fine merino wool does not compete with Indian wool which is predominantly used for carpets.

- Wool operates outside of the food self-sufficiency paradigm making it easier to approach.

Wheat

- Long term Indian demand for wheat will likely outpace population growth. This implies wheat demand could grow from about 84 million tonnes in 2015 to 97 million tonnes by 2025 and 115 million tonnes by 2035.12

- One of the biggest future drivers of grain demand will be increasing per capita meat consumption, leading to growth in the Indian livestock sector (primarily poultry), and a corresponding growth in the stockfeed industry. Feed conversion ratios entail a multiplier on grain demand: for example, one kilogram of chicken meat needs two to three kilograms of grain input.

- Self-sufficiency for wheat in India is technically achievable, but unlikely to be economically efficient or environmentally sustainable.

- The volume of Indian wheat production is heavily dependent on the monsoon and government supports. In good years, India is a net exporter.

- Competing uses of land also means India's import demand could grow at a faster rate than consumption. As India focuses on pulse production, the area planted with wheat declines, increasing demand for wheat imports.

Dairy

- There is a widening gap between demand and supply of milk in India.

- India is the largest milk producing country in the world, with production of 156 million tonnes in 2015–16. Demand for milk is growing at an average 7 per cent per annum while milk production is growing at 4 per cent with strong demand for value-added milk products.

- As the animal to land ratio has reached saturation, the focus of India's dairy industry is on milk processing and improving yield per animal. There are systemic shortfalls in cattle nutrition and genetics.

- Aligning health protocols and standards with Australian specifications can unlock genetics export opportunities.xx If we don't, others will as they have in China – potentially reducing market access.

- There will be a sustained need for management skills, technologies and services: training, breeding, rearing, fertility and disease management, veterinary skills and services, milk quality and safety.

- The dairy industry in Australia can be complementary to the food industry in India. Australian dairy manufacturers largely export high quality product in bulk that could be further processed in India for domestic consumption or export to the region.

Fruit, vegetables and nuts

- The demand for fruits and vegetables is expected to grow at 5–7 per cent by 2025. This is, in part, driven by increasing demand for premium products and corresponding higher prices.

- Australia has counter-seasonal production.

- Nuts, in particular, are a largely noncompeting commodity which ticks nutritional and consumer preferences. Fruit and vegetable processing levels are likely to increase significantly, driven by reduced wastage and benefit from value add.

Sheepmeat

- Strong growth in Indian demand for food products, especially sources of protein, is projected out to 2035. Coupled with the Indian market's strong affiliation with sheepmeat through cultural and religious customs, this present tremendous potential for Australian exporters.

- Beyond the Indian consumer's demand for food, demand will also grow for the wider variety of animal products and red meat by-products.

- Australian sheepmeat services a different (higher-end) market segment to that supplied by Indian domestic red meat production and this non-competitive differentiation should be emphasised and leveraged in any dialogue around potential regulatory reform.

- India's import certification requirements for Australian red meat products are some of the main obstacles to maximising opportunities.

Sustainable inputs

- The market for organic foods in India is expected to triple by 2020.45

- Fertilisers are only used in 30 per cent of India's arable land, with demand expected to grow strongly, including for microbial and organic fertilisers and bio pesticides.

Other commodities

- Demand for 'luxury' commodities like wine, poultry and aquaculture is predicted to grow faster than the overall growth of India's agricultural sector.

- Demand for other key commodities like cotton, wood and paper products is predicted to grow in line with the overall growth of India's agricultural sector.

2.2 Collaboration

There will be strong and sustained demand in India for agri-services, consulting and technologies in areas where Australia has expertise. The kinds of long term partnerships that can achieve collaboration beyond simple exports and connect Australian players directly with industry include where Indian demand and Australian capabilities converge.

Soil health

Global soils are depleted and Australia and India are no exceptions. Soils contain three times as much carbon as the atmosphere. If managed properly, they could be a significant long term sink for carbon dioxide. Getting it right means more income for farmers and better long term sustainability. This presents opportunities in:

- land management inputs and advisory services, including agroforestry, low-till agricultural methods, holistic grazing, shallow underground drip irrigation of broadacre crops compatible with no-till crop establishment

- joint research and development – we have relatively little information about the physical and biological soil–plant interface, or how to improve soil carbon consistently.

