Departmental operating result

The department was required to operate in an environment of strong financial discipline to achieve a slim surplus of $2.0 million in 2018–19 before depreciation and amortisation. The financial statements reported an operating deficit of $193.5 million, including depreciation and amortisation expenses of $195.5 million. This tight budget position required careful prioritisation and resource allocation.

The 2018–19 Budget included funding to implement the White Paper, which provides a strategic framework to guide Australia’s international engagement. This includes a commitment to increase our support for a more resilient Pacific and funding for three new Indo-Pacific posts—a consulate-general in Kolkata, India, a consulate-general in Shenyang, China, and a high commission in Funafuti, Tuvalu.

See also Managing our financial resources, and the financial statements

Revenue

The department reported $1,604.0 million of revenue in the Statement of Comprehensive Income, comprised of:

- $1,439.3 million of appropriation revenue from government

- $156.7 million of own source income

- $8.0 million in gains including sale of assets.

This is a decrease of $38.7 million from 2017–18. The main factor contributing to this movement is a reduction in gain from sale of assets which was partly offset by an increase in appropriation revenue from government.

The department also reported $220.5 million of other comprehensive income arising from asset revaluation movements in the Statement of Financial Position. This is recorded as equity on the Statement of Financial Position and is not incorporated into the departmental operating result.

