Download

Chapter 3 – Rules of Origin [DOCX 105 KB]

Formatting of content below may have been modified in order to meet accessibility to users who require assistive technology to access information online. The CEPA agreed text is in the file available for download above.

Article 3.1 Definitions

For the purposes of this Chapter:

aquaculture refers to the farming of aquatic organisms including fish, molluscs, crustaceans, other aquatic invertebrates and aquatic plants, from seedstock including seed stock imported from non-parties, such as eggs, fry, fingerlings and larvae, parr, smolts, or other immature fish at post-larval stage, by intervention in the rearing or growth processes to enhance production, such as regular stocking, feeding, and protection from predators;

change in tariff classification means a change at the two-digit, four-digit, or six-digit level of the Harmonized System;

competent authority refers to:

- for the UAE, to the Ministry of Economy or any other agency notified from time to time; and

- for Australia, the Department of Foreign Affairs and Trade or its successor, or any other agency, or any entity authorised to issue a Certificate of Origin; as notified from time to time;

consignment means products which are either sent simultaneously from one exporter to one consignee or covered by a single transport document covering their shipment from the exporter to the consignee or, in the absence of such a document, by a single invoice;

customs value refers to the value as determined in accordance with the Customs Valuation Agreement;

fungible goods or materials means goods or materials that are interchangeable for commercial purposes and whose properties are essentially identical, irrespective of minor differences in appearance that are not relevant to a determination of origin;

Generally Accepted Accounting Principles means the recognised consensus or substantial authoritative support in the territory of a Party, with respect to the recording of revenues, expenses, costs, assets, and liabilities, the disclosure of information the preparation of financial statements. These principles may encompass broad guidelines of general application as well as detailed standards, practices and procedures;

good refers to any article product, material or merchandise;

indirect material means a material used in the production, testing, or inspection of a good but not physically incorporated into the good; or a material used in the maintenance of buildings or the operation of equipment, associated with the production of a good, including:

- fuel, energy, catalysts, and solvents;

- equipment, devices, and supplies used to test or inspect the good;

- gloves, glasses, footwear, clothing, safety equipment, and supplies;

- tools, dies, and moulds;

- spare parts and materials used in the maintenance of equipment and buildings;

- lubricants, greases, compounding materials, and other materials used in production or used to operate equipment and buildings; and

- any other material that is not incorporated into the good but the use of which in the production of the good can reasonably be demonstrated to be a part of that production;

material refers to any ingredient, raw material, compound or part used in the production of a good and physically incorporated into it;

non-originating good or non-originating material refers to goods or materials that do not qualify as originating in accordance with this Chapter;

originating good or originating material refers to goods or materials that qualify as originating in accordance with this Chapter;

packing materials and containers for shipment means goods used to protect another good during its transportation, but does not include the packaging materials or containers in which a good is packaged for retail sale;

person of a Party means a natural person or juridical person:

- natural person is defined in accordance with Article 9.1 (Definitions) of Chapter 9 (Trade in Services);

- juridical person means any entity constituted or organised under applicable law of a Party, whether or not for profit, and whether privately or governmentally owned or controlled, including any corporation, trust, partnership, sole proprietorship, joint venture, association or similar organisation;

preferential tariff treatment means the customs duty rate applicable to an originating good, pursuant to each Party's Schedule set out in Annex 2A (Schedules of Tariff Commitments);

producer means a person who engages in the production of a good;

product refers to that which is obtained by growing, cultivating, raising, mining, harvesting, fishing, aquaculture, trapping, hunting, capturing, collecting, breeding, gathering, extracting or working, assembling or manufacturing, even if it is intended for later use in another manufacturing operation; and

production refers to operations including growing, cultivating raising, mining, harvesting, fishing, aquaculture, trapping, hunting, capturing, collecting, breeding, extracting, gathering, manufacturing, working, processing, and other specific operations, including assembling.

Section A: Origin Determination

Article 3.2 Originating Goods

- For the purpose of implementing this Agreement, except as otherwise provided in this Chapter, a good shall be regarded as originating if it is:

- wholly obtained in the territory of the Parties, as established in Article 3.3 (Wholly Obtained or Produced Goods);

- goods produced in the territory of one or both of the Parties exclusively from originating materials; or

- produced entirely in the territory of one or both of the Parties using non-originating materials, provided the goods satisfy all applicable requirements of Annex 3A (Product Specific Rules Schedule).