CASE STUDY: Australian Almond Board: Australian almond exports to India triple in a decade

Almonds are a big part of Indian culture and are sought-after gifts during festivals like Diwali, as well as for weddings and other large family celebrations.

Australian almond producers have invested in additional supply in the Mildura region to meet this ongoing demand. In the last decade, almond exports to India have more than tripled, from $28 million in 2006–07 to more than $113 million in 2016–17. Australia is now the second biggest source of almonds for India after the United States, and India is Australia's biggest export market for almonds.

Timing helps. Australia's season is opposite to that in California. This means we are well placed to meet the demand of the major gift-giving period prior to the Indian festival of Diwali in November, and the major wedding period of northern India.

Working together and perseverance has been key to success. The industry peak body, the Almond Board of Australia, has developed a collaborative export marketing program funded by contributions from growers. This program has promoted Australian almonds to key markets, including India, for the past 15 years.

The world's largest annual food and beverage show, Gulfood in Dubai, has been a significant marketing and promotional opportunity for Australian almonds for many years. In 2018, almost a hundred participants, including representatives of all the major almond traders in India, attended a networking seminar organised annually by the Australian Almond Board.

Food waste

Food waste is a global challenge that has environmental, economic and social impacts. Like India, Australia seeks to address this challenge

- food waste costs the Australian economy about $20 billion a year

- the Australian Government's National Food Waste Strategy, released in November 2017, aims to halve Australia's food waste by 2030 through technical improvements and innovative practices and polices

- there is acute demand for logistical and supply chain improvements in India to minimise food waste and also consumer prices – this presents opportunities for collaboration and investment in

- bulk storage systems, which could increase in importance as Indian supply chains grow

- cold chain storage, including the provision of solutions to government institutions like the Food Corporation of India which are responsible for handling agricultural products

- supply chain standards and practices and the application of advanced analytics to identify bottlenecks

- collaborating with India to develop and roll out high yielding varieties of plants, seeds, and animals can help offset food waste

- including through joint research and development investments to increase productivity

- the development of efficient farm machinery can help minimise food waste at the point of production

- which could be designed in Australia and manufactured in India.

Water management

Water management underpins the food and agriculture sector

- water supply is not assured in much of the country with 80 per cent of India's water resources used in agriculture

- With Australia's expertise in irrigated, rain-fed and arid-zone farming and groundwater management there is scope to build further engagement with local partners to link water and agriculture thereby increasing food and water security

- for example, the Australian Centre for International Agricultural Research (ACIAR) is trialling water-efficient farming technologies and practices in two Indian states and the Australian Water Partnership, BOM, CSIRO, University of Western Sydney, International Centre of Excellence in Water Resources Management (ICEWaRM) and eWater have water engagement activities to build on.

2.3 Investment

While Indian regulation prevents foreigners from buying agricultural land, India is seeking to attract investment into its agribusiness industries and companies

- India currently allows 100 per cent FDI in agricultural businesses, plantations and food processing industries through the 'automatic route'48

- there are fiscal incentives from the government like capital subsidies, tax rebates, depreciation benefits, and reduced custom and excise duties for processed food and machinery.

Investing in food processing and import pathways in India could achieve more stable trade regimes for Australian exporters and could provide long term opportunities given that demand will shift in favour of processed categories like packaged and branded, fortified, and ready-to-eat snacks and meals

- but the regulatory environment currently makes investment risky and will need to improve to provide confidence to investors.

Indian investment in Australia's agribusiness sector is small

- the wide range of investment opportunities in our agri-sector could attract Indian investment in the long term and vertically integrate supply chains

- Australia's policies to develop northern Australia, which includes a focus on agriculture, should also be a good fit with India's key economic priorities, including the possible purchase of properties

- though this would be a long term outcome: India is not currently investing in northern Australia in a substantial way.

3.0 Constraints and challenges

Key judgement

The attractiveness of India's agricultural market for exporters swings sharply with tariff and policy changes. The sector is politically sensitive and protectionist – this won't change over the medium term, at least. The Government of India seeks to balance the needs of smallholder farmers and the needs of consumers with the broader goals of minimising social disruption and maximising political support.