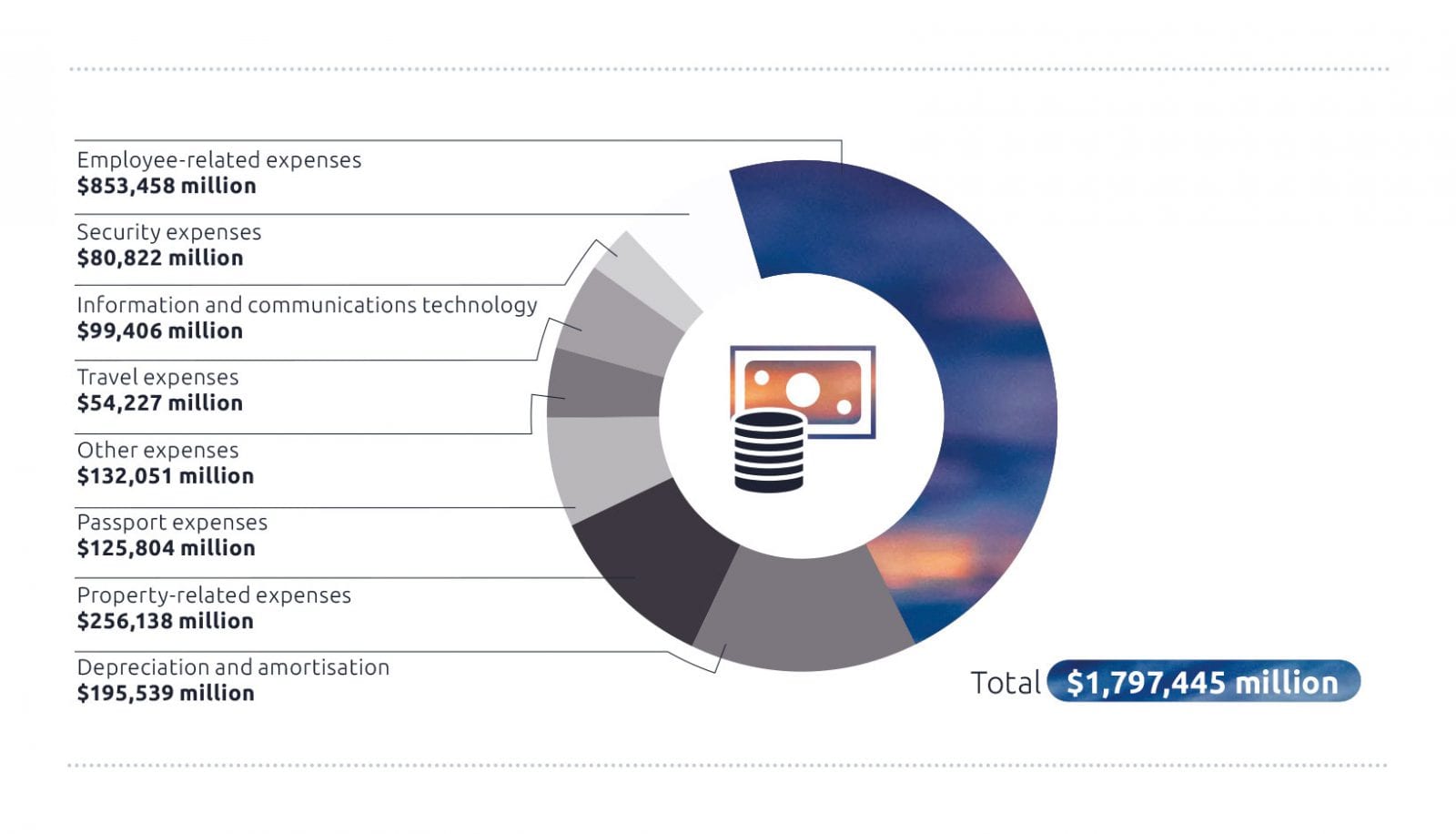

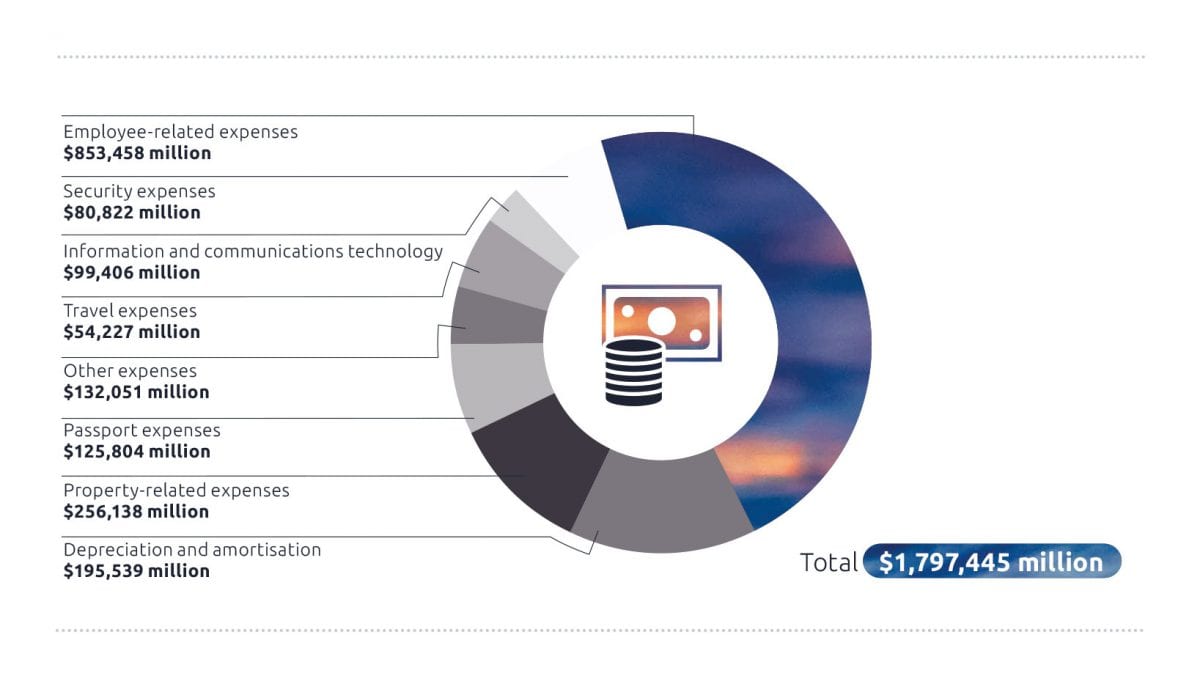

Expenses

The department reported $1,797.4 million of expenses in the Statement of Comprehensive Income. This is an increase of $100.9 million over 2017–18.

The main factors contributing to the movement in 2018–19 were increases:

- in employee expenses of $55.9 million due to the decrease in the 10-year government bond rate which increased the long service leave provision

- in FBT expenses from the impact of exchange rate movements on overseas allowances and the impact of the two per cent pay rise on salary, superannuation and leave expenses

- of $33.5 million in supplier expenses. This was related to information and communications technology costs associated with specific projects. Increases in property-related expenses relate predominantly to exchange rate movements on overseas property expenses

- in depreciation and amortisation expenses of $8.4 million due to the increased value of the department’s asset holdings. This was offset by a decrease in write-down and impairment costs of $2.8 million.

Assets and liabilities

The department reported a strong net asset position of $4,490.5 million in the Statement of Financial Position, with liabilities equating to less than 11 per cent of the total asset base.

This is an increase of $121.9 million from 2017–18. The main factors contributing to the movement in 2018–19 were the increase in the value of physical non-financial assets due to new purchases and developments, and revaluation movements.

Administered program performance

In 2018–19 expenses administered by the department on behalf of government were $4,063.5 million, an increase of $335.3 million over 2017–18. The majority of the increase is attributed to payments of $170 million for existing multilateral commitments. There was also a loss from re-measuring multilateral liabilities of $137 million due to changes in the 10-year Australian Government bond rate and foreign exchange fluctuations. Payments to international organisations (including the United Nations) increased by $33 million compared to 2017–18 due primarily to timing of contributions.

The department’s $3,660.4 million administered development program is focused where we can make the most difference: in the Indo-Pacific (see Priority 4 for more information on the development program).

In 2018–19 income administered by the department on behalf of government was $647.1 million, which is $401.7 million less than 2017–18. The movement is due predominantly to decreases in reporting on multilateral replenishments of $388.5 million as a result of a change in Australian Accounting Standard AASB 9 Financial Instruments: gains and losses are no longer recognised in the net cost of services, and are now recognised in other comprehensive income. Passport, consular and other fee revenue increased by $21.0 million due to the legislative passport fee increase from 1 January 2019 and an increase in the number of passport applications.

Other comprehensive income was $240.8 million, an increase of $240.6 million over 2017–18.

This is primarily due to a $151.0 million increase in the value of multilateral subscriptions (as assessed by independent experts) and a $94.3 million increase in the value of investments relating to the net assets of Export Finance Australia’s (formerly Efic) commercial account. The income increase was offset by a decrease in a re-measurement of locally engaged staff defined benefit schemes.