- In each case provided in paragraph 1, the goods satisfy all other applicable requirements of this Chapter.

Article 3.3 Wholly Obtained or Produced Goods

- For the purposes of paragraph 1(a) of Article 3.2 (Originating Goods), the following goods shall be deemed to be wholly obtained or produced in the territory of a Party:

- plants and plant products or fungus grown, collected, harvested, cultivated, picked, or gathered there;

- live animals born and raised there;

- products obtained from live animals there;

- mineral products or natural resources extracted or taken from that Party's soil, subsoil, waters, seabed or beneath the seabed;

- products obtained by hunting, trapping, collecting, capturing, fishing or aquaculture conducted there; but not beyond the outer limits of a Party's territorial sea;

- products of sea fishing and other marine products taken from outside the territorial waters of the Parties by a vessel registered, recorded, listed or licensed with a Party and flying its flag;

- products made on board a factory ship registered, recorded, listed or licensed with a Party and flying its flag, exclusively from products referred to in subparagraph (h);

- products, other than products of sea fishing and other marine products, taken or extracted by a Party or a person of a Party from the seabed, ocean floor or the subsoil of the continental shelf or the exclusive economic zone of any of the Parties, provided that the Party or person of the Party has the right to exploit such seabed, ocean floor, or subsoil in accordance with international law;1

- a good that is:

- waste or scrap derived from production there; or

- waste or scrap derived from used goods collected there, provided that those goods are fit only for the recovery of raw materials; and

- products produced or obtained there exclusively from products referred to in subparagraphs (a) through (j), or from their derivatives, at any stage of production.

- Where Annex 3A (Product Specific Rules Schedule) provides a choice of rule between a Qualifying Value Content (QVC) based rule of origin, a change in tariff classification based rule of origin, a specific process of production, or a combination of any of these, a Party shall permit the producer or exporter of the good to decide which rule to use in determining if the good is an originating good.

Article 3.4 Qualifying Value Content

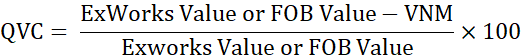

- Each Party shall provide that a QVC requirement specified in this Chapter, including related Annexes, to determine whether a good is originating, is calculated using one of the following methods as follows:

- Indirect (Build-Down) Method: based on the value of non-originating materials

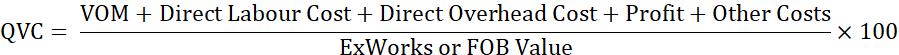

or Direct (Build-Up) Method: based on the value of originating materials

where:

QVC is the qualifying value content of a good, expressed as a percentage.

- Indirect (Build-Down) Method: based on the value of non-originating materials

For the purposes of the product specific rules of origin, the following definitions apply:

Value of Non–Originating Materials (VNM) is the customs value of the non-originating materials at the time of importation, inclusive cost of insurance and freight up to the port of importation, or the earliest ascertained price paid or payable in the Party where the production takes place for all non-originating materials, parts or produce that are acquired by the producer in the production of the good. When the producer of a good acquires non-originating materials within that Party the value of such materials shall not include freight, insurance, packing costs and any other costs incurred in transporting the material from the supplier's warehouse to the producer's location;

Value of Originating Materials (VOM) is the value of originating materials, parts, or produce acquired or self-produced, and used in the production of the good;

Free-On-Board (FOB) Value means the price actually paid or payable to the exporter for a good when the good is loaded onto the carrier at the named port of exportation, including the cost of the good and all costs necessary to bring the good onto the carrier;

Ex-Works Price means the price paid for the good ex-works to the manufacturer in the Party in who's undertaking the last working or processing is carried out, provided the price includes the value of all the materials used, minus any internal taxes which are, or may be, repaid when the good obtained is exported;

Direct Labour Cost includes wages, remuneration, and other employee benefits;

Direct Overhead Cost is the total overhead expense; and

Other Costs are the costs incurred in placing the good in the ship or other means of transport for export including, but not limited to, domestic transport costs, storage and warehousing, port handling, brokerage fees and service charges. This cost is only applicable when calculating QVC on FOB basis.

- Each Party shall provide that all costs considered for the calculation of QVC are recorded and maintained in conformity with the Generally Accepted Accounting Principles applicable in the territory of a Party where the good is produced.