3.1 The policy and regulatory environment

Defining features of India's policy environment include:

- Political sensitivity, which constrains big reforms

- agriculture is the biggest employer in India and a commanding political constituency

- for example, the granting of farm loan waivers has been an expedient political tool

- political pressure to support farmers is compounded by the relatively high numbers of farmer suicides

- the sector is also culturally sensitive: central and state governments have intervened from time to time to regulate the slaughter of cattle.

- Unpredictability

- tariff and regulatory changes are abrupt, consequential and lack transparency, diminishing the confidence in foreign partners

- for example, in December 2017 India increased tariffs on chickpeas from zero to 30 per cent, and up to 66 per cent in February 2018

- these changes are often prompted by Indian production that is affected by monsoons, seasonal conditions and election cycles

- this disincentivises supply contracts and both Australian exporters and Indian importers/processors underinvest in the business relationship because of this unpredictability.

- tariff and regulatory changes are abrupt, consequential and lack transparency, diminishing the confidence in foreign partners

- India's entrenched philosophy of food self-sufficiency permits arbitrary and ad hoc protectionist measures

- India could theoretically achieve self-sufficiency, but few forecast it could do so consistently, sustainably or economically

- India periodically exports goods related to food security (wheat, rice) during periods of high production and seeks to export goods not linked to food security (buffalo meat, table grapes, mangoes).

- Food, agriculture and water policy is spread across several central ministries, making policy management and renewal very complex.

Agriculture is one of India's most regulated sectors

The Indian Government has three objectives: food security, food self-sufficiency, and income support for farmers

- in pursuit of these objectives, it applies competing regulatory regimes: suppressing domestic food prices; supporting producers; barriers to imports

- India spends nearly 20 per cent of its budget on these measures44

- the budget impact of these competing policy ideals will increase in the future, raising questions of fiscal sustainability.

Major market distorting regulations include the Essential Commodities Act and Agricultural Produce Market Committee (APMC) Act which restrict price, supply and distribution for domestic producers, hindering the development of private markets

- the latter requires wholesale trade to pass through an APMC, hindering the establishment of contract farming, the development of private markets and the direct trade of agricultural products from farmers to consumers

- small regulated markets lead to a fragmentation within states

- this limits investment, including in warehousing, cold storage and cold chain logistics, as well as food processing.

The Central Government has opened the door to reform, and implementation is being taken up at various speeds in the states

- the launch of the online National Agriculture Market portal by the Central Government can facilitate better links between sellers and buyers, as can the rationalisation of taxes on agricultural commodities as a part of the APMC Act Reform

- the Central Government is considering incentivising states to accelerate some of their reforms by linking part of the financial grants for states under Central Government schemes to the agriculture reforms implemented.

Current barriers to trade include:

- Minimum support prices: for certain commodities, underpinned by the Food Corporation of India and state governments

- producers are able to sell as much as they wish to procurement agencies at set prices, subject to quality.

- Input subsidies: fertiliser support is one of the largest input subsidies, where the government controls prices and pays the difference to market prices

- other subsidised inputs include irrigation, electricity, diesel and seeds.

- Import tariffs: which are applied to most imported food products, keep domestic food prices above world levels

- India's simple average applied tariff for all products is 13.4 per cent, compared with 9.9 per cent for China and 2.5 per cent for Australia

- but India's average applied tariff for agricultural products is 32.7 per cent49

- while applied tariff rates have declined significantly since 1991, they are volatile and remain among the highest in the world.

- Food subsidies: the Central Government subsidises food to support the section of the population living in poverty, and to offset the impact of policies (such as the maintenance of Minimum Support Prices and tariffs) that keep food prices high.

- Divergence from internationally accepted standards: including from the World Organisation for Animal Health, the Codex Alimentarius Commission, and the International Plant Protection Convention

- this means India imposes import certification requirements which are not in accordance with international food safety measures or those adopted by the majority of Australia's other trading partners

- nor does India currently recognise Australia's disease freedom and management of export certification procedures.

- Other non-tariff barriers: include import bans (animal products), quality standards (fumigation of pulses by methyl bromide), and labelling and packaging rules.

- Sanitary and phytosanitary (SPS) issues: are often treated inconsistently, without transparency, and driven by politics over science.

- A weak intellectual property (IP) regime: seed, fertiliser and pesticide companies can be required to provide proprietary knowledge to domestic industry.

