Uranium Exports and Production

Australia has approximately one third of the world's uranium deposits and, as at 30 June 2022, has two operating uranium mines in South Australia – Olympic Dam and Beverley/Four Mile. Australia fell from the second largest producer of uranium ore concentrate (UOC) in the 2020 calendar year to fourth largest in 2021, behind Kazakhstan, Namibia and Canada. This fall is due to both increased production internationally and reduced production domestically – arising from a combination of the closure of Ranger uranium mine and maintenance activities at the two operating mines.

Future production outlook is positive, with two projects looking to resume or begin uranium mining in coming years. Honeymoon in South Australia is working to restart production in the final quarter of 2023 and Mulga Rock in Western Australia is undertaking a feasibility study with the goal of beginning production in 2025. Mine owners are motivated by the increased price of uranium which is at its highest price per ton in a decade.

| Item | Data |

|---|---|

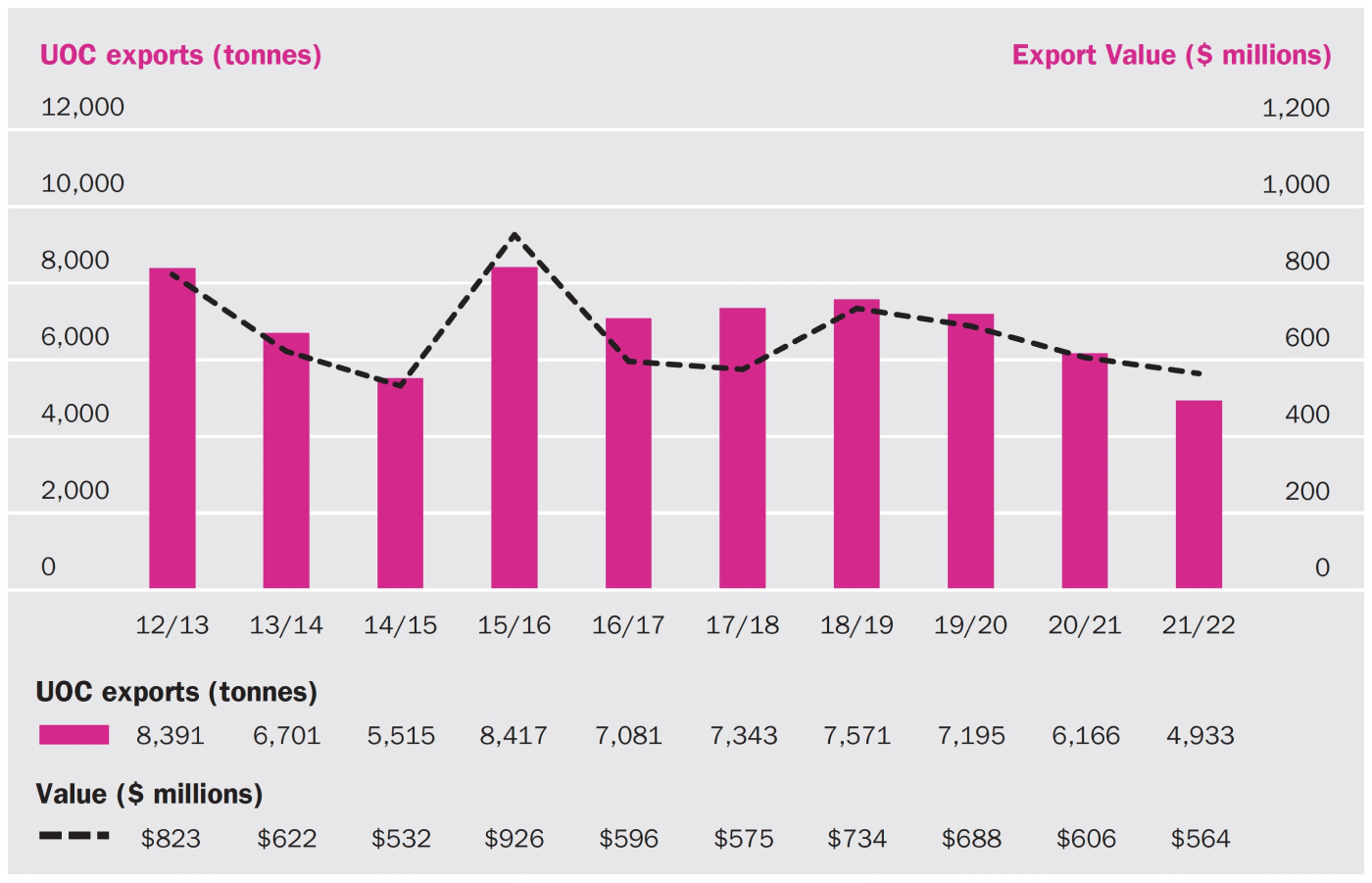

| Total Australian UOC exports 2021–22 | 4,933 tonnes |

| Value Australian UOC exports | $564 million |

| Australian exports as percentage of world uranium requirements3 | 6.7% |

| Power generated by these exports | 178 TWh |

| Expressed as percentage of total Australian electricity production4 | 67% |

Figure 1: Quantity and value of Australian UOC (U3O8) exports from 2012–13 to 2021–22

3 Based on a comparison of GWe of nuclear electricity capacity and uranium required, for countries eligible to use AONM, from the World Nuclear Association's Nuclear Power Reactors and Uranium Requirements, August 2022.

4 Based on Australia's electricity generation in 2019–2020 of 265 TWh from the Department of Industry, Science, Energy and Resources, Australian Energy Update 2021.