Article 3.5 Accumulation

- An originating good or material of one Party shall be considered originating in the territory of the other Party when used in the production of a good in the territory of the other Party.

- The Joint Committee may agree to review this Article with a view to providing for other forms of accumulation for the purpose of qualifying goods as originating goods under this Agreement, including cumulation of production.

Article 3.6 De Minimis

A good that does not satisfy the requirements pursuant to Annex 3A (Product Specific Rules Schedule) shall nonetheless be treated as an originating good if:

- for a good classified in Chapters 01-49 and 64-97 of the HS Code, the value of non-originating materials that have been used in the production of the good and did not undergo the applicable change in tariff classification does not exceed 10 per cent of the FOB or 15 per cent of the Ex-Works value of the good. The value of those non-originating materials shall be determined pursuant to paragraph 1 of Article 3.4 (Qualifying Value Content); or

- for a good classified in Chapters 50 through 63 of the HS Code, the weight of all non-originating materials used in its production that did not undergo the required change in tariff classification does not exceed 10 per cent of the total weight of the good or the value of those materials does not exceed 10 per cent of the FOB or 15 per cent of the Ex-Works value of the good;

and the good meets all other applicable criteria of this Chapter.

- Notwithstanding paragraph 1, the value of such non-originating materials shall, however, be included in the value of non-originating materials for any applicable QVC requirement for the good.

Article 3.7 Insufficient Working or Processing

- Where a claim for origin is based solely on QVC, a good shall not be considered to be originating in the territory of a Party if the following operations are undertaken exclusively by itself or in combination in the territory of that Party:

- operations to ensure the preservation of products in good condition during transport and storage such as drying, freezing, ventilation, chilling and like operations;

- sifting, washing, cutting, slitting, bending, coiling or uncoiling, sharpening, simple grinding, slicing;

- cleaning, including removal of oxide, oil, paint or other coverings;

- simple painting and polishing operations;

- testing or calibration;

- placing in bottles, cans, flasks, bags, cases, boxes, fixing on cards or boards and packaging operations;

- simple mixing of goods, whether or not of different kinds;

- simple assembly of parts of products to constitute a complete good or disassembly of products into parts;

- changes of packing, unpacking or repacking operations, and breaking up and assembly of consignments;

- affixing or printing marks, labels, logos and other like distinguishing signs on goods or their packaging;

- husking, partial or total bleaching, polishing and glazing of cereals and rice; and

- mere dilution with water or another substance that does not materially alter the characteristics of the goods.

- For the purposes of paragraph 1, the terms "simple" and "simple-mixing" are defined as follows:

- "simple" generally describes an activity which does not need special skills, machines, apparatus or equipment specially produced or installed for carrying out the activity.

- "simple mixing" generally describes an activity which does not need special skills, machine, apparatus or equipment specially produced or installed for carrying out the activity. However, simple mixing does not include a chemical reaction.

Article 3.8 Indirect Materials

An indirect material shall be treated as an originating material without regard to where it is produced and its value shall be the cost registered in accordance with the Generally Accepted Accounting Principles in the records of the producer of the good.

Article 3.9 Accessories, Spare Parts, Tools

- Accessories, spare parts, tools, and instructional or other information materials delivered with a good that form part of the good's standard accessories, spare parts, tools, and instructional or other information materials shall be regarded as a part of the good, and shall be disregarded in determining whether or not all the non-originating materials used in the production of the originating goods undergo the applicable change in tariff classification provided that:

- the accessories, spare parts, tools, and instructional or other information materials are classified with and not invoiced separately from the good; and

- the quantities and value of the accessories, spare parts, tools, and instructional or other information materials presented with the good are customary for the good.

- Notwithstanding paragraph 1, for goods that are subject to QVC requirement, the value of the accessories, spare parts, tools and instructional or other information materials shall be taken into account as originating or non-originating materials, as the case may be, in calculating the QVC of the goods.

Article 3.10 Packaging Materials and Containers for Retail Sale

- Each Party shall provide that packaging materials and containers in which a good is packaged for retail sale, if classified with the good, according to Rule 5 of the General Rules for the Interpretation of the Harmonized System, shall be disregarded in determining whether all the non-originating materials used in the production of the good undergo the applicable process or change in tariff classification requirement set out in Annex 3A (Product Specific Rules Schedule) or whether the good is wholly obtained or produced.