3.2 Skills, infrastructure and other constraints

Constraints and limits on the Indian side include:

- the Government of India's view that more imports of Australian products will undermine the livelihoods of farmers, despite many Australian higher-priced products catering to the wealthier segment of Indian society

- a lack of reliable supply chain logistics and cold storage options (including due to lack of capital and erratic electricity supply although the latter is improving)

- lack of skilled personnel to operate or maintain systems, for example micro irrigation

- the small scale of much of India's farming (around 80 per cent of farms are less than two hectares) hinders the adoption of capital-intensive equipment like precision agriculture

- lack of access to financial services and formal credit for Indian farmers

- while Australia has a lot to offer in agri-services, unlike the market for METS, the Indian agricultural sector is fragmented and predominantly smallholder, and with few institutions with budgets for research and development or new technologies.

Constraints and limits on the Australian side include:

- the bandwidth limit of Australian producers

- Australian agricultural producers are selling all their stock in global and domestic markets already

- they would need to take on higher value crops under reliable Indian demand to shift focus

- trade policy fluctuations in India, often with little notice, affect market confidence; Australian farmers are less likely to take a chance on India until they see more surety in its trade policy

- it is challenging for Australian peak bodies to convince industry to sponsor collaboration given short term returns are scarce and India is a long term competitor

- Australia's current engagement with India on water involves development cooperation, commercial transactions and twinning partnerships. But given Australia does not have a bilateral aid program in India, many funding sources are confined to regional funds or multilateral bodies.

CASE STUDY: Fletcher International Exports: High-end hungry for Australian Lamb

Indian cities are rapidly growing and with them high-end hotels and restaurants. This is opening up new markets for premium Australian food, and particularly meat and wine.

As a world leader of quality sheep meat, Australia has been positioning itself to supply the growing middle to upper class segment of the market.

With processing facilities in Western Australia and New South Wales, Fletcher International Exports was an early exporter of lamb meat to India in 2012, after the Indian Government opened its markets to lamb imports.

Fletcher International Exports focused on the growing interest in lamb in the fine dining sector and spent time to get to know the market before the company entered. It identified a market gap in high value lamb racks and large lamb legs. Importantly in this market segment, it identified that Australian products would not compete with India's farmers, as local producers focus on smaller sized lamb and mutton preferred for curry.

Displaying their products at trade fairs including Fine Food India, Fletcher International Exports focused on building brand prestige based on the consistent high quality of Australian lamb and sheep meat products underpinned by stringent quality control methods.

Fletcher International Exports also used brand prestige associated with other high-end Australian products already in Mumbai, Delhi, Bengaluru and Chennai and was able to make use of already established distribution lines through a series of Australian food and beverage events organised by Austrade.

Through their Halal certification, Fletcher International Exports are now looking to expand to nearby countries Pakistan and Nepal.

4.0 Where to focus

Australian efforts should: focus on the Central Government for market access and policy issues; and target states which are responsive to implementing reforms, willing to spend on infrastructure, and have conditions conducive to trade and investment.

The Central Government sets price controls, tariffs and other barriers. It also plays a role through promotional schemes for particular varieties of crops and agricultural products.

The states have responsibility for implementing agriculture policies, meaning states affect conditions for delivery of agri-services, technology and investment.

Besides taking account of the size, dynamism and infrastructure in each state, target states can be identified by considering several factors: urban centres provide big and accessible markets, including affluent consumers; special economic zones lend themselves to food processing and investment; well-developed agri-sectors and favourable policies provide opportunities for delivery of services and technologies; we can double-down on established relationships on water engagement.

4.1 Key states

Andhra Pradesh

- Net State Value Added (NSVA)xxi for agriculture sector: 34 per cent

- Investment: Coastal economic zone around Vizag presents potential for setting up food processing hubs. As a new state, Andhra Pradesh is seeking to attract investment and establish liberalised markets. It has a newly created agritech accelerator, Gastrotope, focused on tech-enabled smart agriculture.

- Services: Andhra Pradesh has a growing agri-sector with opportunities for better dairy productivity, sustainable fisheries and aquaculture management, especially given strong growth in agriculture and aquaculture (26 per cent and 33 per cent in 2015–16).