- If the good is subject to QVC requirement, the value of such packaging materials and containers shall be taken into account as originating or non-originating materials, as the case may be, in calculating the QVC of the good.

Article 3.11 Unit of Qualification

The unit of qualification for the application of the provisions of this Chapter shall be the particular product which is considered as the basic unit when determining classification using the nomenclature of the Harmonized System. Accordingly, it follows that:

- when a product composed of a group or assembly of articles is classified under a single heading, the whole constitutes the unit of qualification;

- when a consignment consists of a number of identical products classified under the same heading, each product shall be taken individually into account when in determining whether it qualifies as an originating good.

Article 3.12 Packaging Materials and Containers for Transportation and Shipment

Each Party shall provide that packing materials and containers for transportation and shipment are disregarded in determining whether a good is originating.

Article 3.13 Fungible Goods and Materials

Each Party shall provide that the determination of whether fungible goods or materials are originating goods shall be made either:

- by physical segregation of each of the goods or materials; or

- by the use of an inventory management method recognised in the generally accepted accounting principles of the Party in which the production is performed or otherwise accepted by that Party, provided that the inventory management method selected is used throughout the fiscal year of the person that selected the inventory management method.

Article 3.14 Sets of Goods

Sets, as defined in General Rule 3 of the Harmonized System, shall be regarded as originating when all component goods are originating. However, when a set is composed of originating and non-originating products, the set as a whole shall be regarded as originating, provided that the value of non-originating products does not exceed 20% of the FOB value of the set.

Article 3.15 Intermediate Goods

- If a good which has obtained originating status in a Party in accordance with Article 3.2 (Originating Goods) is used as a material in the manufacture of another good, no account shall be taken of the non-originating materials which may have been used in its manufacture.

- If a non-originating material is used in the production of a good, the following may be counted as originating content in determining whether the resulting good meets a QVC requirement:

- the value of production of the non-originating material undertaken in the territory of one or both Parties by one or more producers; and

- the value of any originating material used in the production of the non-originating material undertaken in the territory of one or both Parties by one or more producers.

- The customs authority of the importing Party may request that the importer provide evidence of compliance with the requirements set out in paragraph 2.

Article 3.16 Value of Materials Used in Production

For the purposes of this Chapter, the value of a material is:

- for a material imported by the producer of the good, the price actually paid or payable for the material at the time of importation or other value determined in accordance with the Customs Valuation Agreement, including the costs incurred in the international shipment of the material;

- for a material acquired in the territory where the good is produced:

- the price paid or payable by the producer in the Party where the producer is located;

- the value as determined for an imported material in subparagraph (a); or

- the earliest ascertainable price paid or payable in the territory of the Party; or

- for a material that is self-produced:

- the costs incurred in the production of the material, which includes general expenses; and

- an amount equivalent to the profit added in the normal course of trade, or equal to the profit that is usually reflected in the sale of goods of the same class or kind as the self-produced material that is being valued.

Article 3.17 Further Adjustments to the Value of Materials

- For an originating material, the following expenses may be added to the value of the material, if not included under Article 3.16 (Value of Materials Used in Production):

- the costs of freight, insurance, packing, and all other costs incurred to transport the material to the location of the producer of the good;

- duties, taxes, and customs brokerage fees on the material, paid in the territory of a Party, other than duties and taxes that are waived, refunded, refundable, or otherwise recoverable, which include credit against duty or tax paid or payable; and

- the cost of waste and spoilage resulting from the use of the material in the production of the good, less the value of reusable scrap or by-product.

- For a non-originating material or material of undetermined origin, the following expenses may be deducted from the value of the material:

- the costs of freight, insurance, packing, and all other costs incurred in transporting the material to the location of the producer of the good;

- duties, taxes, and customs brokerage fees on the material paid in the territory of one or both Parties, other than duties and taxes that are waived, refunded, refundable, or otherwise recoverable, which include credit against duty or tax paid or payable; and

- the cost of waste and spoilage resulting from the use of the material in the production of the good, less the value of reusable scrap or by-product.

- For greater certainty, when a non-originating material is used in the production of a good, the values referred to in paragraphs 2(a) through 2(b) of Article 3.15 (Intermediate Goods) may be:

- deducted from the value of the non-originating material if calculating the QVC requirement using the Indirect Method; or

- included in the value of originating materials if calculating the QVC requirement using the Direct Method.

- For the purposes of this Article, if a cost, expense, or value is unknown or documentary evidence of the amount of the adjustment is not available, then no adjustment is allowed for that cost, expense, or value.

Section B: Origin Procedures

Article 3.18 Transit and Transshipment

- An originating good shall retain its originating status if the good has been transported to the importing Party without passing through the territory of a non-party.

- An originating good transported through the territory of one or more non-parties or stored in a temporary warehouse there shall retain its originating status provided that the good:

- does not undergo further production or any other operation outside the territories of the Parties, other than unloading, reloading, separation from a bulk shipment or splitting of a consignment, storing, repacking, labelling or marking required by the importing Party or any other operation necessary to preserve it in good condition or to transport the good to the territory of the importing Party; and

- is not released to free circulation in the territory of any non-party.

- "Free circulation" means that the good has cleared customs, applicable duties have been paid, and the good is available for use in a domestic market. The customs authority of the importing Party may request that the importer provides evidence of compliance with the requirements set out in paragraph 2. This evidence may include, but is not limited to, the following:

- certificate (known as a certificate of non-manipulation) issued by the customs authorities of the country of transit:

- giving an exact description of the goods;

- stating the dates of unloading and reloading of the goods and, where applicable, the names of the ships, or the other means of transport used; and

- certifying the conditions under which the goods remained in the transit country.

- contractual transport documents such as bills of lading;

- factual or concrete evidence based on the marking or numbering of packages;

- any evidence relating to the good itself; and

- any substantiating documents to the satisfaction of the customs authorities of the importing country.

- certificate (known as a certificate of non-manipulation) issued by the customs authorities of the country of transit:

Article 3.19 Free Economic Zones or Free Zones

Goods produced or manufactured in a free zone situated within a Party shall be considered as originating goods in that Party when exported to the other Party provided that the treatment or processing is in conformity with the provisions of this Chapter and supported by a Proof of Origin.

Article 3.20 Third Party Invoicing

- The customs authority in the importing Party shall not deny a claim for preferential tariff treatment only for the reason that the invoice was not issued by the exporter or producer of a good provided that the good meets the requirements in this Chapter.

- The exporter of the goods shall indicate "third party invoicing" and such information as name and country of the company issuing the invoice shall appear in in the appropriate field as detailed in Annex 3B (Certificate of Origin Minimum Information Requirements) or, in the case of an Origin Declaration made out by an approved exporter as per Article 3.24 (Origin Declaration), on the Origin Declaration.

Article 3.21 Proof of Origin

- Each Party shall provide that an importer may make a claim for preferential tariff treatment under this Agreement on importation into the other Party, on the basis of a Proof of Origin.

- Either of the following shall be considered as a Proof of Origin:

- a Certificate of Origin issued by competent authority as per Article 3.22 (Certificate of Origin); or

- an Origin Declaration implemented in accordance with Article 3.24 (Origin Declaration).

Article 3.22 Certificate of Origin

- A Certificate of Origin shall:

- contain information, as set out in Annex 3B (Certificate of Origin Minimum Information Requirements);

- may cover one or more goods under one consignment provided that each good qualifies as an originating good separately in its own right; and

- be in a printed or electronic format.

- Each Certificate of Origin shall bear a unique serial reference number separately given by each place or office of issuance.

- A Certificate of Origin shall bear an official seal of the competent authority. The official seal may be applied electronically.

- Each Party shall provide that a Certificate of Origin shall be completed in the English language and shall remain valid for one year from the date on which it is issued.

- If an official seal is applied electronically, an authentication mechanism, such as authorised QR code linking to a secured website, may be included in the certificate to assist in verification purposes.

Article 3.23 Electronic Data Origin Exchange System

The Parties shall endeavour to develop an electronic system for origin information exchange to ensure the effective and efficient implementation of this Chapter particularly on transmission or verification of certificate of origin.

Article 3.24 Origin Declaration

- The Parties shall commence a review of this Article on completion of two years from the date of entry into force of this Agreement to consider the introduction of an Origin Declaration by an exporter, producer or importer as a Proof of Origin. If the review results in the Parties agreeing on introducing an Origin Declaration, the provisions for such implementation shall be agreed and adopted by the Joint Committee and implemented by the Parties.