Madhya Pradesh

- NSVA for agriculture sector: 41 per cent

- Services: Madhya Pradesh has India's highest agricultural growth rate and output, including strong production of wheat, pulses and dairy. During 2012–17, growth in agriculture averaged 21.5 per cent. One of the contributing factors to this includes a massive expansions in irrigation.

Maharashtra

- NSVA for agriculture sector: 11 per cent

- Trade: Mumbai provides a major urban market, affluent consumers and a big port.

- Investment: Maharashtra has a coastal economic zone which presents potential for food processing hubs.

New Delhi NCR

- NSVA for agriculture sector: 1 per cent

- Trade: New Delhi provides a major urban market.

- Conservation agriculture: Stubble burning in surrounding regions contributes to intense air pollution and opportunities for agri-services.

Punjab

- NSVA for agriculture sector: 31 per cent

- Punjab is widely regarded as India's breadbasket and contributes over 20 per cent of India's food production, including wheat, rice, barley and dairy.

- Even as agriculture's share of Punjab's Gross State Domestic Product (GSDP) has sharply declined, it continues to play an important role in the state (and indeed national grain production), with more than 83 per cent of Punjab under intensive agriculture.

- As with much of India, Punjab suffers from falling water tables and poor soil quality.

Rajasthan

- NSVA for agriculture sector: 28 per cent

- Services: Given the extensive areas of desert and dry land farming, there are opportunities in water management services. As a major producer of milk, cereals, pulses and oilseeds there should be long term opportunities in food processing.

Tamil Nadu

- NSVA for agriculture sector: 13 per cent

- Trade: Chennai provides a major urban market. Tamil Nadu is a major agricultural producer and a major importer of Australian pulses and grain.

- Investment: Tamil Nadu has established strengths in fisheries, aquaculture and agri-technology.

- Australian wheat has a freight advantage into south India over India's domestic production which is predominantly grown in northern India.

Uttar Pradesh

- NSVA for agriculture sector: 28 per cent

- Trade: India's most populous state (over 200 million people) and a corresponding broad based market.

- Services: Major producer of milk.

- Investment: Acute demand for cold-chain logistics.

West Bengal

- NSVA for agriculture sector: 17 per cent

- Trade: Kolkata provides a major urban market. It is the biggest city in eastern India, an economic hub for the north east, and one of the fastest growing cities in the country. It is the main point of entry for Australian pulse exports to India.

- Water: West Bengal is in the Eastern Gangetic Plain. ACIAR has established irrigation, water and conservation agriculture projects showing good results.

Recommendations

India's demand profile will keep changing out to 2035 so businesses should continue working to reach current markets, while also playing with a long view for the markets of tomorrow. Providing services or technical cooperation to India could be on an outright commercial basis. It could also align with Indian policies to build perceptions of Australia as a constructive partner and develop links for future exports or commercial services.

- 29.Seek to mitigate fluctuations in Indian demand for raw agricultural commodities

- 29.1Work with the Indian Government to put in place mechanisms to provide better forecasting and greater visibility of fluctuations in Indian demand for agricultural commodities imported from Australia

- Australia could provide globally-competitive forecasting services directly to India's Directorate General of Foreign Trade to help ensure earlier advice on policy decisions such as tariff increases

- including through deeper relationships between the Australian Bureau of Agricultural Resource Economics (ABARES), the BOM and the Indian Meteorological Department

- import tariffs and trade restrictions are often applied in response to changes in domestic production driven by seasonal conditions or due to specific Indian Government schemes

- improved weather and monsoon forecasting, and monitoring of Indian Government schemes, could add an element of predictability that could assist India to know earlier its likely harvest levels

- understanding and managing climatic variability is an area of Australian strength and working with India could also support the provision of timely information to the Australian side.

- Australia could provide globally-competitive forecasting services directly to India's Directorate General of Foreign Trade to help ensure earlier advice on policy decisions such as tariff increases

- 29.2Conduct a feasibility study of investment in Indian storage facilities for pulses and grains at ports of importation

- so India has better capacity to manage surges in its domestic supply without recourse to suddenly imposing tariff increases on imports

- any subsequent investment in import pathway infrastructure should be on the condition that India will provide advance notice of regulatory changes to enhance predictability.