- For the purposes of paragraph 2(b) of Article 3.21 (Proof of Origin), the Parties shall recognise an Origin Declaration made by an approved exporter.

- The customs or competent authorities of the exporting Party may authorise any exporter ("approved exporter") who exports goods under this Agreement, to make out Origin Declarations, irrespective of the value of the goods concerned.

- The customs or competent authorities of the exporting Party may grant the status of approved exporter, subject to any conditions which they consider appropriate.

- The customs or competent authorities of the exporting Party shall share or publish the list of approved exporters and periodically update it.

- An exporter seeking such authorisation must offer to the satisfaction of the customs or competent authorities of the exporting party all guarantees necessary to verify the originating status of the goods as well as the fulfilment of the other requirements of this Chapter.

- An Origin Declaration (the minimum information requirements of which appears in Annex 3C (Origin Declaration Minimum Information Requirements)) shall be made out by the approved exporter by typing, stamping or printing the declaration on the invoice, the delivery note or another commercial document which describes the products concerned in sufficient detail to enable them to be identified.

- The declaration may also be hand-written; if the declaration is hand-written, it shall be written in permanent ink in legible printed English characters.

- The approved exporter making out an Origin Declaration shall be prepared to submit at any time, at the request of the customs or competent authorities of the exporting Party, all appropriate documents proving the originating status of the goods concerned, as well as the fulfilment of the other requirements of this Chapter.

Article 3.25 Waiver of a Certificate of Origin or Origin Declaration

- For the purpose of granting preferential tariff treatment under this Chapter, a Party may waive the requirements for the presentation of a Certificate of Origin or Origin Declaration and grant preferential tariff treatment to:

- any consignment of originating goods of a customs value not exceeding 1,000 AUD for Australia or 2,000 AED for the United Arab Emirates, or such higher amount as each Party may establish; or

- other originating goods as provided under its laws, regulations or administrative arrangements.

- Waivers provided for in paragraph 1 shall not be applicable when it is established by the customs administration of the importing Party that the importation forms part of a series of importations that may reasonably be considered to have been undertaken or arranged for the purpose of avoiding the submission of a Certificate of Origin or Origin Declaration.

Article 3.26 Application for a Certificate of Origin

- Certificates of Origin shall be issued by the competent authority of the exporting Party, either upon an electronic application or an application in paper form, having been made by the exporter or under the exporter's responsibility by his or her authorised representative in accordance with the domestic regulations or administrative requirements of the exporting Party.

- The exporter applying for a Certificate of Origin shall be prepared to submit at any time, at the request of the competent authority of the exporting Party, all appropriate documents proving the originating status of the goods concerned, as well as the fulfillment of the other requirements of this Chapter.

- The competent authority shall, to the best of its competence and ability, carry out proper examination to ensure that:

- the application and the Certificate of Origin is duly completed and signed by an authorised signatory of the exporting party.

- the origin of the good is in conformity with the provisions of this Chapter; and

- HS Code, description, gross weight or other quantity and value conform to the good to be exported.

Article 3.27 Certificate of Origin Issued Retrospectively

- The Certificate of Origin shall be issued by the competent authority of the exporting Party prior to or at the time of shipment.

- In exceptional cases where a Certificate of Origin has not been issued prior to or at the time of shipment, due to involuntary errors or omissions or other valid causes, as determined by the competent authority of the exporting party the Certificate of Origin may be issued retroactively but with a validity no longer than one year from the date of shipment, in which case it is necessary to indicate "Issued Retroactively" in the appropriate field as detailed in Annex 3B (Certificate of Origin Minimum Information Requirements).

- The provisions of this Article shall be applied to goods which comply with the provisions of this Agreement, and which on the date of its entry into force, are either in transit or are in the territory of the Parties in temporary storage under customs control. This shall be subject to the submission to the customs authorities of the importing Party, within six months from the said date, of a Certificate of Origin issued retrospectively by the competent authority of the exporting Party together with documents, showing that the goods have been transported in accordance with the provisions of Article 3.18 (Transit and Transshipment).

Article 3.28 Loss of the Certificate of Origin

- The certified true copy of the original Certificate of Origin shall be endorsed with an authorised signature and seal and bear the words "CERTIFIED TRUE COPY" and the date of issuance of the original Certificate of Origin. The certified true copy of a Certificate of Origin shall be issued within the same validity period of the original Certificate of Origin.

- The exporter shall immediately notify the loss to the competent authority, and undertake not to use the original Certificate of Origin for exports under this Agreement.

Article 3.29 Treatment of Erroneous Declaration in the Certificate of Origin

Neither erasures nor superimposition shall be allowed on the Certificate of Origin. Any alterations shall be made by issuing a new certificate of origin to replace the erroneous one. The reference number of the corrected Certificate of Origin should be indicated in the appropriate field on the newly issued Certificate of Origin. The validity of the replacement certificate will be the same as the original.

Article 3.30 Treatment of Minor Discrepancies

A Party shall not reject a certificate of origin due to minor errors or discrepancies, such as slight discrepancies between documents, omissions of information or typing errors, provided these minor discrepancies or errors do not create doubt as to the originating status of the good.

Article 3.31 Denial of Preferential Tariff Treatment

- Except as otherwise provided in this Chapter, the customs authority of the importing Party may deny a claim for preferential tariff treatment or recover unpaid duties, in accordance with its laws and regulations, where:

- the good does not meet the requirements of this Chapter; or

- the importer of the good failed to comply with any of the relevant requirements of this Chapter for obtaining preferential tariff treatment; or

- the customs or competent authority of the importing Party has not received sufficient information to determine that the good is originating; or

- the competent or customs authority of the exporting Party, exporter or producer does not comply with the requirements of verification in accordance with Article 3.32 (Verification) or Article 3.33 (Verification Visits).

- If the customs authority of the importing Party denies a claim for preferential tariff treatment, it shall provide the decision in writing to the importer that includes the reasons for the decision.

- Upon being communicated the grounds for denial of preferential tariff treatment, the importer may, within the period provided for in the custom laws of the importing Party, file an appeal against such decision with the appropriate authority under the customs laws and regulations of the importing Party.

- The customs authority of a Party may not deny a claim of preferential tariff treatment based solely on the certificate of origin being submitted in electronic format.

Article 3.32 Verification

- The customs authority of the importing Party may conduct a verification check when it has reasonable doubt as to the authenticity of the document or as to the accuracy of the information regarding the true origin of the goods in question or of certain parts thereof.

- For the purpose of paragraph 1, the custom authority of the importing Party may conduct the checking process by issuing a written request for additional information from the contact point of the exporting Party.

- The request shall be accompanied with the copy of Proof of Origin concerned and shall specify the reasons and any additional information suggesting that the particulars given on the said Proof of Origin may be inaccurate.

- The customs authority of the importing Party may suspend the provisions on preferential treatment while awaiting the result of verification. However, it may release the goods to the importer subject to any administrative measures deemed necessary, provided that they are not held to be subject to import prohibition or restriction and there is no suspicion of fraud.

- Pursuant to paragraph 2, the concerned Party receiving a request for verification check shall respond to the request promptly and reply not later than 90 days after the receipt of the request.

- When a reply from the concerned Party is not obtained within 90 days after the receipt of the request pursuant to paragraph 5, the customs authority of the importing Party may deny preferential tariff treatment to the good referred to in the said Proof of Origin that would have been subject to the verification check and recover unpaid duties.

Article 3.33 Verification Visits

- Pursuant to paragraph 2 of Article 3.32 (Verification), if the customs or the competent authority of the importing Party is not satisfied with the outcome of the retroactive check, it may, under exceptional circumstances for justifiable reasons, conduct a verification visit to the producer or exporter premises including inspection of the exporter's or producer's accounts, records or any other check, related to the good under investigation considered appropriate.

- Prior to conducting a verification visit pursuant to paragraph 1, the customs or the competent authority of the importing Party shall deliver a written notification to the contact point of the exporting Party of the planned verification visit.

- The written notification mentioned in paragraph 2 shall be as comprehensive as possible and shall include, among others:

- the producer or exporter whose premises are to be visited;

- justification for the unsatisfactory outcome of the retroactive check based on the information provided by the contact point of the exporting Party; and

- the coverage of the planned verification visit, including reference to the good subject to the verification, and the evidence demonstrating the good fulfills the requirements of this Chapter.