- 29.3Work with other countries to encourage Indian policy makers to action tariff changes in a manner that allows for business continuity

- concerted and coordinated messaging with like-mindeds (for example, the Organisation for Economic Co-operation and Development [OECD], Canada, United States), including through the World Trade Organisation (WTO), to encourage India to recognise its role in the global food chain where abrupt changes affect India's food security in the long term.

- 29.1Work with the Indian Government to put in place mechanisms to provide better forecasting and greater visibility of fluctuations in Indian demand for agricultural commodities imported from Australia

- 30.Seek to make our agricultural markets more interoperable

- 30.1Within the broader effort of harmonising standards with India, [see Recommendation 78.1] pursue greater alignment of food standards

- facilitate further engagement between India's Food Safety and Standards Authority and the Australian Department of Agriculture and Water Resources (DAWR), including through work sharing, information sharing and regulatory convergence activities

- enhance collaboration on Codex standards between the lead Indian and Australian agencies through Codex processes, including with Codex Australia (within DAWR) and Food Standards Australia New Zealand (FSANZ).

- 30.2Fund FSANZ to deliver capacity building and regulatory capability development activities with India.

- 30.1Within the broader effort of harmonising standards with India, [see Recommendation 78.1] pursue greater alignment of food standards

- 31.Build targeted relationships with decision makers and seek to address regulatory barriers

- 31.1Institute greater policy dialogue to discuss market access requests, technical market access issues, domestic policy and regulations

- pursue annual Agricultural Minister meetings

- elevate water/irrigation to be a topic covered by ministers

- continue and expand the Joint Working Group on Agriculture

- seek to promote international standardisation and technical cooperation activities, for example on biosecurity; quarantine and SPS accreditation schemes; harmonisation of treatments; pest risk analysis

- provide more resources to make this core business of the Joint Working Group more effective

- including the pursuit of recognition of Australian certifications and protocols

- expand to include water-related dimensions such as irrigation

- seek to promote international standardisation and technical cooperation activities, for example on biosecurity; quarantine and SPS accreditation schemes; harmonisation of treatments; pest risk analysis

- give greater emphasis under existing MoUs (for example wool, textiles, water cooperation) to collaborating with India on the regulatory environment

- provide technical and scientific capabilities to India to support adherence to international standards.

- pursue annual Agricultural Minister meetings

- 31.2Activities under these policy dialogue frameworks need funding and improved coordination with commercial/financial sectors

- explore, together with industry, options to either establish a 'cooperation fund' to kick-start agricultural technical exchanges and capacity building to underpin policy dialogues

- expand existing government funds such as DFAT's Government Partnerships for Development Fund and Sustainable Development Investment Portfolio

- particularly in support of ACIAR.

- 31.3Develop a coordinated advocacy strategy to address the concern that Australian agriculture would flood India's market and dislocate farmers if tariffs are lowered

- building on the work already being undertaken by Austrade and the DAWR.

- 31.1Institute greater policy dialogue to discuss market access requests, technical market access issues, domestic policy and regulations

- 32.Work with Australian Industry to provide platforms to take Australian agricultural services, consulting and technology to India

- 32.1Facilitate agribusiness pilot projects to showcase expertise with a view to commercialisation

- in close consultation with ACIAR establish pilot dairy programs to showcase Australian genetics, storage, nutrition and transportation

- for example, where Australia provides expertise on productivity improvement along with the basic product, such as milk powders, caseins, protein concentrates and India provides next stage manufacturing and packaging to export products to third markets.

- in close consultation with ACIAR establish pilot dairy programs to showcase Australian genetics, storage, nutrition and transportation

- 32.2Establish model agricultural zones/centres of excellence in conjunction with a target state government to showcase Australian practices and technology to increase productivity

- Andhra Pradesh presents itself as a state likely to be receptive of this.

- 32.3Establish an Australia-India Food Partnership, including an International Agricultural Services Hub to package Australian policy, implementation and services expertise

- the Food Partnership would provide a framework for

- strengthening engagement between Australian and Indian agriculture and food industries

- strengthen Australia's reputation and a longstanding reliable partner in agriculture

- work with Indian policy makers to assist in the design and implementation of effective agricultural legislation, regulation and policy making

- the Hub could offer

- a one-stop shop of advice across university, industry and public sectors

- blended financing, including in-kind contributions from the private sector

- a unique Australian brand

- bespoke services available through fee for service

- if successful in India the concept could be extended to other developing markets.