- The contact point of the exporting Party shall obtain the written consent of the producer or exporter whose premises are to be visited;

- Officials of the customs or competent authority of the exporting Party may participate in the verification visit as observers.

- When a written consent from the producer or exporter is not obtained within 30 days from the date of receipt of the verification visit notification, the customs authority of the importing Party may deny preferential tariff treatment to the good referred to in the said Certificate of Origin that would have been subject to the verification visit.

- The competent or customs authority of the importing Party conducting the verification visit shall provide the producer or exporter, whose good is subject to such verification with a written determination of whether or not the good subject to such verification qualifies as an originating good.

- Upon the issuance of the written determination referred to in paragraph 7 that the good qualifies as an originating good, the customs authority of the importing party shall immediately restore preferential tariff treatment and promptly refund the duties paid in excess of the preferential duty or release guarantees obtained in accordance with the laws and regulations of the Parties.

- Upon the issuance of the written determination referred to in paragraph 6 that the good does not qualifies as an originating good, the producer or exporter shall be allowed 30 days from the date of receipt of the written determination to provide in writing comments or additional information regarding the eligibility of the good for preferential tariff treatment. The final written determination shall be communicated to the producer or exporter within 30 days from the date of receipt of the comments or additional information.

- Except in the case force majeure, the verification visit process, including the actual visit and the determination under paragraph 7, shall be carried out and its results communicated to the competent or customs authority of the exporting Party within a maximum period of six months from the first day the initial verification visit was requested. While the process of verification is being undertaken, paragraph 4 of Article 3.32 (Verification) shall be applied.

Article 3.34 Record Keeping Requirement

- For the purposes of the verification process pursuant to Article 3.32 (Verification) and Article 3.33 (Verification Visits), each Party shall require that:

- the exporter, importer, producer or their authorised representative making the Declaration that the goods are originating goods retain, for a period not less than five years from the date of issuance of the Proof of Origin, or a longer period in accordance with its domestic laws and regulations, all supporting records necessary to prove that the good for which the Proof of Origin was issued was originating; and

- the importers shall retain, for a period not less than five years from the date of importation of the good, or a longer period in accordance with its domestic laws and regulations, all records to prove that the good for which preferential tariff treatment was claimed was originating; and

- the competent authority shall retain, for a period not less than five years from the date of issuance of the Proof of Origin, or a longer period in accordance with its domestic laws and regulations, all supporting records of the application for the Proof of Origin.

- The records referred to in paragraph 1 may be maintained in any medium that allows for prompt retrieval, including but not limited to, digital, electronic, optical, magnetic, or written form in accordance with that Party's laws and regulations.

Article 3.35 Confidentiality

All information related to the application of this Chapter communicated between the Parties shall be treated as confidential. It shall not be disclosed by the Parties authorities without express permission of the person or authority providing it except to the extent that the Party receiving the information is required to provide the information under its laws.

Article 3.36 Mutual Assistance

- The Parties shall provide each other before the Agreement enters into force with the following:

- a specimen impression of the official stamps and signatures used in their offices for the issue of Certificate of Origin;

- name and address of the competent authorities responsible for verifying the Proof of Origin;

- samples of the Certificates of Origin and Origin Declaration containing the data requirements as set out in Annex 3B (Certificate of Origin Minimum Information Requirements) and Annex 3C (Origin Declaration Minimum Information Requirements); and

- secured government website address for verification of QR codes or electronic certificates of origin, if implemented by a Party.

- The Parties shall update the information provided in paragraph 1 annually, or as otherwise agreed.

Article 3.37 Consultation and Modifications

- The Parties shall consult and cooperate as appropriate through the Joint Committee or any subcommittee, working group or other subsidiary body established under this Agreement, to:

- ensure that this Chapter is applied in an effective and uniform manner; and

- discuss necessary amendments to this Chapter, taking into account developments in technology, production processes, and other related matters including:

- importation by instalments;

- origin declarations by an importer, exporter or producer; and

- recovered materials and remanufactured goods.

Article 3.38 Contact Points

Each Party shall, within 30 days of the date of entry into force of this Agreement for that Party, designate one or more contact points responsible for the implementation of this Chapter and notify the other Party of the contact details of that contact point or those contact points. Each Party shall promptly notify the other Party of any change to those contact details.