- the Food Partnership would provide a framework for

- 32.1Facilitate agribusiness pilot projects to showcase expertise with a view to commercialisation

- 33.Foster a knowledge partnership in agri-science

- 33.1Seek to grow ACIAR's technical exchange relationship with India

- create a pathway to more easily invest aid funds in bilateral projects with India

- concurrently, ensure ACIAR's relationship with India is framed around technical partnership, rather than donor-recipient, with India making parallel investments to ensure Indian scientists work in and alongside research teams with appropriate Australian engagement.

- 33.2Foster collaborative training and education services focused on agriculture through:

- sponsoring masters/PhD offerings in food science and agronomy including through Australia Awards

- training, workshops and executive courses in farm management and across all stages of production cycle with a focus on including female farmers.

- 33.3Foster further collaborative research and development and subsequent commercialisation of Intellectual Property

- establish an Austrade Business Development Manager in an Indian agricultural university/research institute to foster institutional linkages (like the India School of Mines model) [see Chapter 4: Resources and METS]

- foster deeper collaboration between Australian research agencies (such as ACIAR, ABARES, the Rural Industries Research and Development Organisation and the Grains Research and Development Organisation) and Indian agencies (such as the Indian Agricultural Research Institute, National Dairy Research Institute) and with international agencies with an India focus (the International Crops Research Institute for Semi-Arid Tropics and the World Bank).

- 33.4Offer internships and support for Australian students to engage with Indian agricultural start-ups

- provide specific funding under the New Colombo Plan

- for example at Andhra Pradesh's agritech accelerator, Gastrotope, which is supported by Japanese investment and focuses on Internet of Things applications for smart agriculture.

- provide specific funding under the New Colombo Plan

- 33.1Seek to grow ACIAR's technical exchange relationship with India

- 34.Foster targeted relationships directly with Indian industry, markets, and producers in key states

- 34.1Sponsor farmer to farmer exchanges

- Draw from Australia's farmer-driven research and development buying groups to send experienced practitioners to India. These would essentially be exchanges between small business owners and entrepreneurs to complement scientific research and help lead to commercial uptake of Australian technologies. This model would get beyond relationships built on fly-in/fly-out researchers.

- 34.2Facilitate Australian producer delegation visits to India to understand the markets and the environment in target Indian states, targeting fairs and conferences with Indian industry bodies.

- 34.3Deepen engagement with Farm Producer Companies to promote and coordinate private sector cooperation and technical exchange with India

- Indian counterparts could be paired with Australian farmer cooperatives

- including with a focus on improving female participation in Indian cooperatives

- one focus for exchange should be on irrigation: industry-industry engagement is currently limited, noting Australia is hosting the World Irrigation Congress in 2020

- out to 2035, Farmer Producer Organisations and Companies in priority States could become useful engagement points, enabling engagement directly with suppliers and customers.

- Indian counterparts could be paired with Australian farmer cooperatives

- 34.1Sponsor farmer to farmer exchanges

- 35.Consolidate Australia's branding

Better coordinate Australian branding in agriculture and water

- drawing on Australia's 'clean and green' brand

- deliver the message that Australian agricultural commodities don't pose a threat to domestic suppliers and service different market segments, or are counter seasonal

- build on success of MasterChef to promote quality of Australian products

- leverage hotel chains as a lobbying force for access to high value produce, for example ITC Hotels, or the Federation of Hotel and Restaurant Associations of India.

- 36.Continue to improve Australian productivity and efficiency

The Australian Government must maintain an ongoing focus on improved domestic productivity to ensure Australia remains cost-competitive relative to its global competitors, including through

- reducing regulatory burdens and building human capital through improving labour availability and skills

- investing in agricultural research and building strong multinational research programs that support productivity and help ensure our farmers have access to the latest technologies.

- xix India takes 80% of Australian chickpea exports. India consumes about 40% of Australia's vegetable exports.

- xx NITI Aayog – Livestock productivity is very low: 5 kg per in-milk buffalo and 3 kg per in-milk cow. Needs better breeds, nutrition and health. Coverage of artificial insemination is only 35 per cent

- xxi NSVA data is for 2015–16. India's national NSVA for agriculture is 17 per cent.